There’s a widely held belief that the three most important aspects to property investing are: location, location and location. But over the long-term location doesn’t really matter much. And over the short-term, …

“It doesn’t matter so much where you buy, but when you buy”

Why Location Doesn’t Matter

If location was so important, eventually good locations would get ahead of poor ones. As more and more time passed, the difference would become greater and greater.

But it simply isn’t true. In fact, the longer the time-frame, the more likely two distinctly different properties in the same suburb will end up with very similar results. And it’s the same with suburbs. Two different suburbs in the same area will end up with pretty much the same growth. And it’s the same with cities too.

Over the long-term there is a tendency for all property to grow at the same rate. It’s actually over the short-term that results are most likely to be radically different.

Apples & Oranges

To highlight why it’s so unlikely for one property to outperform another long-term, we need to go over my Apples & Oranges story. For those of you who have never heard this before, check out this article before going any further…

Now you can see what I mean. It’s highly unlikely that over the long-term any property can continue to outperform other properties in the same suburb. It’s not impossible, but the probability diminishes with each passing year.

Similarly, it’s less likely any one suburb will outperform others in the same city over a long time-frame. And the same can be said about cities in the same country.

Large city examples

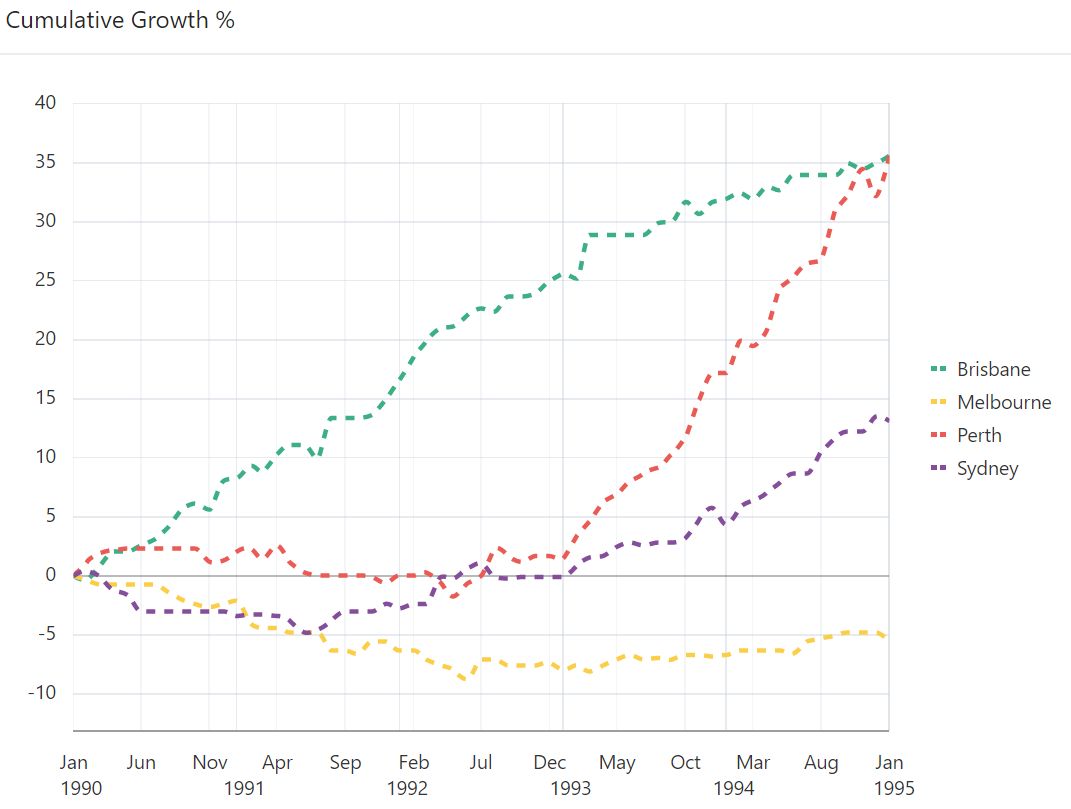

The following chart is a cumulative growth chart. It shows the growth, in percentage terms, for the four biggest cities in Australia over a 5-year period from 1990 to 1995.

The growth difference between the top and bottom markets over only 5 years was 42%.

Here’s the next 5 years with the same 4 cities. This is from 1995 to 2000.

Now its Sydney and Melbourne’s turn to shine. They beat the pants off Perth and Brisbane who had only 16% and 14% growth.

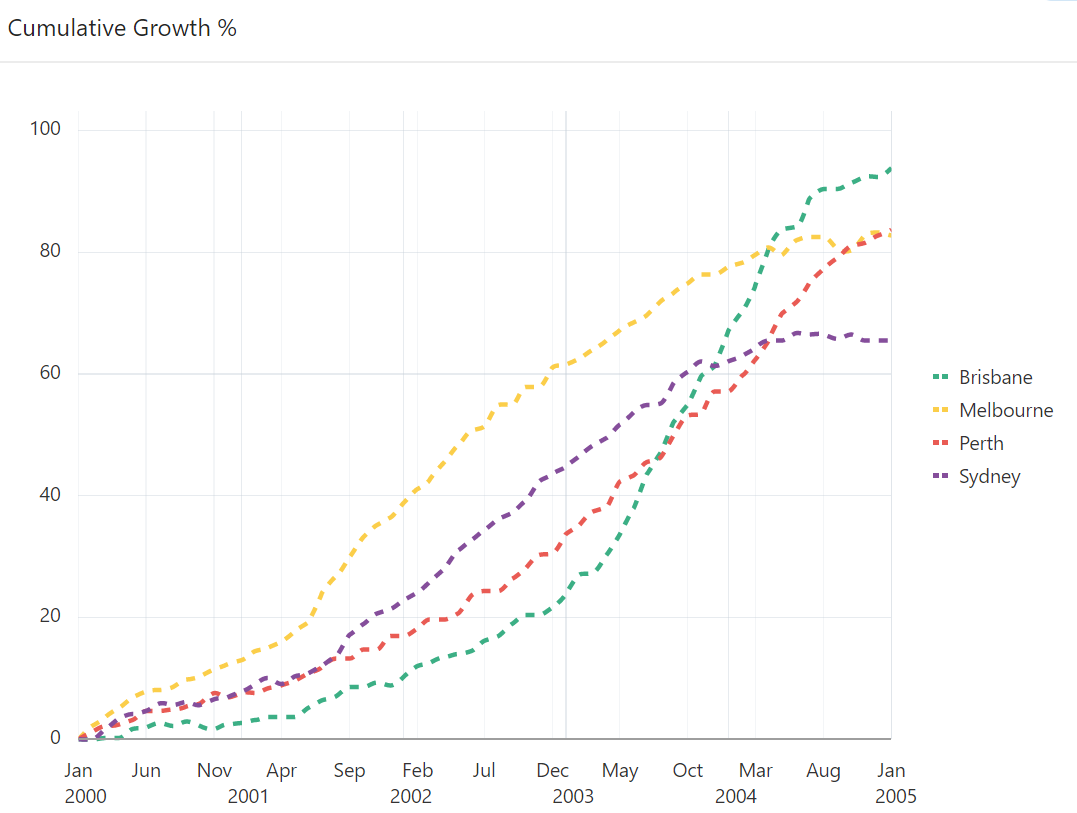

Let’s step forward to the next 5-year interval from 2000 to 2005.

In this period none of the big four stood out from the others. They had varying levels of success, but it was pretty good across the lot. This was a great country-wide boom.

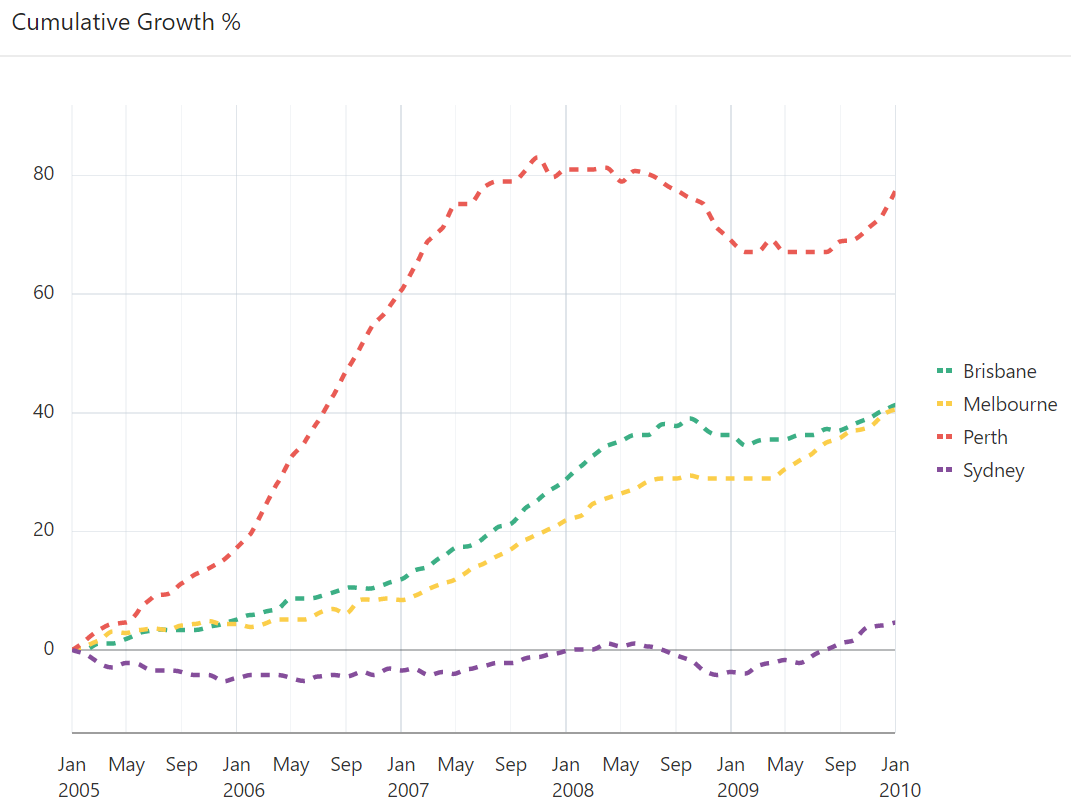

The next 5 years went back to normal. And by “normal” I mean some cities kicked while others cracked.

I hope you’re starting to get the idea. The next one is from 2010 to 2015.

As you can see from these 5-year intervals, every one of the big four had booms and busts.

The average growth difference between top and bottom for all these cases was 43%.

Volatility

These are the 4 largest cities by population and some of the most heavily diversified economies in our country. They are debatably the least prone markets to volatility. If we looked amongst smaller markets, there would be some even larger differences in growth rates.

Notice that I didn’t pick intervals that perfectly matched the growth spurts of any particular city. I just picked 5-year intervals out of convenience.

And did you see how a lot of the truly excellent growth took place in only 3 years, not even 5. And most cities had around a 10-year period of relatively lack-lustre growth before having a decent boom again.

- Booms are short

- There’s a long wait between booms

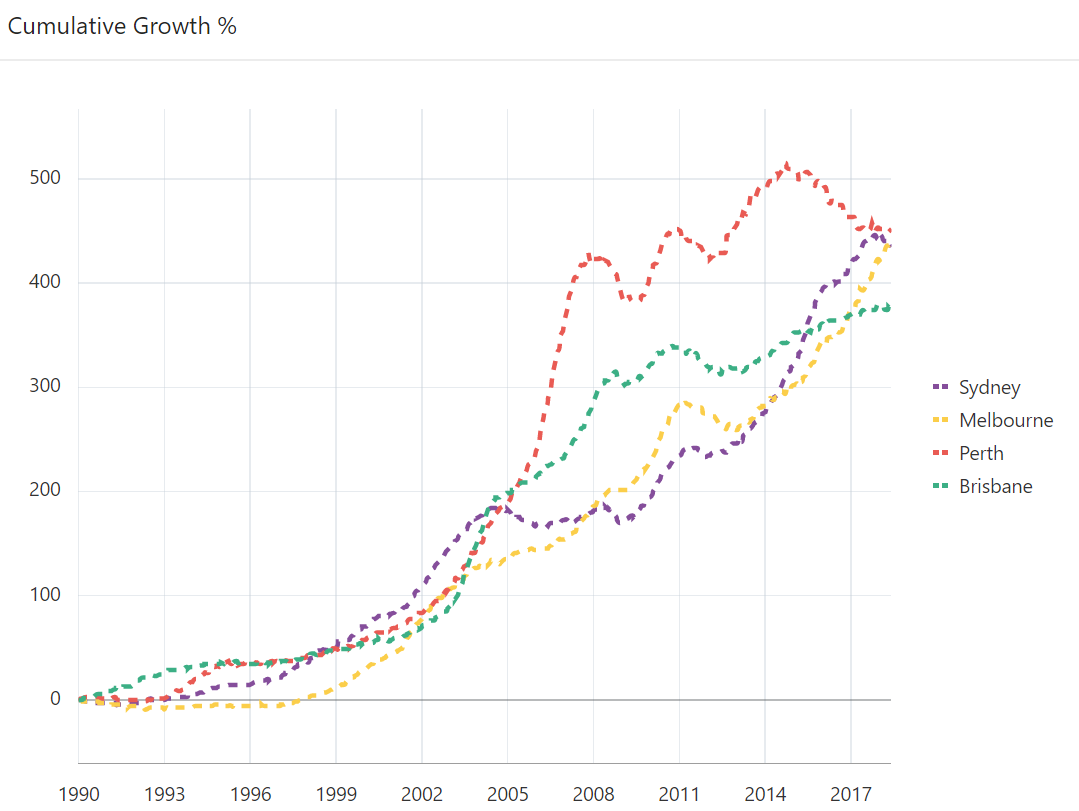

Now let’s look at the full history for all 4 cities.

This is actually a 28 year period from 1990 to June 2018 (time of writing). As you can see, they’re all pretty much the same. There’s very little difference between each city’s total growth in the end. And this isn’t even truly long-term.

The fact that all seem to end up at nearly the same point long-term is no coincidence. This is a natural phenomenon. It’s the “Apples & Oranges” story being played out among cities.

So, what’s the point picking anywhere in particular, when they’ll all end up the same?

What it all means

Let’s say you’re trying to answer the question, “Where should I invest? What’s the best location?” You might start with a state capital. But as you can see from these charts, it won’t really matter which city you pick. What matters is when you pick it.

You don’t really need to put a lot of thought into where to invest. You just need a long investment time-frame.

Over the long-term where you invest doesn’t matter so much. But over the short-term when you invest is crucial.

Counters

Some might argue that it’s hard for investors to time entry, that it’s easier to pick a good location. But we’ve just seen that there’s really no such thing as a “good” location (over the long-term).

Some might say they know of suburbs that have indeed outperformed over the long-term. However, any location that looks like it has had good long-term growth has usually had good short-term growth, but recently, not over the long-term. Such is the nature of compound growth – the majority of it happens at the end. So whichever suburb has had the best recent growth will probably also have the best long-term growth.

The difference in performance between two suburbs is more likely a result of good timing, than it was the result of choosing the right location.

Conclusion

The historical evidence and clear-cut logic refute the old adage of: location, location, location. As you can now see, timing is actually more important.

And timing entry into markets is actually quite easy now days. All you’re looking for is an imbalance between supply and demand.

....................................................................................

Jeremy Sheppard is head of research at DSRdata.com.au.

Jeremy Sheppard is head of research at DSRdata.com.au.

DSR data can be found on the YIP Top suburbs page.

Click Here to read more Expert Advice articles by Jeremy Sheppard

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.