Australia’s dwelling prices remained on a consistent downturn in October, but the pace at which they are declining continued to be varied across markets.

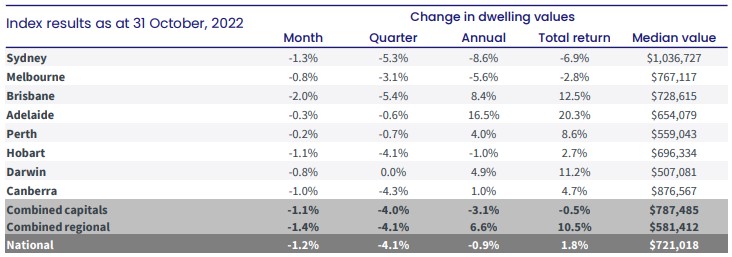

CoreLogic Home Value Index posted a decline of 1.2% in October.

The monthly data showed that all dwelling prices across all capital cities are still on a downtrend, with Perth and Adelaide showing the slowest pace of falls at 0.2% and 0.3%, respectively.

Brisbane, previously the leader of gains among capital cities, now lead the declines at 2%, followed by Sydney with a fall of 1.3%.

Overall, capital cities witnessed a 1.1% decline in median dwelling prices.

CoreLogic research director Tim Lawless said despite the easing of the downturn, it remains too early to claim that the worst of the decline phase is over.

“Despite the easing in the pace of decline, with Australian borrowers facing the double whammy of further interest rate hikes along with persistently high and rising inflation, there is a genuine risk we could see the rate of decline re-accelerate as interest rates rise further and household balance sheets become more thinly stretched,” he said.

Mr Lawless said the downturn in the housing market has remained orderly, especially in the context of the substantial upswing in values over the past year.

In fact, despite the consistent monthly declines, only Sydney, Melbourne, and Hobart posted annual decreases in median dwelling values over the month.

Interestingly, Adelaide’s median dwelling price were still 16.5% higher than over a year ago.

In terms of dwelling type, house values continued to fall at a faster rate than unit values across most regions.

According to the data, capital city house values were down 1.2% in October compared with a 0.7% decline in unit values.

Mr Lawless said the smaller decline in values across the unit sector can be attributed to the more affordable price points across the medium to high density sector.

“The gap between median house and unit values increased to record levels through the COVID upswing. With borrowing capacity being hit hard as interest rates rise, it’s likely more housing demand has been diverted towards more affordable sectors of the market,” he said.

—

—

Photo by Khwanchai Phanthong's Images on Canva