07/11/2014

Many people get stuck after buying one or two investment properties - and it’s partly to do with planning - but it also has to do with how you structure your finances and whether you have a buffer in place. A buffer is absolutely vital, and it is the difference between living stretched to your limits and living comfortably while you invest. Your investment buffer is an overarching and key component to your overall property investment plan.

By ensuring you have a buffer to cover your costs and enough to get you through in the event of something going wrong - and things do happen unexpectedly, as we'll see in a moment – you set yourself up for a hassle-free investment journey.

Let’s set the scene: You have three investment properties and tenants in each. One day you get a call from your property manager to say that your tenant has been laid off at work and wont be able to pay rent for a few weeks – maybe even up to a couple of months. You figure that’s ok, you’ve got enough to scrape by in this situation and they’re going to pay it back eventually. So no problem. But then, that same week there’s another call to say that another tenant of yours has to move out pronto, and that the property manager thinks you should reduce the rent to get someone in quickly. Hmm. You can manage that, but it might be getting a little tight financially.

Of course, the very next week you get a third call, but this time it’s from your tenant in the third property, and the carpet is so threadbare it’s starting to fray, so when will you be replacing it? Ok. Now things are looking a little rough. Three hits in one fortnight. Without a cash buffer in place you’d be pushed to the absolute limit right now. And you know that this sort of thing would only happen over Christmas while you’re stretched as it is!

Thankfully you had your buffer in place, could absorb all of the costs immediately, and get the carpet replaced straight away.

If you have a plan in place you won't see the unexpected things that happen as problems, just things you've already planned for financially, even if they were unexpected at the time. Your buffer is going to protect you against occurrences like repairs, vacant tenancy periods, damages, interest rate hikes, maintenance and other unexpected things that happen.

So how do you create a buffer? You can do it in one of two ways:

- Cash

- Equity

You have a $400k loan on a property that receives $500 per week rent. Your holdings costs are then your expenses minus your income.

| Rental Income $26,000 per annum ($500 x 52)

Expenses

Mortgage repayments $28,000 per annum (based on 7% interest only rate) Rates $1200 (varies from council to council) Property management $2,600 per annum (based on 10% of rent) Insurance $500 (but premiums vary – so shop around) Maintenance $1000 (varies depending on property)

Total costs: $33,500

Holding costs $33,500 (costs) minus $26,000 (rent)

$7500 per annum or $144 per week If you own four properties, your buffer needs to be: Holding Costs X Number Of Properties X Number Of Years You Want A Buffer e.g. $7500 x 4 x 5 = $150,000 (the above example does not include tax deductions) |

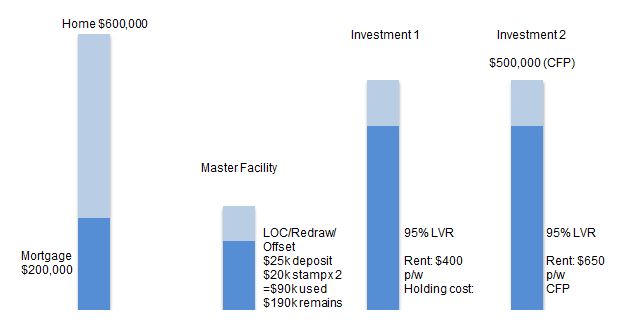

In case you’re thinking that you don’t have $150,000 in cash just lying around to act as a buffer, you can also use an equity buffer. Sound complicated? It’s not. Take a look below:

Your equity buffer is created by using the equity that exists in your home of other investment properties, but then by purchasing investment properties that don't use up the entire amount of equity available to you, and leaving you with some cash free to act as your buffer.

Your buffer is an essential part of investing and something that every investor needs to have. Unexpected things happen all the time and if you don't have the cash to cover it, it's not worth thinking about the stress this can cause.

We can help you to figure out how to arrange your finances to ensure that your buffer is part of your greater investment plan.

Jason Paetow is the Managing Director of AllianceCorp, a buyer's advocacy and property investment company. Jason has over 15 years of experience in the property industry and is an expert at property investment strategy, and in coaching and working with clients to optimise their success through education and support. He is a qualified Financial Planner, Mortgage Broker, REIV Licensed Real Estate Agent and a Licensed Builder. To find out more, please visit www.alliancecorp.com.au.

Jason Paetow is the Managing Director of AllianceCorp, a buyer's advocacy and property investment company. Jason has over 15 years of experience in the property industry and is an expert at property investment strategy, and in coaching and working with clients to optimise their success through education and support. He is a qualified Financial Planner, Mortgage Broker, REIV Licensed Real Estate Agent and a Licensed Builder. To find out more, please visit www.alliancecorp.com.au.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.