QUEENSLAND

After many years as an underperformer, Queensland could finally be on its way to becoming a property market powerhouse as experts see bright prospects for the Sunshine State

Over recent years, the markets of Queensland and its capital city have been perennial underperformers. Hard hit by the GFC and natural disasters, the state struggled to recover – apart from pockets of mining-related joy.

Last year commentators predicted a recovery for the state, which turned out to be correct. Over 2014, the Sunshine State’s fortunes have taken a turn for the better.

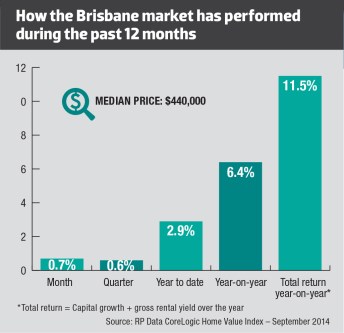

For example, in the latest RP Data CoreLogic Home Value Index results for September 2014, Brisbane was one of only three capital cities to record an increase (of 0.7%) in dwelling values over the month. It also posted a 0.6% increase over the quarter and a year-on-year increase of 6.4%.

After sitting behind the eight ball for so long, price growth is finally on the rise. It is slower than many experts predicted, but the market is broadly in recovery mode.

Commentators now believe that Queensland, particularly the southeast of the state, is the market to watch over the coming year.

Current state of the market

After working through its various economic woes, Queensland’s economy has started to improve. Interestingly, this comes as the mining investment boom is coming to an end.

The pace of state government cutbacks has slowed, which has taken pressure off the economy as a whole. There are also a considerable number of big, well-spaced infrastructure projects in the pipeline. And the lower Australian dollar has already had a positive impact on industries like tourism.

Property markets, particularly Brisbane’s, have started to respond to the rosier economic scenario. While price growth has been moderate, this is expected to ramp up as investors seek out affordable options.

According to the QBE Australian Housing Outlook 2014–2017 report, Brisbane’s price growth (of 5.6% over 2013/14) does mask an uneven performance in the market. While price growth was healthy in the inner and middle suburbs, the median house price declined in Brisbane’s outer suburbs.

There is currently a relative undersupply of stock on the market, which has contributed to both the price growth and the tight rental market.

Australian Property Monitors (APM) chief economist Andrew Wilson says, while the Brisbane market has definitely picked up, the pick-up does not extend to the Southeast Queensland markets like the Gold Coast or Sunshine Coast.

However, the QBE Housing Outlook indicates that Queensland’s various regional markets are telling multiple different stories.

For example, it states that the markets of the Gold Coast, Sunshine Coast, Townsville and Cairns have all experienced flat prices since 2007/8. But undersupply issues on the Gold Coast and the Sunshine Coast are starting to fuel growth, while Townsville is still feeling the effects of economic woes and continues to have limited growth.

Housing Industry Association (HIA) chief economist Harley Dale says mining boom centres have struggled since mining investment fell off. “Out of the southeast corner, markets are a bit wobbly and populations are constricting a bit, although Cairns is starting to move slowly,” he says.

Outlook: What’s ahead

In recovery and with growth on the cards, Queensland is generating increasingly positive commentary. Yet there is still a degree of hesitancy from the experts when it comes to discussion of the property markets.

One reason for this could be that predicted price growth in Brisbane is expected to continue to be moderate. This means it won’t get the same spectacular growth as seen in Sydney and Melbourne recently.

Wilson says Brisbane is starting to rise after being behind the pack for the last 12 to 18 months, and is now in catch-up mode. The city will see real growth, but he believes it will be moderate.

“We’re not going to see a boom situation, such as double-digit growth, in this market. I would pick growth of 7–10%, probably 7%. It depends on where the local economy is going – and they’re still relatively underperforming – plus there’s also a state election coming up.”

Diversity is crucial to future

Another reason for that hesitancy could be the sheer number of different markets within Queensland that need to be taken into account when analysing the state. These markets range from former mining-boom towns, to coastal tourism meccas, to the capital city market.

However, that breadth and diversity may well be the key to the future success of the state. The fact that the state does not rely heavily on one particular city, market or industry means it will be cushioned from the end of the mining boom and well placed to make the necessary economic transitions.

As BIS Shrapnel’s Angie Zigomanis says when analysing Queensland, it’s not just a tale of two cities, it’s a tale of many cities. While former hotspots like Gladstone and Mackay may be struggling now the mining boom is over, other markets like the Sunshine Coast and Cairns are in recovery mode.

Zigomanis says this also means that, although the downturn in mining investment means there is a bit of a negative drag on the economy just as some other sectors are starting to improve, other drivers will start to come through over the next 12 months and beyond.

For example, residential construction is improving, the dollar is starting to fall – which will have significant benefits for the state’s tourism industry – and there are a number of big infrastructure projects underway (eg the Sunshine Coast University Hospital). These are all likely to fuel job growth and help the local economy, Zigomanis says.

Close-up on Brisbane

Within Brisbane itself there are distinct markets. And, to date, growth in Brisbane has been unevenly spread across these markets, while the city’s outer suburbs are still languishing.

According to the QBE Housing Outlook, increasing demand from first home buyers, combined with the ‘ripple effect’ of demand moving outwards as house prices in inner- and middle-Brisbane suburbs become less affordable, should contribute to positive growth in these outer suburbs.

Wilson agrees, and says there will be a general flattening out of activity in the broader market going forward. “Growth has been driven by upper and mid-priced property as buyers look for value and confidence returning in this segment. This is where the energy is going to emerge in these markets.”

Ongoing low interest rates and Brisbane’s affordability quotient mean demand will continue to rise. An increase in ‘housing migrants’ from Sydney and Melbourne should also benefit the city’s markets.

However, Brisbane does have a number of supply issues. On the one hand, there is a widespread undersupply of dwelling stock. On the other, there is the potential for oversupply in the apartment sector.

Zigomanis says the city hasn’t yet seen a big construction response to low interest rates, and most of the construction taking place is occurring in the apartment sector. This means that supply in the housing sector is lagging while demand is growing, which creates a more positive situation for that sector.

“If you look at activity in Brisbane, it is dominated by the apartment sector. And if you narrow that down, it is within 3km of the CBD. So it’s very localised. I think if there is an oversupply problem, it would be in that inner-city area and in apartments, rather than something that is broader.”

Spotlight on regional Queensland

When it comes to Queensland’s regional markets, an analysis of these can be broken down into two parts.

AMP Capital chief economist Shane Oliver says that, while Queensland is a sophisticated economy, it’s always half and half. And, in the coming years, one of those halves will be a tourist-related story.

“Parts of Queensland will suffer in response to the mining downturn, but I suspect it will be dominated by the coastal areas which are going to benefit from the return of tourists.”

This means areas like the Gold Coast, the Sunshine Coast and Cairns are poised to do well economically. The Sunshine Coast and the Gold Coast, in particular, will benefit from some big infrastructure and development projects, such as works underway for the Gold Coast Commonwealth Games. (See ‘Big infrastructure projects in the works’, p35.)

Dwelling undersupply issues in the Gold Coast, the Sunshine Coast and Cairns are also set to impact on these markets. Not only will undersupply drive demand and price growth, but rising construction in response should assist their economies.

It is worth noting that several commentators suggest caution when it comes to the Gold Coast. This is largely due to its history of excessive developer enthusiasm, which has led to significant oversupply in the past.

Markets surrounding mining locations (such as Gladstone, Mackay, and even Townsville) are the ones that are suffering now, and they will be doing it tough for a while, Dale says. In these areas, population growth has slowed and prices and rents are going backwards.

Tread with caution

Overall, the verdict for Queensland has to be a positive one, Dale continues. It is a sleeper market, but he sees capital growth creeping back into the southeast corner of the state, from around the NSW-Qld border up to the Sunshine Coast.

Due to its long period of underperformance, in many ways it has been a difficult market for investors and builders/developers, he says.

“Even now the recovery is nascent and patchy, and patience is needed. But there is a decent entry level and the long-term potential in Southeast Queensland is good. It’s the pick of Australia. Investors just need to make sure they do their research and get it right.”