Rental market pressures seem to be easing as the pace of quarterly growth in rents continued to slow down over the last quarter of 2022.

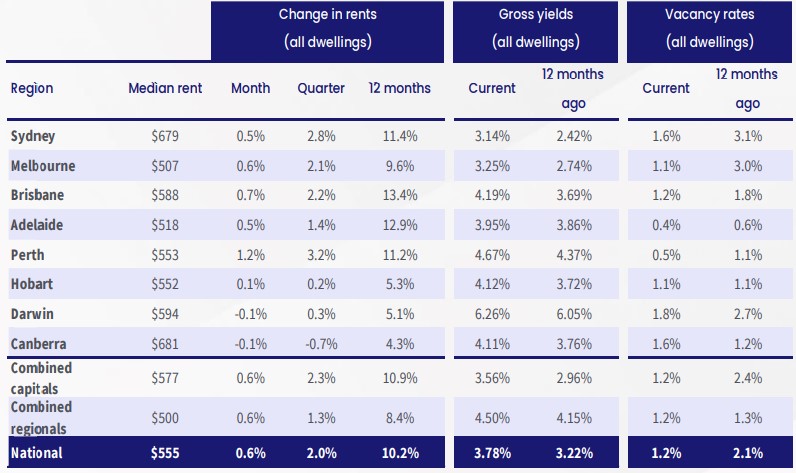

CoreLogic’s latest rental review showed a 2.0% growth in rents during the three-month period to December 2022, down from the 2.3% growth achieved in the September quarter and the peak of 3.0% recorded in May.

CoreLogic head of research Eliza Owen said the second quarter of the slowdown for rental prices came with a small lift in the rental vacancy rate to 1.17%, from a recent low of 1.05%.

“The decline in quarterly rental growth rates observed in the December quarter was led by the capital cities where rents continued to increase but at a slightly slower rate than they have done in September and June quarters,” she said.

Despite the apparent easing in rental prices quarterly, conditions remain challenging for tenants — on an annual basis, rents increased 10.2% in 2022, a new record high.

“Rents are still rising in most capital cities and regional areas with vacancy rates low,” Ms Owen said.

Rents had been on the rise since September 2020 — since then, rent values have increased by 22.2%, marking the largest rental upswing on record.

During the period, tenants saw their median rents increase from $430 per week to $519.

House versus unit

The latest data demonstrates a further narrowing on the gap between house and unit rent prices.

Unit tenants saw their rents increased 2.8% during the quarter, while those leasing houses recorded a 1.7% jump in rents.

The unit market has been reporting higher quarterly growth rates for rents since February 2022.

Rents in both housing types remained high relative to historic averages.

This trend could be explained by the reopening of international borders — the return of overseas migration could potentially be boosting demand for high-density housing.

Yields still on the rise

Rents have been outpacing property values since February last year, which is good news for landlords who are keeping track of yields.

The national gross rental yield increased by 57 basis points (0.57%) since February to 3.78%.

However, the current gross rental yield still pales in comparison from the pre-COVID decade average of 4.24%.

Ms Owen said there are no clear indication of where the rental market will go as 2023 unfolds — despite the apparent increase in demand, investor confidence appear weak.

“Investor activity and rental supply is not expected to pick up substantially in the year ahead — even though rent yields are rising, investors are facing higher interest costs, and reduced capital growth prospects,” she said.

—

Photo by towfiqu ahamed barbhuiya on Canva.