Expert Advice with Doron Peleg 10/07/2017

Recent research on hotspot predictions and their 5 year results, suggests that only 37% of 2011 Property HotSpots and 43% of 2012, performed as well as the research benchmark and significantly lower than the predictions.

Even in NSW, the best performing state, only 51% and 57% of 2011 and 2012 hotspots actually achieved returns in line with the benchmark and once again lower than predicted.

So why did the Hotspots perform poorly despite a panel of property experts predicting growth?

One of the key factors in the poor performance is that a future view requires a comprehensive risk-return analysis on region, location, suburb growth, property type and features. In the absence of that analysis it is harder to properly identify and accurately assess the risks and the projected returns.

The second factor is that other macro factors were probably not taken into consideration. For example, in 2012 BHP Billiton shelved $US30 billion of major projects as part of a significant cost reduction exercise, indicating a slowdown in the mining boom, and the potential future impact on land and property prices and demand in regional mining areas.

Doron Peleg, the CEO of RiskWise Property Review said that “as experts in risk management and property investment, and considering the significant risks associated with property investment in an ever changing market, we were keen to understand whether the hot-spotting approach to making property investment decisions really could predict the best property returns. Sadly, we found that when you apply a combined and an in-depth risk-return approach with a macro overview and review this over 5 years, many hotspot suburbs have significantly underperformed, possibly resulting in many investors losing money, particularly in regional and mining areas”.

The research was undertaken by RiskWise Property Review using standard statistical methods that are typically used to assess investment performance in equities and other investment classes. The aim being to set a standard risk-return investment benchmark performance to compare hotspots investments with other returns, using commonplace investment valuation methods. It evaluated over 200 of the best suburbs in the country (as projected by Property Experts and published in Your Investment Property Magazine in the 2011 and 2012) and evaluated whether the strong capital growth predictions have been realised 5 years later. Each suburb was reviewed against two benchmark components:

- 5 year national capital growth for each property type: house / unit etc.

- 5 year capital growth for the capital city of each suburb.

Many of the HotSpots suburbs significantly underperformed against the benchmark.

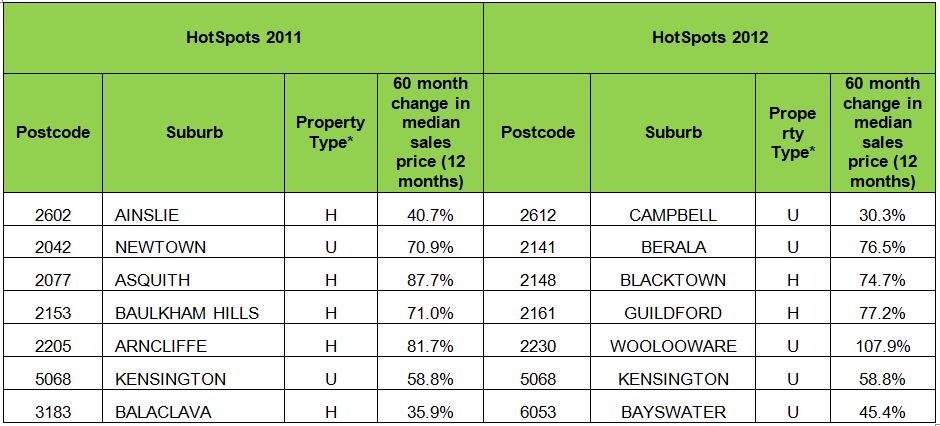

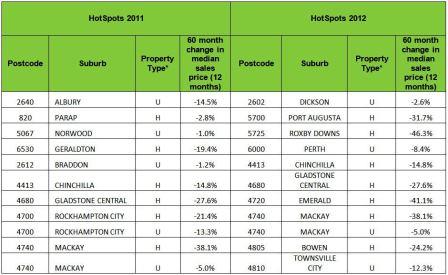

The tables below show examples of Hot Spots that performed well and HotSpots performed poorly:

Top Performing Suburbs - Examples

Property Type - according to the property type(s) that has (have) been mentioned in the list

Source: CoreLogic, RiskWise Property Review

The 5-year annual growth in Australia was 18.2% for houses and 9.5% for units

Poor Performing Suburbs – Examples

In a volatile market, where even the Reserve Bank has raised concerns and is advocating action to protect against a downturn in property returns, what can we learn from this research.

Look for an independent, balanced and informed advice from different sources.

Take a risk-return view based on many factors including property type, property details and demand in that suburb, location, future building factors, larger macro factors that may affect that suburb. When comparing two areas or properties that are projected to deliver a similar capital growth, invest in the area / property that carries a lower level of risk.

Ensure these factors are based on specific properties in specific suburbs, so you assess the individual property and not just the suburb or area that has been predicted as a hotspot.

Use these factors to take a future view of the investment risk versus the return. For example, if you are purchasing a unit in an area where 1,000s of units have already been approved by the local council, you need to consider how these units will impact the future price and demand for units in the area. Re-consider your investment and avoid paying over inflated prices if you can see that the market may become flooded in the future. Always take oversupply advice from an independent party and not from a biased source, such as the developer.

All of this research requires considerable knowledge, time and effort in a very busy world. This is why RiskWise have introduced their Property Expert report – the first of its kind to provide future view risk-return analysis on individual properties in specific suburbs. Using a sophisticated algorithm it combines all these types of factors to provide a future view of capital growth and rental return to help you make better informed property decisions.

Currently RiskWise Property Review is focused on the Eastern Seaboard capital cities. However, due to an increased demand, RiskWise Property Review have started the capital raising 6 months earlier than expected and inviting investors for find out more on our website www.riskwiseproperty.com.au

.....................................................

Doron Peleg is the CEO/Founder of RiskWise Property Review, a Co-Founder and Managing Partner of 'PELEG, KESSEL & CO' and a former Executive Manager at Westpac.

Doron Peleg is the CEO/Founder of RiskWise Property Review, a Co-Founder and Managing Partner of 'PELEG, KESSEL & CO' and a former Executive Manager at Westpac.

Utilizing 20 years of experience in risk management, Doron has Co-developed RiskWise's property risk rating algorithm. This smart algorithm enables potential property investors to better access and mitigate risks for individual propertues in Australia.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.