Everyone loves this quote from Warren Buffet:

“Be greedy when others are fearful and fearful when others are greedy”

A lot of people try applying it to almost anything. And I’ve heard it applied in Australian property investment circles a lot.

It might work well in the share market, which is the context for which Buffet intended it. But the data suggest applying it to property investing is a clear mistake.

Fear, greed and a place to sleep

Investors make their decisions to buy or to sell purely for financial gain. It’s why the share market is often said to be driven by fear and greed.

“Everyone who owns shares considers themselves an investor, but not everyone who owns property does, some just want a place to live”

Therefore, the majority of the property market is driven simply by an essential need for accommodation. The property market is not so intimately linked to fear and greed as the share market is.

“Very few property owners in Australia sell their home to stop losses in a falling market”

So, although it might make sense to keep an eye on the emotions of the share market, perhaps it’s not that important in real estate.

How do we measure fear & greed?

We need some means of measuring fear and greed to know how to apply Buffet’s strategy.

“How do we know if the market is greedy or fearful?”

Perhaps a fearful investor is one who wants to sell.

Can we assess fear and greed as?

- Desire to sell --> fear

- Desire to buy --> greed

Perhaps the count of the number of potential buyers versus the number of sellers will let us know if the market is fearful or greedy. We can look at things like:

- Bidders at auctions

- Open inspection attendees

- Offers to buy

- Searches online

In the share market I don’t know how you would count buyers or sellers in this way. As far as we know, every transaction has a buyer matched with a seller - one to one.

But in real estate, we have the online search interest:

“Online Search Interest (OSI) = searches online vs. properties for sale online”

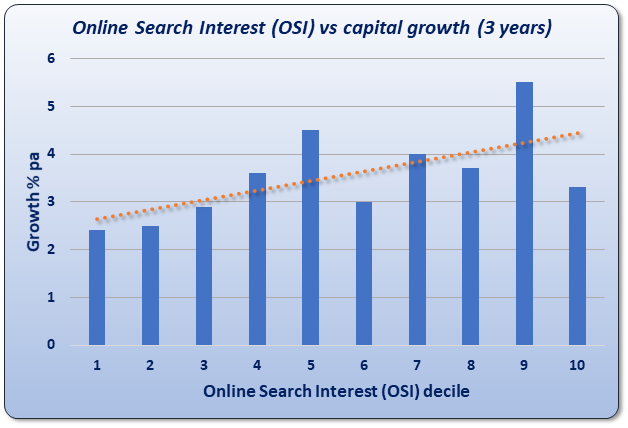

So, I examined historical OSI data to see if an investor would have been better off buying when others were fearful. The following chart shows the relationship between OSI and capital growth.

Along the bottom you can see that I have pooled property markets into 10 groups. Each property market across the country was placed in one of these 10 groups.

Markets with the lowest OSIs were put into the 1st group on the left of the chart. While markets with the highest OSIs were put into the 10th group at the right of the chart. The property markets with the most people searching are on the right, while the suburbs with little interest from buyers are on the left.

The capital growth shown up the left vertical axis is the combined growth for all suburbs in each group over a 3-year period. This combines all the 3-year periods since records of OSI began back in 2010.

As you can see, markets in the lowest OSI group, had the lowest capital growth over the next year – a little less than 3%.

Overall, the relationship between OSI and 3-year capital growth can be seen in the orange dotted line. This is the line of best fit for these ten groups.

Because the dotted line is sloping upwards, it suggests there’s a relationship between OSI and 3-year capital growth. It means that in general, the higher the OSI, the higher the capital growth.

The point of this exercise was to see if greediness is a trigger to sell. And the data shows that using this particular measure of greediness, that’s not the case. The data suggests investors should be greedy when others are.

Buy against the trend

Perhaps we’re measuring greed and fear the wrong way. Perhaps it’s not about the number of buyers and sellers. Perhaps a better measure of fear or greed can be derived from the direction in which prices are moving. Perhaps if prices are falling, this is a better indication of fear.

- Price movement?

- Up --> greed

- Down --> fear

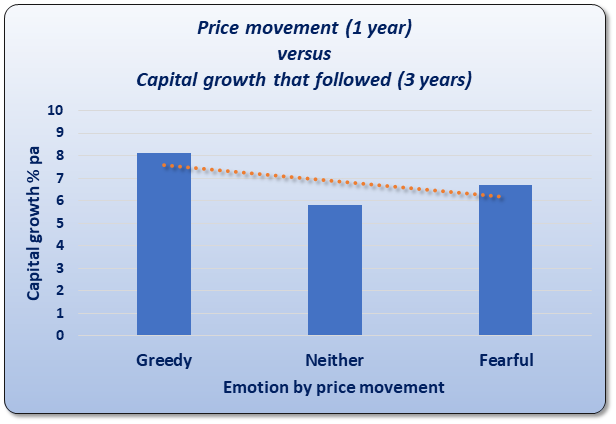

Following this strategy, we would buy into markets that are falling. So, I examined the growth rates of all Australian property markets to find those that had been falling and those that had been rising over any 12-month period.

Then I examined how prices continued to move over the next 2, 3 and 4 years. I repeated this analysis for all historical data over the last 25 years. The next chart shows three columns reflecting the emotions of: fear, greed and neither.

A property market was classified as greedy if there was upwards price movement greater than 4% over a 12-month period.

If prices didn’t move up that much and they didn’t move down too much either, then that suburb was classified as “Neither” greedy nor fearful.

But if the suburb’s price moved down by more than 2%, that is, negative growth, then that market was classified as “Fearful”.

This classification was performed for all property markets over all 12-month windows across the country where there was sufficient data to assume the median was accurate.

The height of the bars shows the 3-year capital growth that followed on from the time these suburbs were classed as Greedy, Fearful or Neither.

As you can see, the suburbs classified as Greedy had better growth than those classified as fearful or neither. In other words, you would have been better off buying in markets that had 12-month price growth already, than buying in markets with negative price growth.

This data analysis covered literally thousands of suburbs. And the data stretched across a number of decades. The conclusion using this approach is pretty clear:

“Following a rising market is a more profitable strategy than following a falling one”

A fearful case

How about we examine a truly fearful case. This is a horror story that a handful of investors have gone through not so long ago. Some have declared bankruptcy. Others may take decades to recover. This is a genuinely heart-breaking circumstance for an investor to go through.

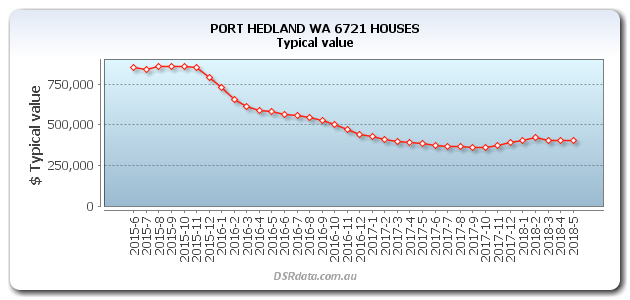

When the resources boom ended in 2015, there were many fearful investors trying to sell off properties in places like Dysart, Moranbah and the Pilbara. These are towns where the dominant industry was mining.

If we were to buy when others are fearful, we would be buying into those markets towards the end of 2015 when everyone else was gripped with fear. Here’s the growth chart for the mining town of Port Hedland from mid-2015…

An investor would have lost close to half a million dollars buying in late 2015. That’s a half a million-dollar loss from being greedy when others were fearful.

But these were isolated cases only affecting a handful of unfortunate investors. Let’s examine a case that affected a great many investors.

A greedy case

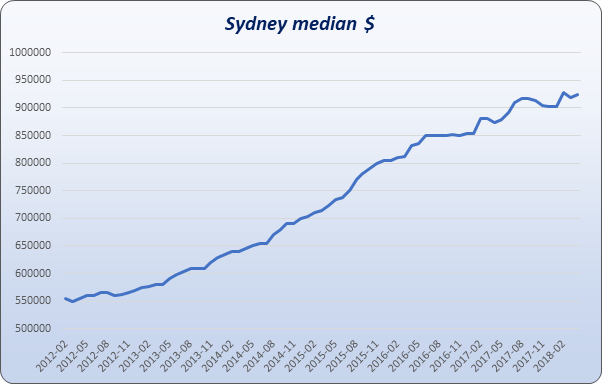

In 2014 Sydney property prices were taking off. Following is a chart of the Sydney median.

There was a lot of talk about greedy property investors being responsible for this boom. It was all over the news and there was a lot of hate towards investors. If we were to be fearful while those investors were being greedy, we would have sold in 2014.

In fact, I can remember one very high-profile expert telling her clients that Sydney was “overheated” in 2014. As you can see from the chart that mistake would have cost an investor a lost opportunity worth around quarter of a million dollars in just 4 years.

Who are the others?

Perhaps I’ve got it all wrong about who the “others” are. Be greedy when others are fearful. Who are the others?

What if everyone followed this advice? How do we know everyone isn’t already following this advice? After all, it seems like everyone has heard it.

If everyone is following this advice, then everyone would be the “others”. So, we’d have to do the opposite of the others which is to not follow the advice, which would mean not doing the opposite of everyone else which would mean we’d follow the heard that is following Buffet’s advice.

ERROR: brain melt

It’s a bit of a vague strategy for property investors to follow, isn’t it?

- How is fear measured?

- How is greed measured?

- Who are the “others”?

We don’t know how to accurately measure fear or greed and we don’t know who the “others” are.

I suspect the problem stems from some significant differences between share investing and property investing. I’ve already mentioned one – not all property owners are investors. There are two more that might be playing a crucial role: Timing & Recycling Costs

Timing

It takes a few minutes to buy some shares. And you can sell them again a few minutes later. The timeframes for doing the same thing in property would be months – literally around 100,000 times slower.

- Shares

- Buy time = minutes

- Sell time = minutes

- Property

- Buy time = 5-7 weeks

- Sell time = months

Perhaps following a trend in the share market is a bad idea since by the time you’re confident it’s a trend, it’s too late. That is not the case in property as we’ve seen. One investment vehicle can U-turn like a dingy while the other is like an oil tanker doing a 3-point turn.

Recycling costs

And there’s another massive difference between the two investment vehicles. Entry and exit costs in property are way higher.

- Entry costs (buying)

- Stamp duty --> $??,000s

- Legal fees --> $1,000+

- Reports --> $1,000+

- Building inspection

- Pest inspection

- Strata report

- Exit costs (selling)

- Capital gains tax (same as with shares)

- Agent’s commission --> $??,000s

- Legal fees --> $1,000+

- Cleaning --> $500

It’s these kinds of differences and how massive they are that triggers alarm bells that a strategy for share investing may not apply so well to property investing. But everyone loves to apply the contrarian approach. And maybe we still can…

Contrarian view

Here’s a way to look at things so in some way we can say we’re kind of following Buffet’s advice…

In real estate, a “buyer’s market” is one in which it’s easy for buyers to buy.

- Buyer’s market

- Supply exceeds demand

- Easy to buy

- Seller’s market

- Demand exceed supply

- Easy to sell

Supply and demand are the sole dictators of price growth. When demand exceeds supply, prices go up. So, if we’re to catch that wave, we need to buy when demand exceeds supply.

- Buyer’s market

- Supply exceeds demand

- Easy to buy

- SELL

- Seller’s market

- Demand exceeds supply

- Easy to sell

- BUY

That means we need to… buy in a seller’s market. It also might mean we should sell in a buyer’s market. There you go, there’s your contrarian view.

Conclusion

Buffet’s advice might work perfectly in the share market. But historically, it hasn’t worked with property in Australia.

No historical data seems to support this strategy working in Australian real estate. I’ve looked at isolated cases with the mining towns and widespread cases like Sydney. I’ve looked at online search interest and price movement. In all cases, we should be greedy when others are.

If you really must do the opposite: “Buy in a seller’s market”

....................................................................................

Jeremy Sheppard is head of research at DSRdata.com.au.

Jeremy Sheppard is head of research at DSRdata.com.au.

DSR data can be found on the YIP Top suburbs page.

Click Here to read more Expert Advice articles by Jeremy Sheppard

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.