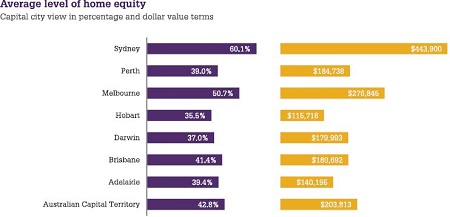

By subtracting the amount borrowers on the loan book of mortgage broking franchise Aussie Home Loans owe from the current CoreLogic RP Data valuations, the two companies claim that on average Australian home owners hold 48.4% equity in their home.

Home owners in New South Wales currently enjoy the highest equity levels at 56.6%, followed by Victorian home owners at 49.3%.

Northern Territory and Tasmanian home owners hold the lowest levels of equity at 36.9% and 32.7% respectively.

Source: Aussie/CoreLogic

When looking at local government areas, equity distribution is even more lopsided, with 18 of the top 20 LGAs located in Sydney, with the remaining two located in Melbourne.

For LGAs with the lowest equity levels, 11 are located in Queensland, four in Western Australia, three in Tasmania and one each in NSW and South Australia.

Source: Aussie/CoreLogic

For those owners fortunate enough to be located in areas where equity levels are high, Michael Beresford, director investment services at real estate investment advisory firm OpenCorp, encourages them to at the very least look at what opportunities are available to them.

“People should be aware of what their property is worth and how it’s changed in value. Property doesn’t always increase in value at a rapid rate. Most of the time it’s steady growth so at a time like this where some areas have seen strong growth people can be surprised by how much it’s actually worth,” Beresford said.

“The first step people should do is talk to their bank and get a valuation to find out how much their value has increased by and what they might be able to access and then go from there,” he said.

While some homeowners may be reluctant to pull out some of the equity they have built up, either thanks to capital growth or by taking advantage of low interest rates to pay down their mortgage faster, Beresford said there needs to be a better understanding of the difference between good and bad debt.

“A lot of it comes down to how people are educated. They’re taught all debt is bad and you should avoid it. In some ways that might apply to the debt you have from an owner occupier loan, but debt you take on for investment has other benefits.

“If you pull out equity to by a rental property you get the advantage that comes with another cash flow to help you service that debt that isn’t coming from out of your pocket and you get the tax benefits that investment loans have but owner occupier loans don’t.”

Philippe Brach, chief executive officer of Multifocus Properties & Finance, also recommends that home owners at least consider taking advantage of the possible positive position they might find themselves in.

“You’ve got that equity building up in your home, but it’s money that doesn’t really work for you, but you can make it work harder for you by drawing it out and investing elsewhere. It could be shares or property or whatever,” Brach said.

“If you’ve got equity and provided that you do it responsibly and don’t over stretch yourself then for sure I would definitely use it,” he said.

Btu Brach recommends home owners don’t sink all available equity into additional purchases.

“From time to time we see people who really want to push it and we have to tell them to slow down. If you use 100% of your equity to invest then where’s your buffer? The first thing to do is to create the buffer, so make sure you don’t use all of your equity.

“Say you have $250,000 in equity you pull out and you use $160,000 to buy two properties, you keep the difference as your buffer in case interest rates go up or you lose your job. The criteria should be are you comfortable and can you sleep at night?”

While he is a proponent of making the most of the equity available, there is one method Brach doesn’t recommend.

“Unless there is a drastic reason, you need $100,000 for an operation or something like that, I wouldn’t recommend selling.

“By the time you pay stamp duty and things like that you’re going to lose out on a lot of money, plus you’ve taken yourself out of the market. If you’re not ready to pull out the equity now, then hold on and what for the next boom and consider it then.”