The past month was an unusual one for many sellers as listings decline while distressed sales rise, a sight rarely seen for October, when spring-selling activity typically peaks.

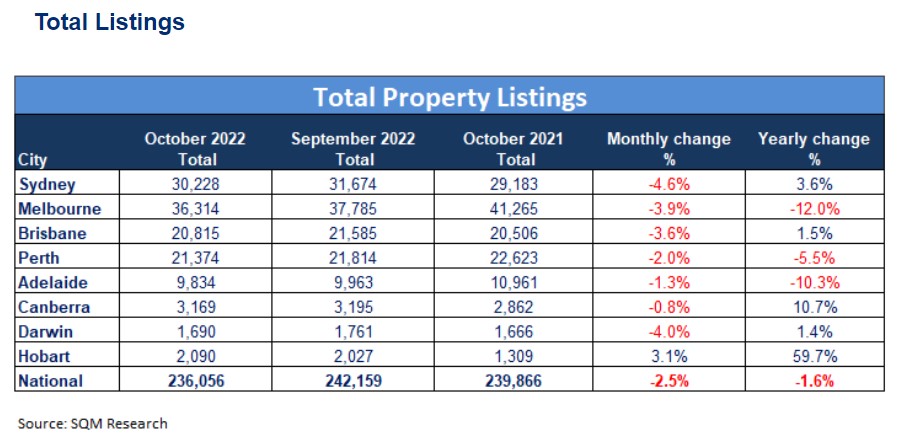

According to SQM Research, total property listings declined by 2.5% over the month and 1.6% annually.

On a monthly basis, all capital cities, save for Hobart, recorded declines in property listings, with Sydney and Darwin posting the biggest drops.

New listings, or those put onto the market over the last 30 days, rose modestly by 1.6%.

Sydney and Darwin recorded declines in new listings at 2.3% and 5%, respectively.

Meanwhile, old listings, which refer to homes that are on the market for more than 180 days declined by 0.9%, driven by the 7% slump in Adelaide.

SQM managing director Louis Christopher said the modest rise in new listings is “abnormal”.

“Meanwhile, older listings fell for the month driven by higher absorption rates in regional Australia,” he said.

“However, it should be noted there were rises recorded in older stock for most of the capital cities, indicating city vendors struggled to move their property over the month.”

In fact, there was a new rise in distressed sales in October — 6,658 residential properties nationwide selling under distressed conditions.

The increase in distressed listings was largely driven by New South Wales and Queensland, where distressed listings increased by more than 7%.

“This may indicate the rising interest rate environment is starting to bite,” Mr Christopher said.

“Overall, it was a disappointing month for sellers and their respective agents in the capital cities — sellers would be wise to meet the market in this environment if they want to sell.”

The higher asking prices, Mr Christopher believes, could potentially hurt sellers even more in this current downturn.

—

Photo by kanchanachitkhamma on Canva.