While Australia’s property market started strongly in 2022, an increasing cash rate and concerns about inflation has seen property price growth slow or even drop for the first time since the Covid-19 pandemic began in early 2022.

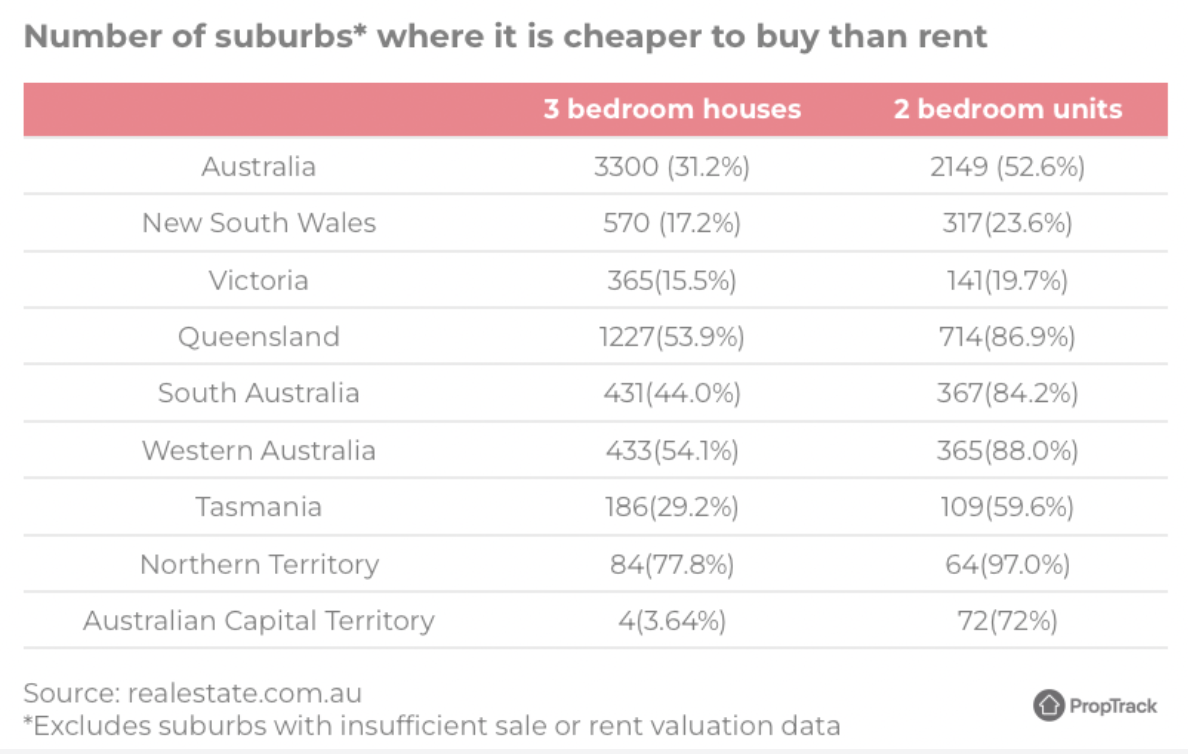

While it was cheaper to buy rather than rent over half the properties in Australia in 2021, the data has turned on its head this year, according to PropTrack’s Buy or Rent report for June 2022.

Of course, this report just looks at the out-of-pocket costs for buying and renting in the current market.

It doesn’t take into account the many other benefits of buying and owning real estate including the strong long-term tax free capital growth and the security of tenure that you don’t enjoy as a tenant.

Having said that, it’s an interesting intellectual exercise, as the research has revealed that it is still cheaper to buy rather than rent around 27% of dwellings across Australia.

This is down sharply from this time a year ago, when this figure was just above 50%.

Continued price increases combined with higher-than-expected interest rates rises have made buying a less attractive financial option, although this does differ depending on location and property type.

More than 50% of dwellings are estimated to be cheaper to buy in Queensland, Western Australia, and the Northern Territory.

By contrast, in NSW, Victoria and the Australian Capital Territory, less than 10% of dwellings appear cheaper to buy at current prices.

The market has shifted

The balance between buying and renting for median valued homes has changed significantly over the past year.

Mortgage rates have already increased 75 basis points in 2022 so far, with further increases expected.

Combined with strong growth in home prices – which are up 14% – renting has become a more affordable option across most of the country now compared to a year ago.

The shift towards more affordable renting costs for median priced homes than buying in late 2021 corresponds with the slowdown in price growth across the country.

The balance between the costs of buying and renting provided by this analysis suggests price growth will continue to be slow over the next year, and rent growth will be strong.

These trends would rebalance the costs of buying and renting towards buying.

Here, we’ll look at the breakdown for the 3 most major Aussie cities: Sydney, Melbourne and Brisbane.

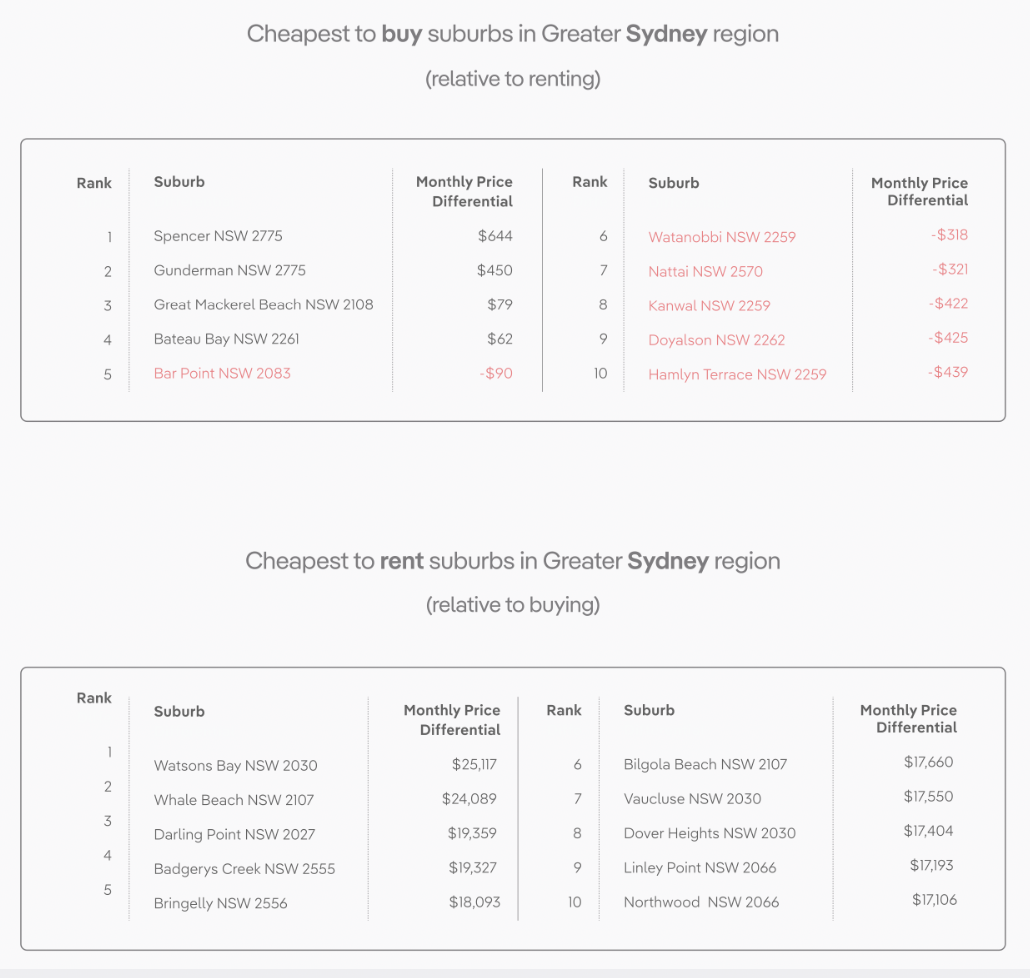

Buy vs rent in Sydney: Houses and units

Price rises across Sydney have made renting houses cheaper than buying almost everywhere across the city, based on PropTrack’s comprehensive financial model.

Renting appears particularly attractive to the north and east of the CBD in prestige suburbs.

However, there remain many pockets of the city to the south-west and west where the cost of buying is not estimated to be significantly higher than renting.

Source: PropTrack Buy or Rent report

Units across Sydney are estimated to mostly cost similar amounts when buying or renting across the city.

While many parts to the north and east of the CBD appear cheaper to rent over the next 10 years, the majority of suburbs to the south and west appear either cheaper to buy units, or very similar in expected costs.

Source: PropTrack Buy or Rent report

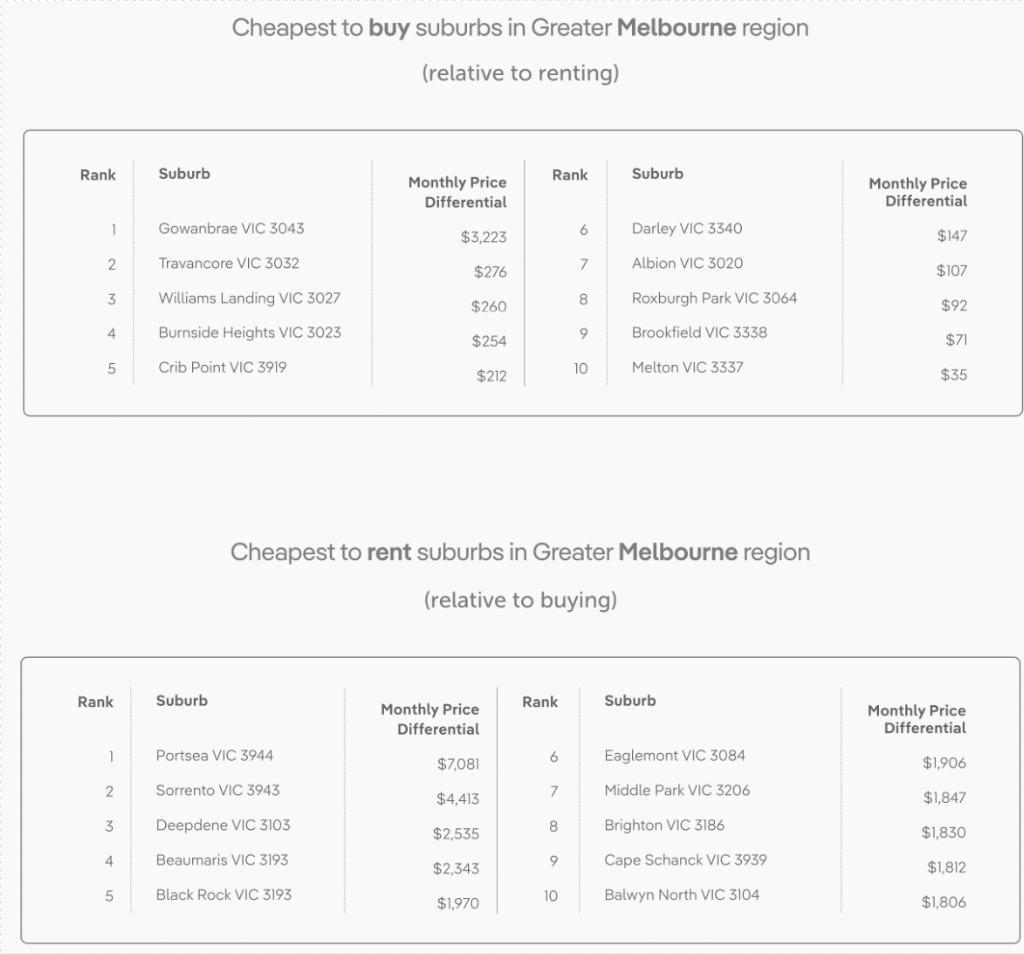

Buy vs rent in Melbourne: Houses and units

Modest changes in advertised rents relative to house prices have made much of Melbourne cheaper to rent than buy over the next 10 years, as estimated by PropTrack’s comprehensive financial model.

This is particularly the case to the east and south of the CBD.

But there remain peripheral regions of the city to the north, east and west where the expected difference in costs is small and will contain attractive houses for buyers.

Source: PropTrack Buy or Rent report

Almost all suburbs across Melbourne are estimated to be cheaper to rent than buy units, despite modest price growth over the past 12 months of less than 2%.

Renting is estimated to be cheaper than buying particularly to the north-east and south-east of the city.

However, there are many suburbs to the north and west of the CBD where both options are expected to have similar costs and are likely to contain good prospects for buyers.

Source: PropTrack Buy or Rent report

Buy vs rent in Brisbane: Houses and units

Those looking to live in houses in the inner-city can save by renting, particularly in suburbs along the Brisbane River.

Buying conditions are very favourable in more peripheral parts of Brisbane to the south and south-west of the CBD.

House price growth of 26% over the past year has reduced the relative attractiveness of buying houses across Brisbane, particularly in the north and the west of the city.

Source: PropTrack Buy or Rent report

Units across Brisbane are almost universally estimated to be cheaper to buy than rent based on PropTrack’s financial model, meaning there are great buying conditions for those looking for smaller but well-located dwellings.

Source: PropTrack Buy or Rent report

The bottom line

While this financial modelling is interesting, and of course it’s important to know that you can afford to take on the commitment of a mortgage, there is little doubt in my mind that owning property rather than renting is the way to go.

Who would’ve like to buy the parents’ home at the price of their parents paid 20 years ago, even though at that time they would have thought it was very, very expensive.