South Australia continues to go against the current market downturn, with home prices across the state going upwards in November.

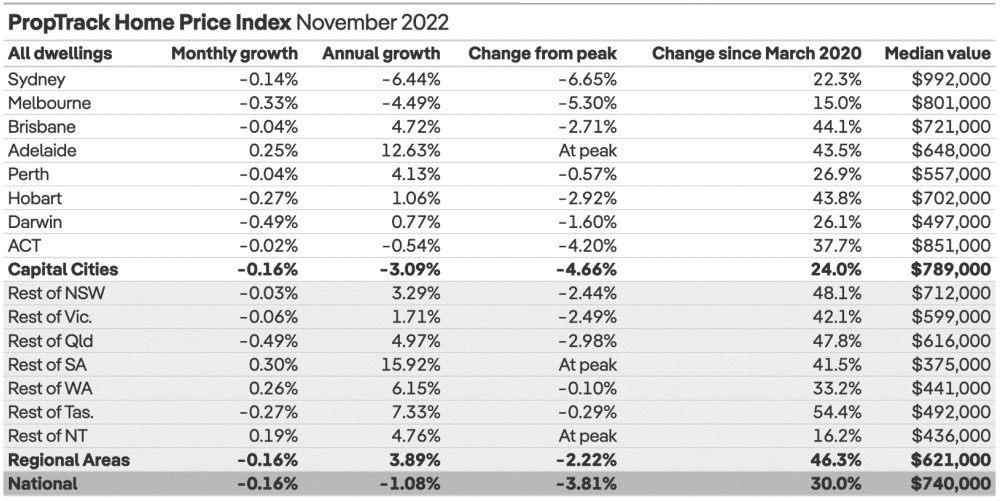

The latest PropTrack Home Price Index showed median value gains of 0.25% in Adelaide and 0.30% in regional South Australia.

Both markets reached a new price peak over the month.

Overall, national home prices posted a 0.16% drop, with Darwin and Melbourne posting the biggest drop at 0.49% and 0.33%, respectively.

Across regional areas, the decline was at a similar rate. Home prices fell the fastest in regional Queensland at 0.49%.

On an annual basis, regional areas outperformed capital cities — median prices in the former were still 3.89% higher compared to last year; the latter on the other hand, reported a 3.09% annual decline.

Compared to pre-pandemic levels, home prices across Australia are still 30% higher.

PropTrack senior economist Eleanor Creagh said the rising trend in interest rates have rebalanced the housing market from last year’s extreme growth.

“National home prices have fallen for the eighth month in a row, with the fastest interest rate tightening cycle since the 1990s weighing on home prices in most parts of the country,” she said.

“Though the pace of price falls remains significantly less than the larger falls seen in June and July when interest rates first started rising, the downturn has continued to deepen as interest rates continue to rise.”

The likely 25bps rate rise in December, which will bring the cash rate to 3.1%, could potentially mean further price falls.

“With additional rate rises on the horizon, borrowing costs will continue to increase and maximum borrowing capacities will further reduce. The significant reduction in borrowing capacities implies further price falls,” Ms Creagh said.

“With additional rate rises on the horizon, borrowing costs will continue to increase and maximum borrowing capacities will further reduce. The significant reduction in borrowing capacities implies further price falls.”

—

Photo by Tourism Australia on Canva.