Sydney house prices are expected to increase by 15.8% over the three-year period while units are expected to significantly outpace, climbing 23% over the same period as reduced borrowing capacity pushes many buyers to cheaper property purchases.

But growth will be subdued in the near term

Increasing an estimated 10.3% over 2023, Sydney’s median house price is estimated to have exceeded its previous peak in the December quarter of 2023, reaching $1.6 million.

However, the pace of growth is slowing; a function of an additional interest rate lift in November and rising total listing volumes.

Fading demand stamina is showing through in softening auction clearance rates.

The report predicts that Sydney will experience subdued home price growth over 2024 but will quickly gain pace throughout the 2025 and 2026 financial years.

“With the context of a growing dwelling stock deficiency, the return of interest rate cuts will drive the next acceleration of price growth from late 2024 onwards,” Maree Kilroy, senior economist at Oxford Economics, said.

Oxford Economics Australia expects 2024 will see house price growth of only 3.3% and 5.2% for units in the 2024 financial year.

But the relatively cheaper price point of units is expected to help back stronger growth near term.

Sydney's median house price is forecast to increase 5.9% per annum over the two years to June 2026, while median unit prices are expected to jump 8.3% per annum during the same period.

On a national level, the report says the country's median house price hit a new record of $939,000 last December but that it expects growth to slow this year, pointing to national clearance rates falling from 70% to 60%, while monthly price growth has leveled off.

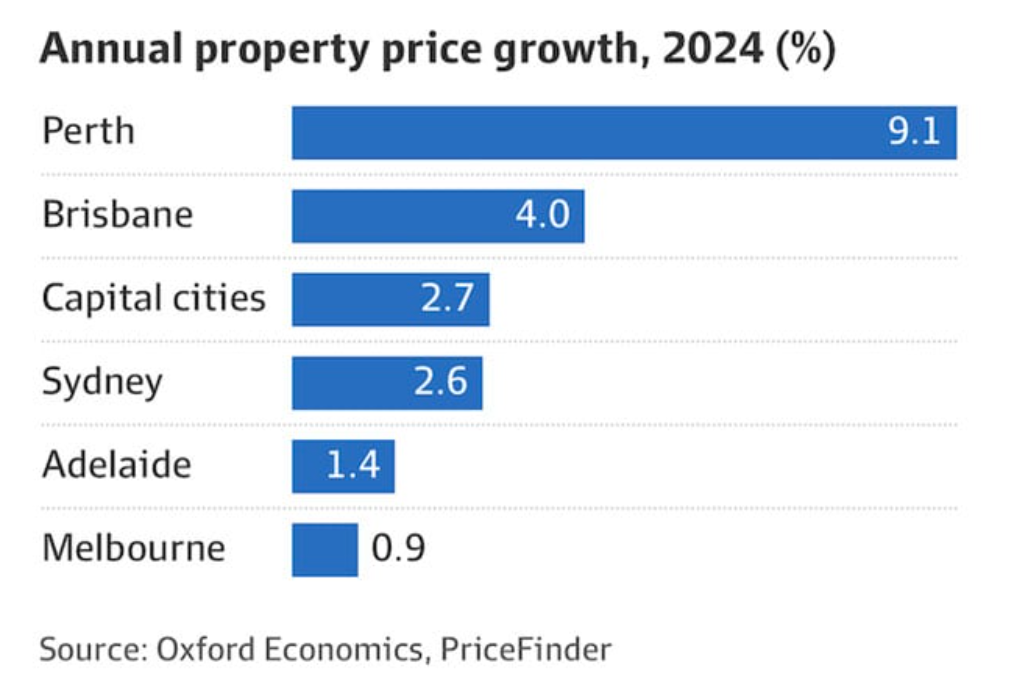

"Capital city performances have diverged in recent months," said Kilray.

"Total listings have risen in Melbourne and Sydney, a trend we expect to continue in coming quarters, acting to slow price growth."

You can always outperform the averages

While it’s likely that property price growth will be lower in 2024 than it was last year, the good news is that if you don’t like the outlook for what property will do on a national level, or even at a city level, you can always beat it by investing in the right property in the right location.

Now by that, I don’t mean look for the next hotspot.

I mean buying quality properties in locations that will outperform in the long term such as gentrifying suburbs.

You see...property offers countless opportunities to improve your results through your own time, skills, and knowledge – so you don’t need to settle for average.

And there’s more to it than just location.

You can add value through refurbishment, or redevelopment.

So what should a property investor do?

There is no doubt the shortage of dwellings both for sale and for rent, at a time of skyrocketing population growth is going to continue in Sydney into 2024.

And as buyers and sellers realise that we have reached a peak of interest rates and that inflation is coming under control and consumer confidence returns, buyer and seller activity will pick up.

So I currently see a window of opportunity to get into the property market before the crowd does.

In fact, the cost of waiting to invest in 2024 became even more real.

If you look back at previous cycles, when the market turned property prices surged rapidly – look at what happened in the post-Covid property rebound in 2020 or in 2019 when the market suddenly turned after the Federal election.

Of course, those who acted then and purchased quality investment-grade properties are possibly thousands of dollars ahead and have set themselves up for financial security.

The media are catching onto what’s happening and reporting more good news prop stories.

This means the window of opportunity will close sooner rather than later as more homebuyers and investors into the market.

Moving forward over the next decade, townhouses, villa units, and family-friendly apartments will be great investments, especially considering their current affordable entry price compared to houses.

And with soaring construction costs it is likely that all new apartment projects will cost 25%-30% more than currently completed projects and this causes the value of established apartments to rise as well.

My advice to investors is to avoid:

- Packed high-rise apartment towers.

- Locations right in the thick of the CBD – they’re over-supplied and have low growth drivers.

- Highly-featured complexes with lots of shared spaces that are expensive to maintain, like lifts, pools, and gyms.

Instead, I suggest you look for larger family-friendly Sydney apartments and units in middle-ring suburbs, which are close to good schools, parks, and cafes.

Throw in some good public transport links, and you’ve got the ideal investment for the Australian family of the future.

Photo by Tiff Ng from Pexels