The analysis by CoreLogic shows that just 33.1% of all houses and 40.6% of all units sold across Australia in the year to June 30 were transacted at less than $400,000, down from 34.8% and 44.1% respectively in the year to June 2015.

Nationally, the proportion of houses that sold for less than $400,000 over the 12 months to June was the lowest on record.

"These figures highlight the decline in sales across more affordable price points, particularly across the capital city housing markets," CoreLogic research analyst Cameron Kusher said.

"With values continuing to rise it is a fairly safe bet that there will continue to be a decline in the number of homes selling for less than $400,000," Kusher said.

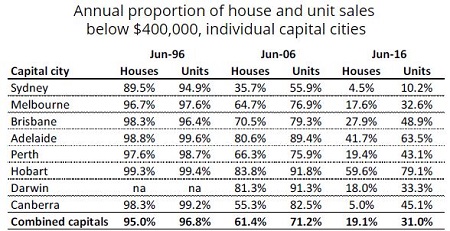

Looking at the capital city markets, sub-$400,000 homes are even harder to find.

In the 12 months to June, just 19.1% of capital city houses sold for less than $400,000, down from 21.3% over the previous 12 months.

Source: CoreLogic

In the unit market, 31.0% of capital city dwellings sold for less than $400,000 in the 12 months to June, down from 31.9% over the previous year.

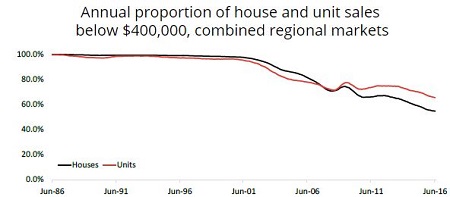

Across the regional areas, buyers do stand a much better chance of finding a house or unit for $400,000 or less.

In the 12 months to June, 54.6% of houses and 65.4% of units sold across regional markets carried a price tag of less than $400,000.

Source: CoreLogic

In regional New South Wales at least that increased availability of affordable properties has been noticed by investors.

Matthew Ward, director of Orange-based Aspect Buyer’s Agency, told Your Investment Property that an increasing number of buyers have been ventured out from their usual environments recently.

“There’s a big influx coming from the eastern seaboard capital cities. The price point is good, the yields are good and the markets are really looking good to them,” Ward told Your Investment Property.

“Particularly in the larger regional centres like Dubbo, Tamworth, Wagga and Bathurst things have been kicking on quite well,” he said.

Ward said a combination of the low price of entry plus rental yields of 4% - 7% on offer have made the regional markets attractive to a range of different buyer types.

“We’re seeing people who have lost trust in places like Sydney and see it as being overheated and want to spread their money and risk around,” he told Your Investment Property.

“If you’ve got a million bucks to spend and you can’t get into Sydney you can head out to those areas and pick one or two properties.”

“We’re also seeing the rentvestors or those with maybe one or two properties who can’t get into the city markets because of the prices.”

While regional centres are likely to remain more affordable than there capital city counterparts, Ward said the gap between the two is likely to contract in the near future.

“My prediction is that the regional cities are set to go. If you looked at what happened in the late ‘90s and early 2000s it took two or three years to flow into the regional markets when Sydney had a boom.

“It went up the coast to Newcastle and then over the hill and that’s about to happen again.

“Newcastle and Central Coast prices are rising off the back of Sydney’s pressure and we’re starting to see some price movement out this way.”