Dwelling values across Australian capital cities are set to finally recover from the downturn next year, driven by the strong population growth and the sharp decline in new dwelling completions, a new industry report said.

The loosening of lending restrictions, the tax discounts, and the expected rate cuts over the coming months are expected to fuel the interest of would-be homebuyers, providing an impetus for housing prices to grow, according to QBE's Australian Housing Outlook 2019-2022.

However, it would be the imbalance between supply and demand that would ultimately dictate the fate of housing prices in the majority of the markets, said QBE Lenders' Mortgage Insurance CEO Phil White.

"Our report suggests that a drop-off in construction completions is likely to drive prices higher over the next few years," he said.

Also read: Where to find Sydney's best home deals

Building approvals in Australia went down by 19% in the 2018-2019 financial year. Given this, building completions are expected to fall to 163,500 dwellings by 2020-2021.

"With population growth expected to remain strong, that's well below underlying demand. This could mean some previously oversupplied markets will tip back into undersupply by 2021-2022. With other factors also stimulating the economy and by association the housing market, there is potential for a recovery in prices," White said.

Planning to invest in property? Check out if you can afford one by using this free online tool.

Of all the capital cities, Brisbane is expected to see the most substantial recovery. A decade of modest price increase made the city relatively affordable for many home-seekers. On the other hand, growth in Sydney and Melbourne markets over the next three years could be limited.

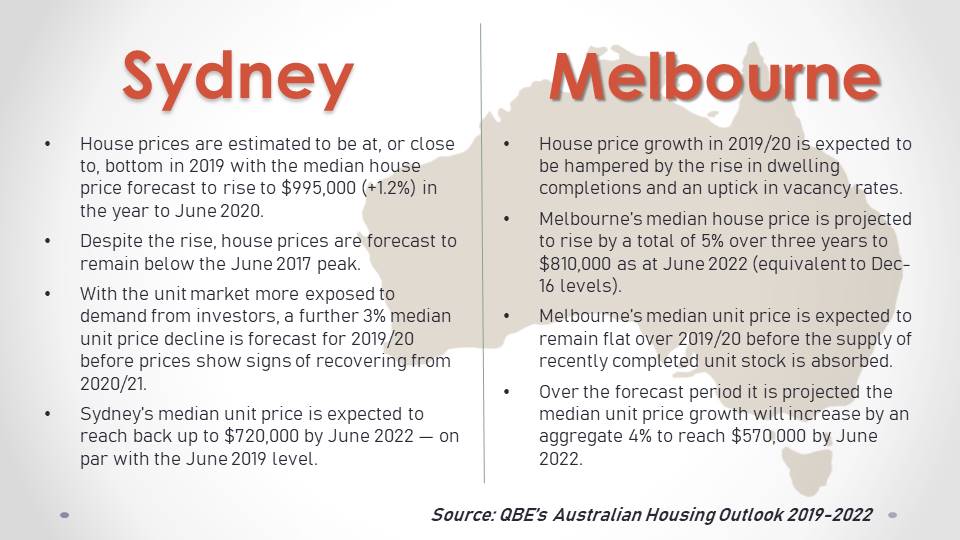

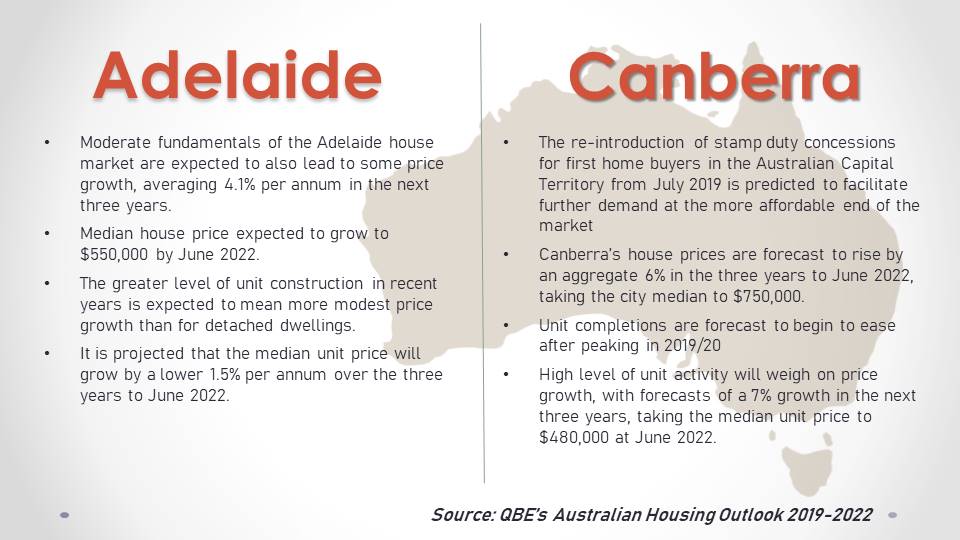

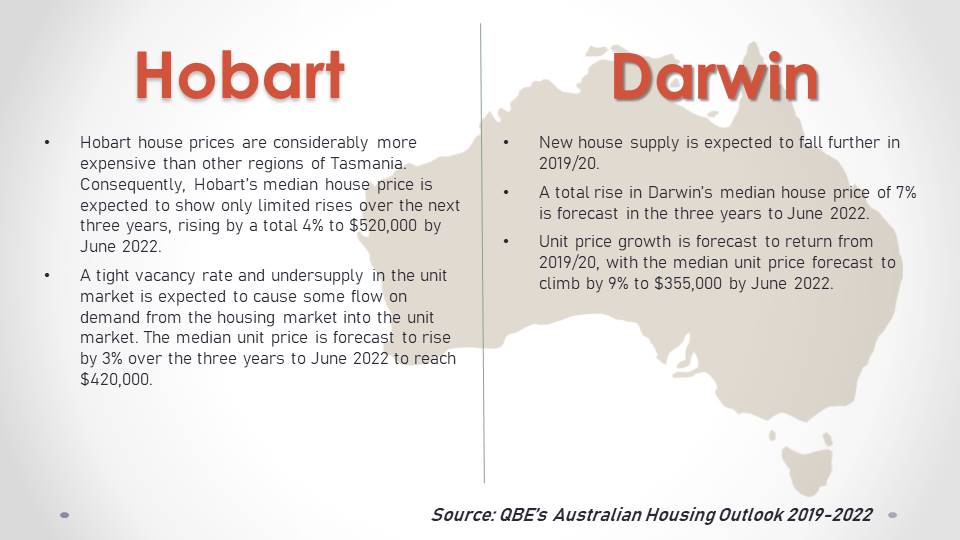

The tables below show how each capital city is expected to perform next year: