Rental markets in smaller capital cities and regional areas are benefitting from the exodus of residents from Sydney and Melbourne.

The latest figures from the Australian Bureau of Statistics (ABS) showed a substantial increase in movers from Sydney and Melbourne amid the pandemic, with more than 60,000 residents departing the two biggest cities to other parts of the country over the year to March 2021.

This was particularly significant in Melbourne, which has lost 32,000 residents during the period following the COVID-19 recession.

"The shift in population out of Melbourne is a new trend and one that is compounded by the loss of overseas migration that has underwritten economic growth in Victoria for the past decade," said Housing Industry Association chief economist Tim Reardon.

The migration of more than 31,600 residents of Sydney to other parts of the country, while also driven by the pandemic, was consistent with the trends over the past two decades.

"This shift in population is the main driver of the tight rental market that exists across the country, other than in Sydney and Melbourne," Mr Reardon said.

“Given that the population is moving interstate and building new homes it is unlikely that they intend to return to Sydney or Melbourne.”

Vacancies shrinking, rents rising

The latest vacancy report from SQM Research shows the rental market continues to tighten with vacancy rates in many parts of the country shrinking while rents increase.

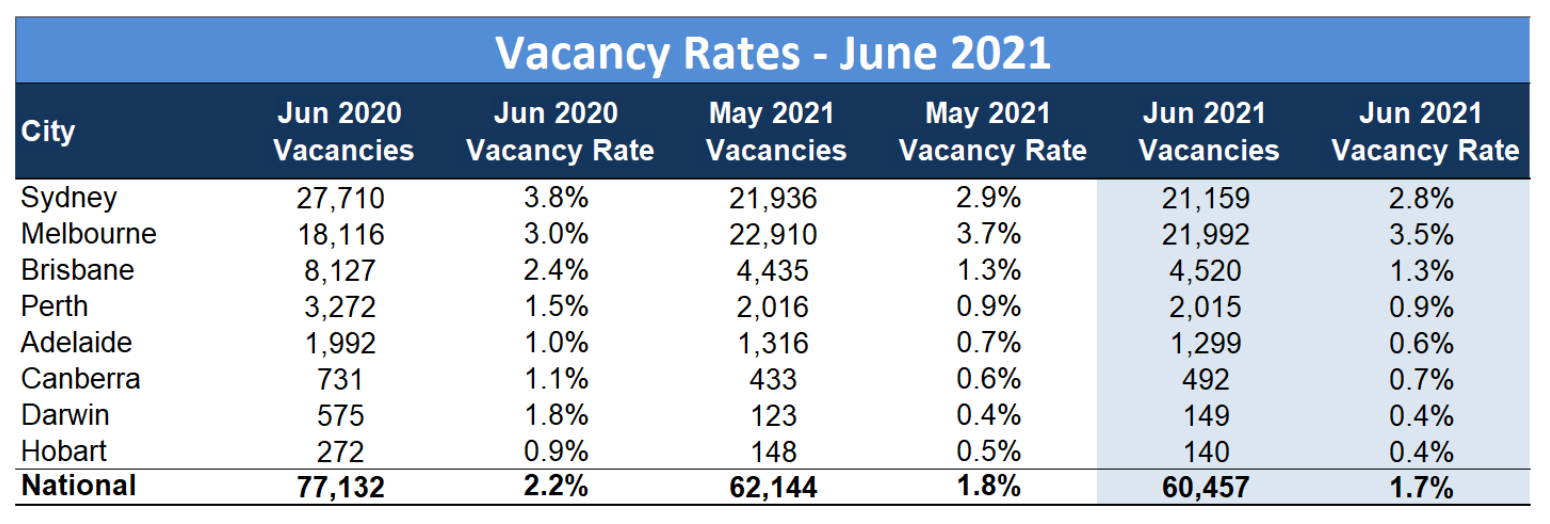

Sydney and Melbourne had the highest vacancy rates in June at 2.8% and 3.5%, respectively. However, these vacancy levels were slightly lower than the previous month.

On the other hand the rest of the capital cities, except for Brisbane which recorded a rate of 1.3%, all posted vacancy rates of below 1%.

Darwin and Hobart had the tightest supply of rental properties during the month, with their vacancy rates further shrinking to 0.4%.

Overall, the decline in vacancy rates across capital cities has dragged the national figure to 1.7%, the lowest since May 2011.

Typically, a vacancy rate from 2-3% is considered to be ‘healthy’ while above 4% or below 1% poses risks.

SQM Research Managing Director Louis Christopher said low vacancy rates were pushing up rents, which could affect inflation later in the year.

"Rental vacancy rates have fallen in our largest capital cities," Mr Christopher said.

"Meanwhile there was some further evidence that we have reached the high point in regional occupancy and some relief for local renters may be coming later this year, notwithstanding Sydney’s latest lockdown.

"Rents are now accelerating in our larger capital cities which may have ramifications for the CPI [inflation] read in the coming quarters."

Given the limited supply of rental properties, rents have been rising week on week.

For the week ending 12 July, weekly rents for houses increased by 4% on average for capital cities to $575. Weekly unit rents also went up by 2% to $419.

The only declines during the week were from the unit markets of Brisbane (0.1%), Canberra (3.7%), and Hobart (10.9%).

On an annual basis, unit rents across capital-city markets hit a slight decline of 0.5%. Sydney also recorded a decline in unit rents at 1.5% while Melbourne hit a drop in both houses (1.5%) and units (9.5%).

A recent CoreLogic report showed Australia’s rental market was able to clock its highest annual gain in rents since 2008 in July.

During the period, national rents soared by 7.7%, with Darwin and Perth reporting the strongest increases.