A self-managed super fund could be the ideal vehicle to grow your property wealth in a safe, smart and profitable way. But there are many complexities to be aware of, and costly pitfalls to avoid. We present a guide to buying property through your SMSF. Sarah Megginson reports

Investing in property through your self-managed super fund (SMSF) can help you to supercharge your profits and build your wealth. But go about it the wrong way and the financial penalties can be harsh.

Many Australian investors are beginning to cotton on to the benefits of investing in property via an SMSF, with more than $28bn of all SMSFs currently invested in residential property alone.

Jordon George, head of policy at the SMSF Association, says that while SMSF growth has been significant over the past decade, it has been more modest recently.

“For much of this time, the sector has seen quarterly SMSF establishments of 8,000 funds per quarter, whereas since 2015 quarterly establishments have fallen,” George says.

“However, growth in the number of SMSFs for financial years 2015 and 2016 still totalled a healthy 4.4% and 5.5% increase in the number of SMSFs, respectively.”

It’s easy to see why more people are contemplating SMSF as an investment vehicle. The benefits are plentiful, with the ability to access concessional tax rates of 0–15% topping the list.

That said, buying an investment property is one of the biggest financial decisions you’ll make, and any type of property investment requires a long-term view – it’s not a get-rich-quick scheme.

“Buying an investment property via an SMSF isn’t for everyone,” says Damian Collins, managing director at Momentum Wealth, “but it should at least be considered as part of your retirement planning”.

Investors need to seek appropriate specialist financial and legal advice to establish an SMSF, he suggests, before engaging a reputable property investment consultancy to help identify the most suitable type of property for their circumstances.

• Increased transparency and control

• Reduced cost of administration

• You can still borrow to purchase residential property

• An SMSF can purchase your business premises

• Super assets of up to four members can be consolidated

• Greater flexibility in terms of investment options

• Concessional tax rates range from 0% to 15%

• Investment income may be tax-free when in pension phase

• Concessional superannuation contributions

• Greater asset protection

Risks of investing through an SMSF

Collins confirms that the number of people using their SMSFs to buy an investment property has been on the rise. However, he cautions that this strategy is not right for everyone.

It was a regulation change in 2007 – one that allowed investors to effectively borrow money with their SMSFs – that led to an increase in the number of people buying investment properties through their super, Collins says.

“The changes essentially unlocked a large pool of money and, subsequently, many developers and property marketers emerged, claiming to be able to help investors establish SMSFs and assist them in buying an investment property,” he says.

“While SMSFs are classed as a financial product and are heavily regulated, regrettably the property industry isn’t, leaving it susceptible to unscrupulous operators.”

This has created an environment in which some less-than-reputable operators have flourished, Collins warns.

“Unfortunately, it’s not uncommon for some companies to receive kickbacks for recommending that investors buy particular properties.

These are typically new or off-the-plan properties, which look like good investments on paper but turn out to be second-rate assets that underperform,” he says.

For this reason, Collins suggests that any investor considering using an SMSF to buy an investment property should seek expert advice to ensure it fits into their retirement plan and investment strategy.

“For those who set up SMSFs, there are considerable legal obligations as to how the fund is structured and managed. In some cases there can be compliance issues if the property underperforms, and the investor may face penalties,” he says.

“The changes essentially unlocked a large pool of money and, subsequently, many developers and property marketers emerged, claiming to be able to help."

“Buying a property via an SMSF can be very complicated and take longer than it would to buy a property outside a fund. This is why it’s crucial to source reliable and independent investment advice before choosing to take this path.”

Passive property investing

Just as investing in property through an SMSF won’t suit every investor, not every investment type is suited to SMSF ownership.

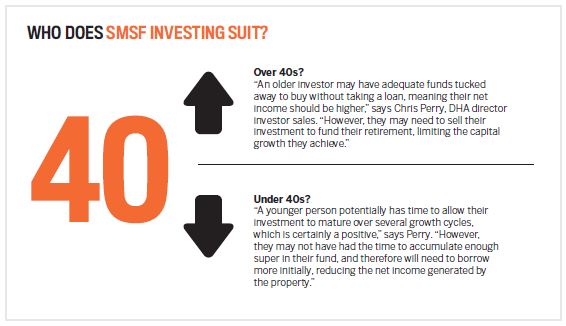

In general, passive, ‘set and forget’ investments are the ideal match for an SMSF ownership structure. For instance, Defence Housing Australia’s director investor sales, Chris Perry, says many investors in DHA properties find that purchasing via an SMSF is a smart way forward.

“DHA has sold many properties to SMSF buyers, and direct property is one of the more common asset classes held by SMSFs. For SMSF trustees searching for a consistent income stream, a DHA property can be an ideal option,” he says.

“DHA provides housing to members of the Australian Defence Force and their families, while selling and leasing back properties directly from investors to supplement its housing portfolio, and so with a DHA investment property you receive a guaranteed rental income. Rent is even paid if your property isn’t occupied. This security of income makes Defence Housing particularly attractive to those operating an SMSF.”

This type of low-fuss, set-and-forget investment vehicle is ideally suited to a passive SMSF ownership model, particularly as SMSF trustees can even borrow to invest in property.

“A trustee can utilise a limited recourse borrowing arrangement to fund the acquisition of residential property, held in a separate trust. The income earned from the property goes to the SMSF trustee,” Perry says.

“Although it is possible for SMSF trustees to borrow, DHA does recommend that investors consult a qualified professional to discuss their investment strategy and the most appropriate structure based on the individual circumstances of the members and their fund.”

He adds: “Every individual is different, and how you benefit from any investment is based on your personal strategy and what you are hoping to achieve. DHA’s property investment program is considered a long-term investment, which is why it is suitable for many SMSF investors.”

If so, click here to learn about the benefits of a Self-Managed Super Fund.