THROUGHOUT 2016, the Sydney and Melbourne property markets continued to be the standout performers, although growth did taper off significantly from the peak of 2015.

Meanwhile, Perth and Darwin continued their downward slide. Perth will likely trough first, and it will be a long and slow recovery. Adelaide trundled along while Brisbane continued its moderate growth, although the number of inner-city apartments selling at a loss continues to grow due to oversupply in this area.

"With wage growth at historically low levels and bank interest rates at all-time lows, every year that you hold off on buying a property can cost you thousands of dollars"

So, where are we now?

Tighter lending controls are helping to control growth in dwelling prices, particularly in Melbourne and Sydney. Investor housing credit growth is now less than half of APRA’s speed limit of 10% per annum and once again less than the growth in owner-occupier housing credit.

Affordability remains a topic of discussion and is putting a cap on growth, especially in Sydney where dwelling prices have increased by more than 65% over the cycle which started in mid-2012. In many respects this increase was justifi ed though, as NSW has started rolling out the $20bn Rebuilding NSW Plan.

Largely as a result of the affordability problem, home ownership rates are steadily declining. There is also a generational wealth gap developing in Australia, and the younger generations are finding it increasingly difficult to get into the real estate market.

Buying with the help of friends or parents is now relatively common.

ME Bank has found that one in five Australian fi rst home buyers receive financial help from their family. Those that are unable to get into the market may fi nd that they will unfortunately be forced to rent all their lives, unless they move to a regional area.

There is also a growing preference for location and access to amenities over property size. This means that more people are choosing to live in apartments with nearby parks and established infrastructure than in houses with backyards in the outer suburbs.

This demand has led to a boom in the construction of apartments, which has now overshot the mark in some markets and is self-correcting. Apartment approvals have come down from the record highs experienced in 2016. Properties recently approved will take a couple of years to be built, so the reduction in apartment completions will be delayed. On the other hand, many will not commence construction until the next growth phase, particularly in inner-city Melbourne and Brisbane.

How can you leverage the 2017 market to your advantage?

As an alternative to the traditional mantra of buying a home first and then buying an investment property once you have created some equity, many millennials are choosing to rent a home and buy a separate investment property.

This strategy is known as ‘rentvesting’ and allows ambitious young people who want it all to achieve their lifestyle goals, and also to get on the property ladder so they don’t get left behind. We have helped many clients with this type of strategy and put them on the path to financial independence.

With wage growth at historically low levels and bank interest rates at all-time lows, every year that you hold off on buying a property can cost you thousands of dollars.

Many have also realised that an additional benefit of rentvesting is that regional and outer suburb properties tend to offer much higher rental returns than their inner-city peers, so the investment doesn’t need to have a detrimental effect on the rentvestor’s lifestyle.

CASE STUDY 1: AFFORDABLE INVESTMENT FOR POSITIVE CASH FLOW

Many of our clients are seeking the best of both worlds, and when we ask the question, “What is more important – capital growth or cash flow?”, they answer, “Both!”

Using our detailed research methods, we identify areas where the fundamentals of the property market deliver strong cash flow as well as opportunity for growth. Stewart Fraser, a buyer’s agent and investment specialist working on my team, has worked successfully with hundreds of our clients and built incredible equity for them.

Stewart sourced one off-market property in the Brisbane area for a very affordable $350,000. It was a highset home in a family-friendly area with space underneath to create what are called ‘utility rooms’. While these cannot be legally classified as bedrooms, they can create extra space greatly needed by families for rumpus rooms or study areas.

Our local knowledge about council requirements for legal heights means you can’t advertise these as bedrooms but they can be used as rumpus or utility rooms. By doing a small reno on the underfloor area, the rent achieved was $450pw, and delivered a 6.7% gross yield.

It is important to get good local advice and to not rent the upper and lower floors separately in these highset homes, as the noise transference is too great. It’s far better to do things the right way from the start. To get a dual income, consider a granny flat.

What will be the predominant trends in 2017?

We predict there will be a continued preference for well-located real estate, including commercial property, among private investors, companies and superannuation funds, over other asset classes such as equities and fixed interest.

The value of Australian residential and commercial real estate is now estimated to be almost $7trn and $1trn respectively, compared to Australian-listed stocks, which are valued at around $1.7trn. Real estate has always been seen as a bedrock for building wealth, and smart investors understand the need for holding quality property assets in their overall portfolios.

With interest rates expected to remain low for the foreseeable future, quality real estate provides comparable (or superior) interest to bank deposits, and offer the benefit of future capital gain.

In saying this, capital gain will be less than experienced in recent history in Melbourne and Sydney, which have shown the strongest performance over the cycle to date. Gone are the days when you could expect to buy any house in a metropolitan area and see its value double every seven to 10 years, so the ability to generate equity uplift will be a more important consideration in 2017.

As property yields in sought-after inner-metropolitan areas in Melbourne and Sydney are likely to move only slightly off their record lows of 2016, there will be a continued flight to yield. Property in regional hubs (both residential and commercial) will benefit from this trend.

Areas around Brisbane, such as Moreton Bay and Logan City, will also see increased demand due to their relative affordability and yields of above 5% in some cases. Canberra and Hobart also offer relatively high rental yields. Canberra houses will show strong capital gains for the first half of 2017, but this market is dependent on the political environment so is more of a risk in the longer term than the other eastern seaboard capital cities.

Investors can also use specific strategies to obtain higher yields, such as completing capital improvements, for example renovating, adding a second level, building a granny flat (attached or detached); subdividing land; and completing fit-outs of commercial property in order to secure higher rents and/or longer lease contracts.

The next level up from these strategies is building a duplex property, which inherently has a higher level of risk although it has the possibility for capital uplift on completion as well as a high yield. The construction of duplex and dual-living properties by ‘mum and dad’ investors is becoming increasingly popular and can be completed in a variety of areas to suit a range of budgets.

Other trends include the increasing number of days on market for East Coast capital city properties, while Perth property will start its road to recovery, followed by Darwin, as resource prices and exports continue to make their way out of the slump. Towards the end of the year, Sydney yields are likely to start to increase again due to continued strong tenant demand but declining capital growth rates.

There will also be more awareness of apartment oversupply risks and the difficulty of selling apartments in highrises that don’t offer many features that differentiate them from the competition.

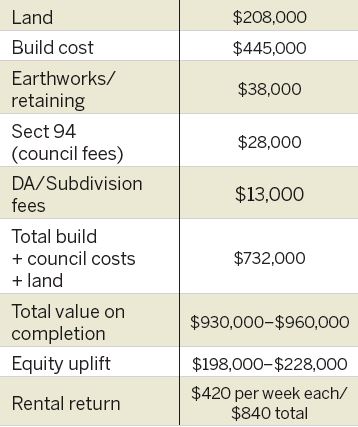

CASE STUDY 2: DUPLEX BUYER CREATES STRONG EQUITY

We assisted a client who was seeking to undertake a value-adding strategy by completing a duplex.

Kevin Mason, a senior buyer’s agent and investment specialist on my team, assisted our client in securing a duplex block that was advertised for $225,000, and negotiated this down to $208,000 (and this was when another duplex block in a local estate was selling for between $265,000 and $300,000).

Working with a team of other specialist consultants, we assisted the client in choosing a plan that would suit the block, and helped project manage the process. Kevin conducted due diligence and discovered that the local environment plan actually allowed a duplex, whereas most buyers thought this was not possible.

The design is an attached dual occupancy with three bedrooms, two bathrooms and parking for one car on each side. Here’s how the numbers worked out:

Are apartments still considered risky?

Some off-the-plan projects are still selling out in one afternoon, although this doesn’t mean that they are not somewhat risky.

Many buyers, such as foreign residents, are (broadly) only permitted to buy new residences. Others simply have a preference for new dwellings due to perceived benefits such as low maintenance, high depreciation, rentability, views, or building facilities such as a pool or concierge service.

However, problems can arise because a greater proportion of investors buy apartments rather than houses, which can lead to many properties in the same building hitting the rental market at the same time. Investors may be forced to lower asking prices in order to secure a tenant. Further to this, as leases are normally signed for 12 months, this problem may recur the following year (although not to the same extent).

Some developers offer a rental guarantee to compensate for this risk; however, investors should be aware that the expected cost of this guarantee to the developer is built into the purchase price, and this could be a sign that the investor is likely to have problems when trying to secure a tenant.

"To avoid buying a lemon that suffers years of lacklustre growth, you need to know the market inside out"

Further, when investors decide to sell the property, there will not be the same number of potential buyers as the property will no longer be new and will not be attractive to those who originally bought in the building.

However, these risks apply to some new developments more than others, or do not apply at all to some. Ideally, there should be a medium to high level of demand for purchasing existing property in the area due to proximity to jobs, transport and amenities. This can be gauged by the number of views of properties advertised online, and by the weekly auction clearance rates for the different regions of capital cities (although the latter measure is most useful for Melbourne and Sydney, where the majority of auctions are held).

To avoid buying a lemon that suffers years of lacklustre growth, you need to know the market inside out. A buyer’s agent scours the market and can uncover pre-market and off-market properties to reduce your competition and ensure you pay a fair price. Some buyers in Melbourne and Sydney are now paying above the market due to frustration or fear of missing out, but this can mean they don’t have any capital gain for multiple years to come.

Are apartment oversupply risks still high?

Apartment oversupply risks are very location specific, but bank lending restrictions for certain postcodes provide an indication. The ABS also provides regular data on the number of dwelling approvals and commencements in specific regions.

In Sydney, the main areas of concern are Green Square, Auburn, Ashfield to Strathfield, Parramatta, Blacktown, Ryde to Hunters Hill, Liverpool, Rockdale to Kogarah and Hurstville. In Brisbane, it’s the inner-Brisbane area, while in Perth and Melbourne it’s mainly the CBD.

Buying off the plan comes with another whole set of risks, so if you are considering this type of purchase you must be super selective and conduct additional due diligence to ensure your chosen strategy will work. Suburbs with continuing high demand and in close proximity to employment hubs, trains, shops and local amenities are less likely to suffer falls in pricing.

Some investors are steering clear of apartments altogether and opting for free-standing properties. Again, this depends on location and the buyer’s goals and requirements. Houses avoid strata levies, are easier to renovate or extend (you don’t need to reach agreement with other owners for work to be done), and may have superior growth and/or development potential to units.

On the other hand, they generally have lower yields, require more maintenance, and have a higher land value (and therefore higher land tax) than apartments. One way to counter this is to subdivide or build a granny flat, although this is a specific strategy and advice should be sought first.

Australia-wide, there is actually a broad trend towards apartment living. The Australian dream of the quarteracre block is now a distant memory for many, and the average household size has decreased to around 2.5 people from 4.5 people in 1911. This number is even lower in inner-metropolitan areas.

Families, especially smaller, younger families, are more willing than ever to trade size for lifestyle.

There is often also higher tenant demand for apartments close to the CBD and amenities as opposed to outer suburban houses. As long as there is not an oversupply of new units, this is likely to translate into a low vacancy rate, which is obviously desirable for investors.

In addition, if there is a property slump, these properties with a better supply-demand ratio will be less affected in terms of both capital price and rental income than those properties further out that were once achieving stellar rental returns but did not have strong tenant demand.

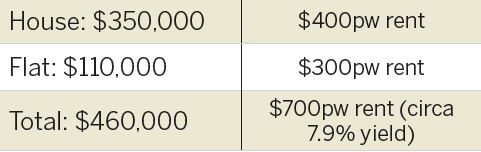

CASE STUDY 3: SUBDIVISION AND GRANNY FLAT

In some cases, there is opportunity to combine more than one strategy to create higher returns. Stewart Fraser found a large block in the Brisbane area sitting on 1,000sqm. Moving quickly, he secured the house for $435,000 for our client. By doing a quick reno of the utility rooms, the client will be able to achieve a gross rental of $530pw, delivering an initial 6.3% yield.

"The preconditions for a property bust are simply not present, so talk of a bubble is just hot air"

The client will be able to subdivide the block, which will create additional equity of around $250,000, plus he has the ability to build a granny flat on the existing block if he chooses to. We have educated some of the Queensland builders on the optimalsize granny flat to generate the best rent. Granny flat laws in Queensland are different to NSW and have specific council requirements in each area. When deciding on a granny flat you must consider how to position the flat correctly for privacy, aspect and access. You will also need separate water and electrical meters.

Using the granny flat strategy in the Brisbane market, we can generally get around 8% gross yield, as per the following:

Quite often, friends or family will rent the second dwelling. One of the key advantages of granny flats is the shorter construction time of typically around six weeks, which means minimal disruption to existing tenants. We also work with reputable builders that have the right construction materials (not a shipping container!) and build on site.

Looking to the future

Despite forecasts of apartment gluts in certain pockets, together with rising interest rates, wobbles in China’s growth, tighter credit controls, lower price growth and compressed yields, the savvy investor will simply need to dig harder, look wider and research more than ever before to make smart property investment decisions.

The preconditions for a property bust are simply not present, so talk of a bubble is just hot air. I expect we are in for a longer period of slower growth and stability, which is generally good news, as a more volatile market is harder for both buyers and sellers.

Some say that Sydney and Melbourne have had their day in the sun and investors should look elsewhere. This is a shortsighted view and doesn’t take into account the huge diversity of properties available in Australia’s two largest cities.

Sydney has a unique property market in many respects and is currently experiencing a massive infrastructure boom, which is delivering significant benefits to the economy. Projects such as the North West Rail Link, the eastern suburbs light rail, WestConnex and NorthConnex will deliver vastly improved travel times, and Badgerys Creek Airport will spurn incredible growth of whole new suburbs in adjacent areas. The Westmead medical precinct will create up to 50,000 new jobs and the new Northern Beaches Hospital will see rezoning in surrounding areas.

Investors should look for opportunities that are underpinned by consistent population growth, a reliable job market and nearby infrastructure development.

This is the classic PIE formula for investing (population/infrastructure/ employment). As mentioned above, property investors need to take a long-term view of the market and not be swayed by sensational media headlines that can influence short-term thinking.

- Baby boomers?

- First-timers?

- Upgraders?

- Middle-aged investors?

Investors were head of the pack in the heady times of the boom; however, they have now taken a back seat to homebuyers, according to recent housing finance data.

The most popular homebuyer demographic in Sydney seems to be the middle-aged and baby boomers who have generated equity during the current or previous property cycles. Given the difficulty of obtaining finance at the moment, this makes sense.

We are also seeing a growing trend of parents providing equity (or loaning equity) to their children to help them get a leg up into the property market. We’ve been engaged many times by parents to help them secure investment properties that their kids will one day own.

Many are choosing to renovate and/or extend rather than deal with the lack of stock, transaction costs, hassle of moving, or difficulty of obtaining enough finance to upgrade.

..........................................................................................................

Rich Harvey

Rich Harvey

Managing Director, propertybuyer

This article was written by Rich Harvey, founder and Managing Director of propertybuyer, Sydney & Australia’s most awarded Buyers Agents. Propertybuyer helps property investors and home buyers search and negotiate the right property at the right price, everytime. For further details please visit www.propertybuyer.com.au or call +61 2 9975 3311 or 1300 655 615.

Click Here to read more Expert Advice articles by Rich Harvey

While due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.