If you’ve always wondered what negative gearing was all about but were afraid to ask, you can now finally make sense of the concept with this easy-to-understand guide by Eddie Chung.

Many people, especially accountants and advisers, tend to take terms like ‘negative gearing’ for granted. Terminology like this tends to make information inaccessible to those who need to understand it the most.

To save those who need to muster up the courage to ask the question, the following is an absolute beginner’s guide to negative gearing.

Tax basics

Before we define what is meant by the term ‘negative gearing’, we need to look at the current marginal tax rates that are applicable to an individual.

The above does not include the Medicare Levy of 2% of taxable income, nor does it include the Temporary Budget Repair Levy announced in the last Federal Budget of 2% for every dollar of taxable income exceeding $180,000. Further, if you do not have private health insurance but your income goes over a certain threshold, you may be slugged with an additional Medicare Levy Surcharge of up to 1.5%.

In other words, if you are subject to these surcharges and levies and your taxable income is more than $180,000, every dollar you earn exceeding this amount will be taxed at as high as 51.5% – more than half of that dollar will be going straight to tax! Apart from the arguably draconian tax rates, before we discuss negative gearing you should also be aware that 100% of income such as rent derived from an investment property, net of rental expenses, is included in your taxable income.

On the other hand, if you sell your investment property and make a capital gain, that capital gain is also included in your taxable income. However, if you, as an individual, have owned the property for at least 12 months before it is sold, you will be entitled to the 50% capital gains tax (CGT) discount, which will reduce the capital gain by half before the gain is included in your taxable income.

In other words, the tax system currently has an inherent bias that favours capital gain over income.

Negative gearing

Negative gearing is just a fancy term to describe a situation in which the total expenses you incur on your investment property exceed the total rental income you derive from the property.

For most people, by far the largest rental expense is interest on the loan that was drawn down to buy the property. Other expenses include body corporate fees, council rates, cleaning, property management fees, repairs and maintenance costs, etc.

As your annual outgoings to maintain the investment property exceed the rental income you derive from it, you will be making a net loss, which is numerically expressed as a negative figure.

Coupled with the fact that the loss is commonly attributable to interest expenses from borrowings taken out to buy the property (borrowing is also known as gearing), the term ‘negative gearing’ was conceived, which captures the common scenario in which you make an annual net loss on an investment property due to the interest on the loan, but, technically speaking, other expenses may also contribute to this loss.

In particular, the loss may be further amplified by depreciation and capital works deductions, which are not cash outgoings but are nonetheless tax deductible.

What makes negative gearing particularly tax attractive is that the net loss can be offset against other income that would otherwise be included in your assessable income. Therefore, if a dollar of income would otherwise be taxed at 51.5%, every dollar of negative gearing loss which offsets that income will save you 51.5 cents!

Meanwhile, if the investment property goes up in value but you do not sell the property, no CGT will be payable. Even if you do sell the property after 12 months, the capital gain will be discounted by 50%.

Accordingly, provided that the total after-tax capital gain on your property and the total tax you have saved from negative gearing exceed your total rental losses during your ownership of the property, you will be in front and make an overall net profit from the property.

How it works in real life

To illustrate the above, consider the following example:

• You purchased a property for $500,000 by putting in $100,000 of your own money and $400,000 from the bank.

• The interest rate on the loan is 5.5% per annum. The loan is an interest-only loan, ie none of the principal is paid down each year. Therefore, the annual interest expense on the loan is $500,000 x 5.5% = $27,500.

• The annual rent on the property in the first year is $25,000, which increases by 3% per year.

• The annual expenses for the property in the first year, excluding interest expenses, is $10,000, which increases by 3% per year.

• Based on a depreciation report prepared by a qualified quantity surveyor, you can also claim depreciation and capital works deductions of $4,000 per year.

• You own the property for three years before it is sold for $550,000.

• You pay tax at the highest marginal tax rate of 51.5%, inclusive of all levies and surcharges.

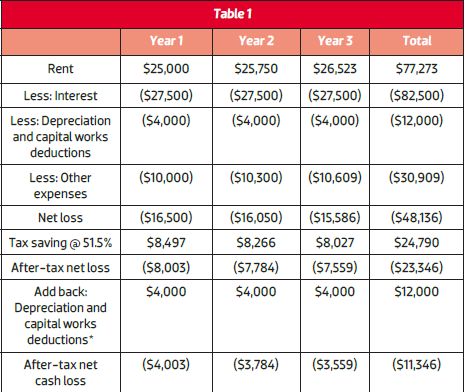

Your total negative gearing losses over the three years will look like this:

*Depreciation and capital works deductions are added back because these are not ‘cash expenses’ you have incurred.

Ignoring other incidental costs, if you sell the property after three years, you will make a capital gain of $550,000 – $500,000 = $50,000.

$50,000 x 50% CGT discount x 51.5% = $12,875.

Therefore, your after-tax capital gain will be: $50,000 – $12,875 = $37,125.

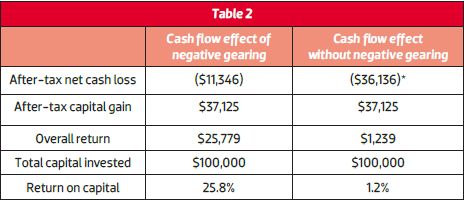

In summary, a comparison of your return on capital from the property investment, with or without negative gearing, is as follows:

*$48,136 (from last column of Table 1) – $12,000 (non-cash tax deductions) = $36,136

In other words, negative gearing may provide significant tax savings that may turbo-charge the return on capital on your investment property.

Having said that, negative gearing is a hotly debated topic in the public space at the moment. In particular, the opponents to negative gearing argue that negative gearing encourages property investment by providing significant tax perks that drive up housing prices, which makes home ownership inaccessible especially to first home buyers.

Therefore, watch this space.

Eddie Chung is Partner, tax & advisory, property & construction, at BDO (QLD) Pty.

Important disclaimer: No person should rely on the contents of this article without first obtaining advice from a qualified professional person. The article is provided for general information only and the author and BDO (QLD) Pty Ltd are not engaged to render professional advice or services through this article. The author and BDO (QLD) Pty Ltd expressly disclaim all and any liability and responsibility to any person in respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance, whether wholly or partially, upon the whole or any part of the contents of this article.

.jpg)