Promoted by PGS Invest

While the concept of an ageing population and increasing life expectancy is not foreign, the notion of reaching or nearing 100-years-old is a paradigm shift many haven't fully considered.

According to projections by the Australian Bureau of Statistics (ABS), by 2051 there will be a staggering 50,000 centenarians in Australia, a tenfold increase from current numbers.

Traditionally, individuals in their 40s and 50s focus on preparing for retirement, often investing in properties, shares, and superannuation with the assumption that they'll live comfortably until around 85.

However, studies like the one conducted by YourLifeChoices reveal a sobering truth: many will surpass this age by a decade or more, yet they're financially ill-prepared for such longevity. This could leave a dangerous gap in financial planning.

Chanel Slijderink (pictured), a Gold Coast-based financial analyst and development manager for PGS Invest, suggests a practical solution for middle-aged Australians: maximise voluntary super contributions.

"While it's challenging to determine the optimal contribution amount as everyone's financial position and goals are unique," Ms Slijderink said.

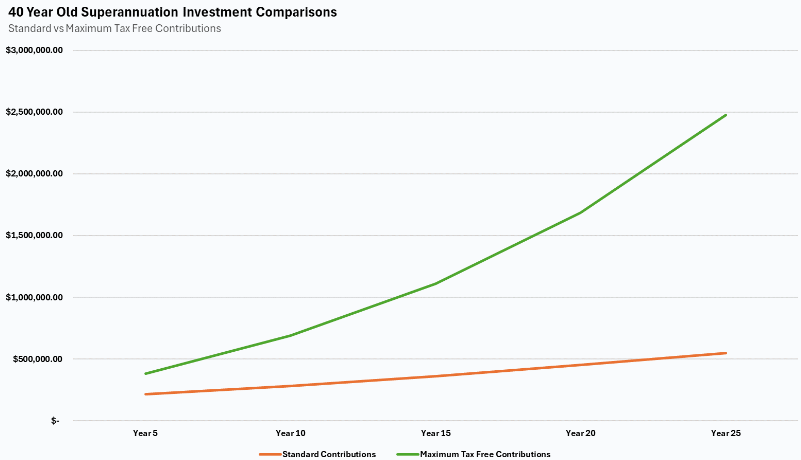

"If for example a 40-year-old was to choose a portfolio with standard returns of 6.50% per annum, with a starting sum of $156,000, making maximum voluntary contributions could amass $2.6 million by age 66."

But the true value of prudent financial planning reveals itself in later years. Chanel explained her projections.

"Upon retirement age of 65, with a conservative 3.5% portfolio return rate and a 4% annual drawdown for income, one could enjoy a substantial $100,000 per year until their 80s and around $90,000 per year until hitting the century mark. Even more impressively, there would still be $2 million left to pass down to family at age 100 or use for unexpected expenses.

"When these figures are put into perspective, specifically the value in compounding, people can really see the benefit of making larger contributions when they are younger. If you have an extra couple of hundred dollars per week that you can put into your super, the long-term outcome is enormous.

"What's more impressive is that these figures are per person, so hypothetically a household could generate over $5m dollars for their retirement!"

The importance of considering the implications of a 100-year life cannot be overstated. It's crucial to ask tough questions: What if our super runs dry at 85, with no pension to fall back on? How will this affect our loved ones?

There is not enough attention being allocated towards smart super allocation, and with the right advice, and proper planning, people could retire with increased financial security. This stark reality demands proactive planning for a century-long journey that's already upon us.

Images provided by PGS Invest