A new PropTrack Housing Affordability Index has revealed that the share of homes that a median-income household can afford has never been lower, highlighting the ‘alarming state; of housing and affordability at current interest rates.

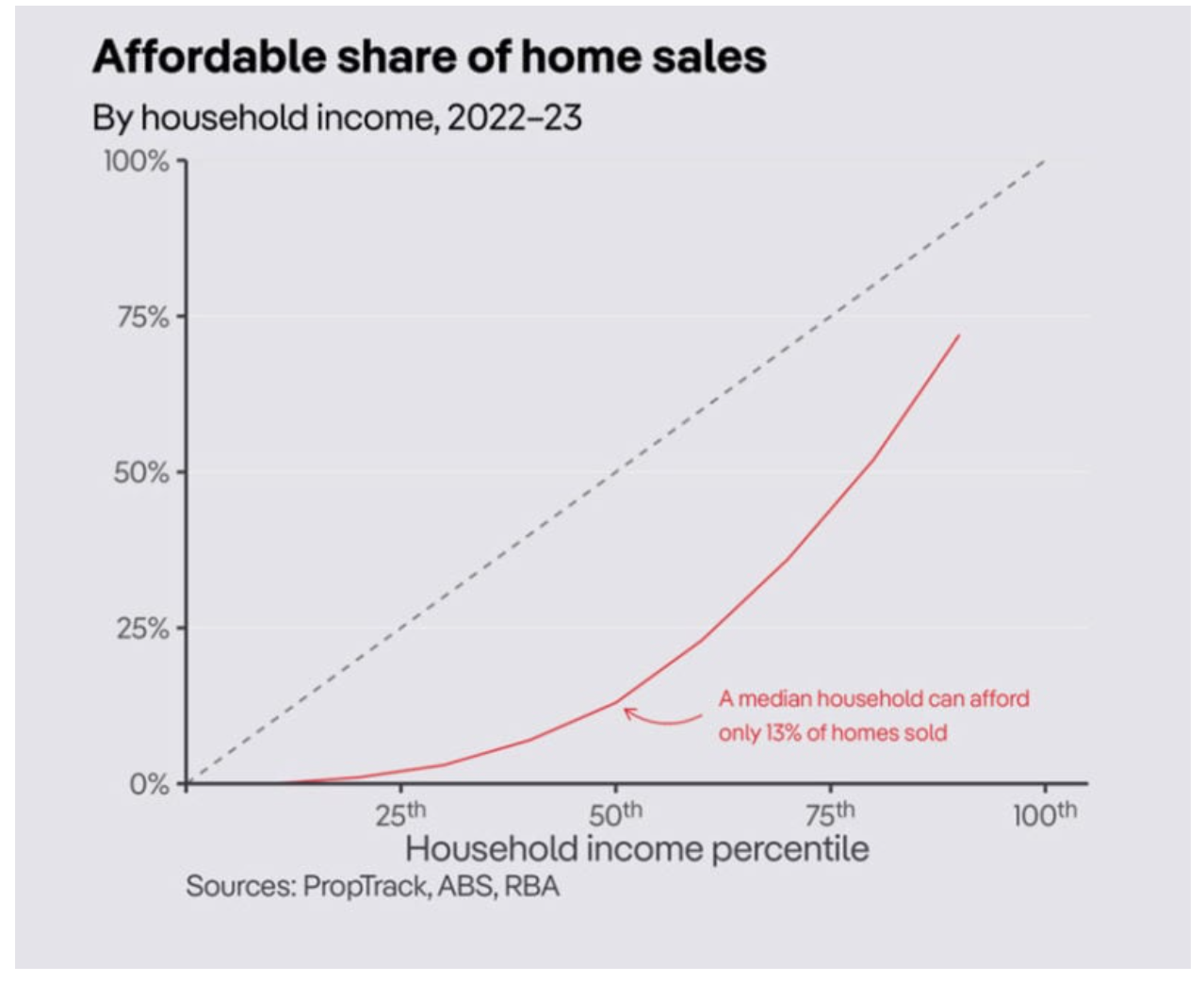

The data shows that a household earning the median (or typical) income of just over $105,000 per year in Australia can now afford loan repayments on just 13% of properties sold across the country over the past year.

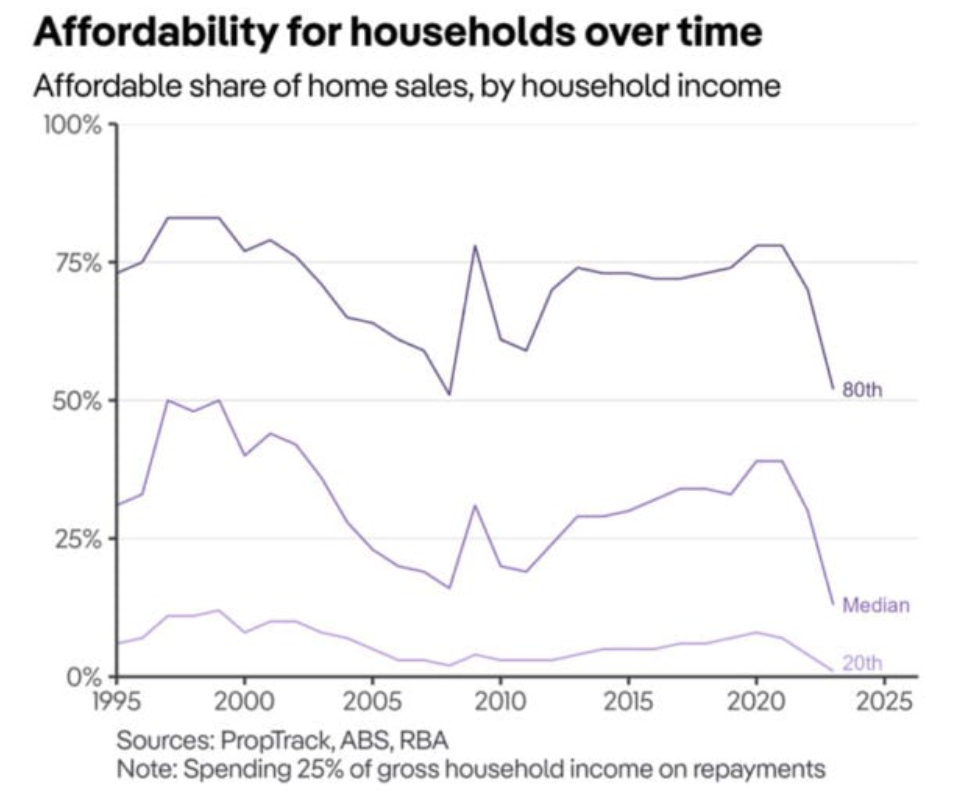

Not only does this represent the lowest level in history, but it also represents a significant shift from historically favourable affordability conditions over much of the past decade, the report explains.

Australia’s property market appeared to peak in 2019-21 when a median-income household could afford just shy of 40% of homes sold across Australia.

The data shows that even high-income households - those earning around $200,000 a year which sees them earning more than 80% of Australians - are facing strained affordability.

Current mortgage rates and property prices mean even these households can afford loan repayments on just over 50% of all homes sold over the past year.

The data also shows, concerningly, that any increase in household incomes since the pandemic, due to improved labour market conditions and wage growth, has been ineffective in offsetting the mortgage rate surge and higher property prices.

Mortgage serviceability is worse than ever

Mortgage interest rates have increased rapidly over the past 15 months with the Reserve Bank pushing the cash rate target to 4.1% from just 0.1% in an effort to take control over inflation as it snowballs.

This has caused the sharpest increase in mortgage rates since the mid-1980s and has reduced borrowing capacities by as much as 30% for new borrowers.

At the same time, existing borrowers, which make up around a third of Australian households, have faced sharp increases in mortgage repayments - a typical borrower now faces repayments as much as 50% higher than in early 2022.

And while mortgage repayments have increased rapidly, home prices are down only slightly from their post-pandemic highs, a key driver of affordability deterioration.

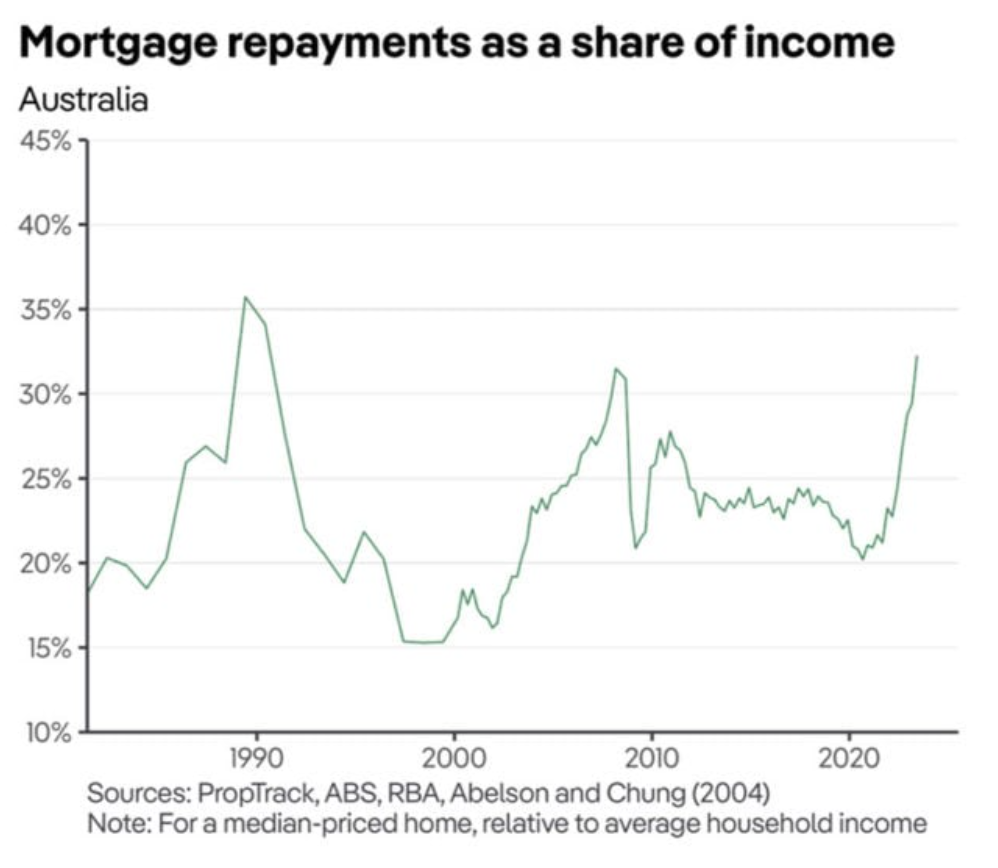

It’s no surprise that PropTrack’s data shows that servicing a mortgage is close to as hard as it has ever been, sitting just below the peak reached in 1989.

Of course, other measures of housing affordability also show the impact of sharply higher interest rates and the consequent surge in mortgage repayments.

A household earning an average income would need to spend about a third of their income on mortgage repayments to buy a median-priced home in what is the highest level since 1990.

Affordability is particularly severe for households in NSW, Victoria and Tasmania

Mortgage repayments as a share of income are particularly high in NSW, Victoria, and Tasmania, the three states where affordability has been hit.

The impact of higher interest rates and home prices in New South Wales can be seen in the high costs of servicing a new mortgage - a household earning average income, which in NSW is estimated to be just under $130,000 per year, would need to spend 39% of their income to buy a median-priced home, the highest in any state.

In Tasmania, the second-worst affected state, mortgage repayments are at the highest ever level relative to incomes thanks to surging property prices over the past 2 years - mortgage repayments on a median-priced home are equivalent to 35% of the average household income in Tasmania.

In Victoria, the increase in interest rates has also driven mortgage serviceability sharply higher.

A household earning an average income in Victoria (approximately $116,000 per year) would need to spend 35% of their income on mortgage repayments to afford a median-priced home.

Household types suffering the most and faring the best

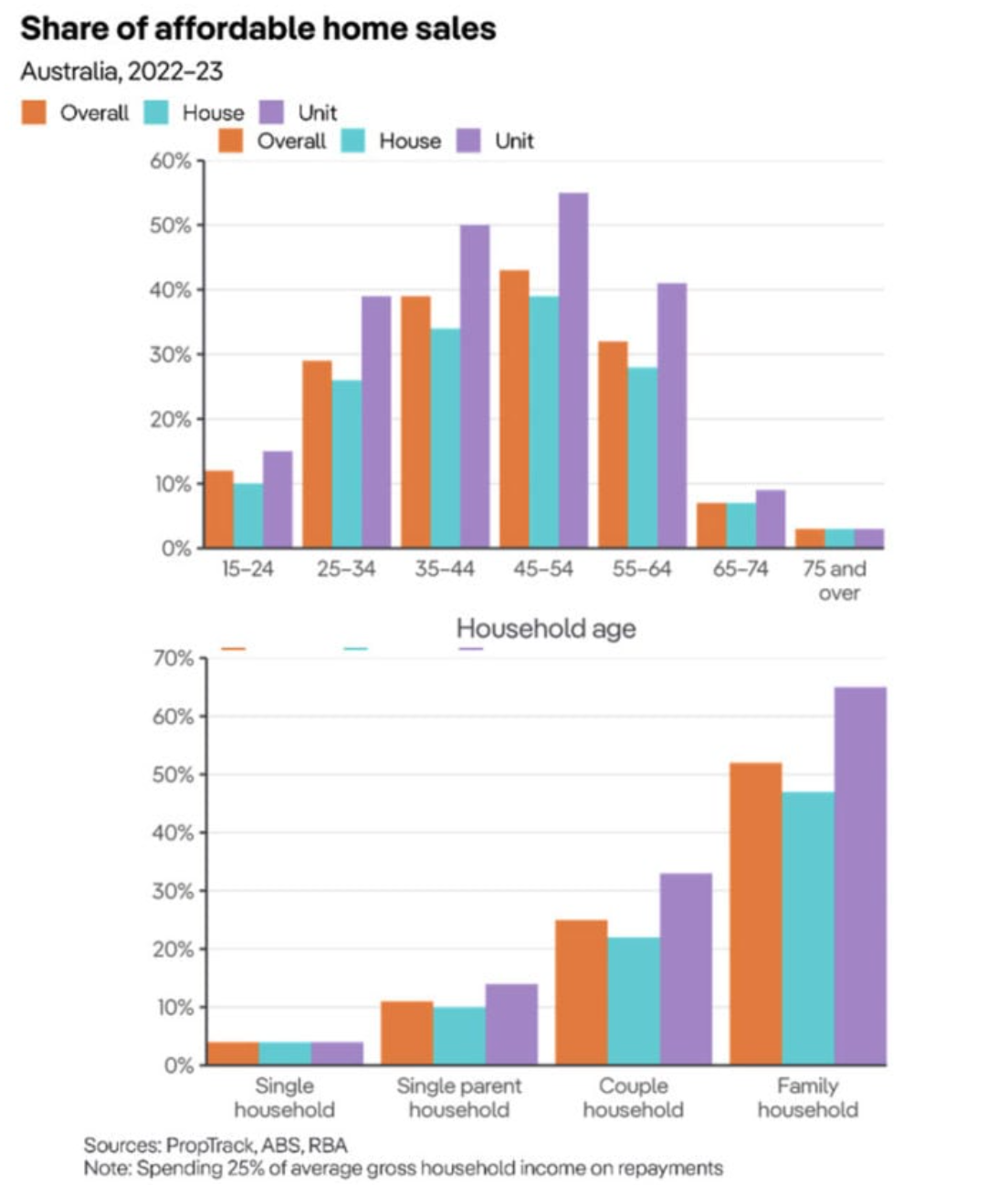

When we break the data down by household type and composition, PropTrack’s data reveals that while affordability is lower for all households, it is the worst for single-income households and those on their end of the age spectrum.

Affordability is very stretched for younger households - an average 25-34-year-old household could afford fewer than 30% of homes sold in 2022-23.

Although measured affordability is very low for older and single households, this largely reflects that the majority are retired with low incomes given most older households already own their own home so these measures based on mortgage serviceability are less likely to reflect housing challenges for them, the report explains.

Meanwhile, housing affordability is highest for families in peak working years, aged 35-54.

An average 35-44 year old household can afford just under 40% of homes sold across Australia, while a typical 45-54 year old household can afford just over 40%.

Many of these households will be families, which together could afford more than half of the homes sold.

First-home buyers forced to pull back

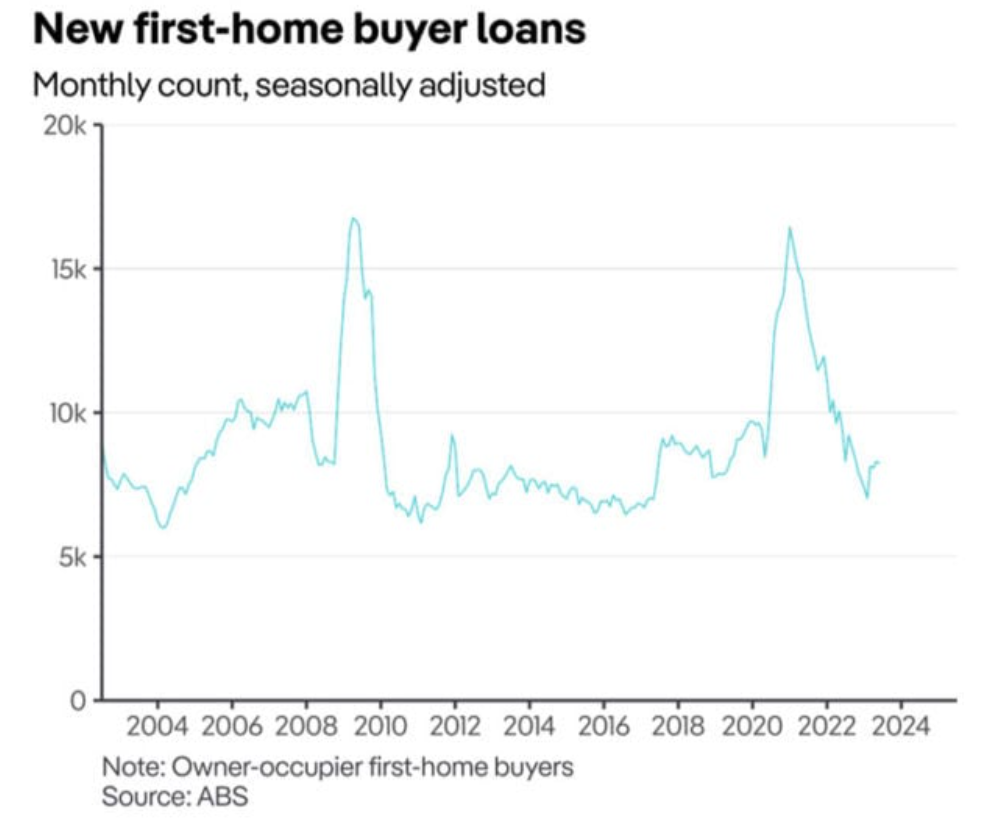

PropTrack’s report shows that worsened affordability has resulted in a pullback in first-home buyers entering the market.

Many first-home buyers were able to enter the market in 2020-21 when government pandemic stimulus saw ultra-low interest rates and government incentives to help make property buying more attractive and more attainable.

As a result, the value of loans to first-home buyers surged, peaking at more than a quarter of all lending at the end of 2020, and throughout 2021 more than 160,000 first-home buyers took out new mortgages, the highest annual number of first-home buyers in more than a decade.

But now, first-home buyer borrowing has returned to pre-pandemic levels - in the first half of 2023 there were half as many first-home buyers as two years prior.

And while lending to first-home buyers has increased a little recently, continued strained affordability suggests first-home buyers will continue to struggle to break into the market for the foreseeable future, the report said.

It’s not just mortgage serviceability that is creating an issue for first-home buyers though.

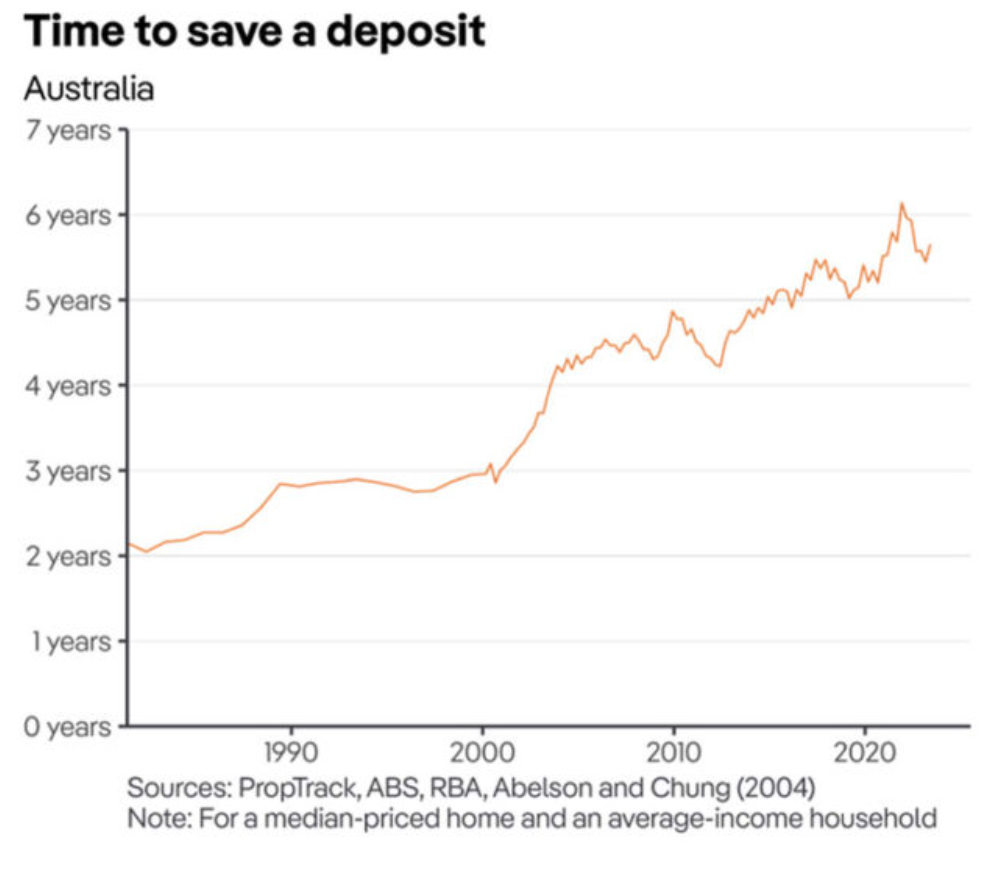

Saving a deposit has become a key barrier, with many struggling to save enough cash to put towards a property purchase at a time when inflation is high and income isn’t stretching as far.

An average-income household, earning just over $120,000 per year, would need to save 20% of their wage for more than five and a half years to save a 20% deposit on a median-priced home.

Home price declines throughout 2022 and stronger wages growth have reduced the time it takes to save a home deposit by about half a year from its peak at the end of 2021.

But, the time it takes a typical household to save a home deposit remains higher than it was before the pandemic, continuing the decades-long upward trend.

A final word

PropTrack’s report confirms what we had also seen in data elsewhere, that Australia is suffering a housing crisis, with a stark undersupply of property only helping to exacerbate high prices and affordability issues.

First-time buyers continue to be held back from entering the market, with tightened lending and high-interest rates making it challenging to secure a home loan, no matter what your income.

PropTrack expects that looking ahead, anticipation that,

“interest rates are close to their peak, and strong prospects for employment and wages may curb the rapid decline in affordability we’ve witnessed over the past year.

But, further home price growth will continue to pose affordability challenges for current generations and those to come.”

But while it might feel counterintuitive to buy in a correcting market, any buyer or investor can also benefit from less competition, low consumer sentiment, more time, and minimal risk of oversupply.

Now is still a good time to buy because consumer confidence is low and many prospective homebuyers and investors are sitting on the sidelines.

After all, sooner rather than later these buyers will realise that interest rates are near their peak and that inflation has peaked as the RBA's efforts have brought it under control.

And at that time pent-up demand will be released as greed (FOMO) overtakes fear (FOBE - Fear of buying early), as it always does as the property cycle moves on.

However, another result of the affordability challenges is that our markets will be more fragmented moving forward.

In other words, those with higher incomes will be able to and will be prepared to pay to buy in the middle and inner ring suburbs of our capital cities, whilst those living in the less affluent outer suburbs will keep struggling financially, creating less impetus for price rises.

My advice?

Don’t try to time the market, don’t hunt down a bargain… focus on buying an investment-grade property in an A-grade location.

These types of properties are in short supply but are still selling for reasonably good prices and will hold their value better in the long term.