Rental yields continued to recover across capital cities and regional markets as house prices remained on a downwards trajectory towards the end of 2022.

According to CoreLogic, the national gross rental yield for all dwellings was at 3.8% in December — 4.5% for regional markets and 3.6% for capital cities.

While rental yields are generally still below the decade average, they have already recovered to the levels seen before the pandemic.

CoreLogic research director Tim Lawless said the disparity between the recent strong rental growth and falling housing values has seen the gross yield rise over the twilight months of 2022.

“Gross rental yields moved through record lows at the beginning of the year due to housing values rising at a faster pace than rents — since then, gross yields have been on a rapid recovery trajectory,” Mr Lawless said.

“Importantly though, when factoring in the higher cost of debt since May, it’s likely net rental yields have worsened for most investors as mortgage repayments have increased more than rental income.”

|

Regional Area |

Gross Rental Yield (%) |

|

Northern Territory |

7.1 |

|

Tasmania |

4.4 |

|

Western Australia |

6.3 |

|

South Australia |

5.1 |

|

Queensland |

4.9 |

|

Victoria |

3.8 |

|

New South Wales |

4.1 |

|

Capital City |

Gross Rental Yield (%) |

|

Canberra |

4.1 |

|

Darwin |

6.3 |

|

Hobart |

4.1 |

|

Perth |

4.7 |

|

Adelaide |

4.0 |

|

Brisbane |

4.2 |

|

Melbourne |

3.3 |

|

Sydney |

3.1 |

Rents rise across the board

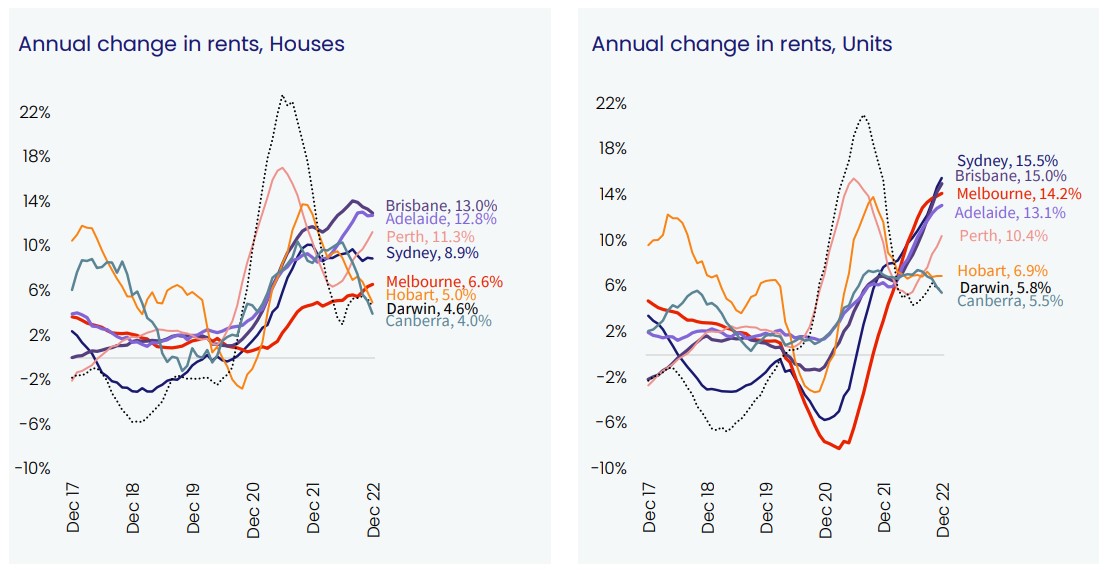

A big factor behind the recovery in gross rental yields is the strong growth in national dwelling rents.

Over the year, national rents went up 10.2%, rising across every broad region and housing type of the country.

Mr Lawless said the movement in rents over the recent years has been more closely linked to demographic trends due to the pandemic.

“Fewer people per household through the pandemic, and more recently the strong return in overseas migration, has added substantially to rental demand,” he said.

“Over the coming year, high rental demand is most likely to be concentrated in Sydney and Melbourne, which have historically accounted for around two-thirds of overseas migrant arrivals.”

The robust rental growth occurred alongside record low vacancy rates — capital cities finished 2022 with a vacancy rate of 1.2%, with Adelaide reporting the lowest level at 0.4%.

Still, it is worth noting that the pace of rental growth has already eased in some markets, which could be explained by affordability factors and some seasonal factors.

“As renters face worsening affordability pressures, it’s logical to expect more rental demand to transition towards higher density options, where rents are generally more affordable, or for rental households to maximise the number of tenants in a rental dwelling,” Mr Lawless said.

-

Photo by Robert Linder on Unsplash.