While buyers were provided with more options as listings rose in October, they seem to be delaying their plans of purchasing a property as home sales continued to stumble amid the spring-selling season.

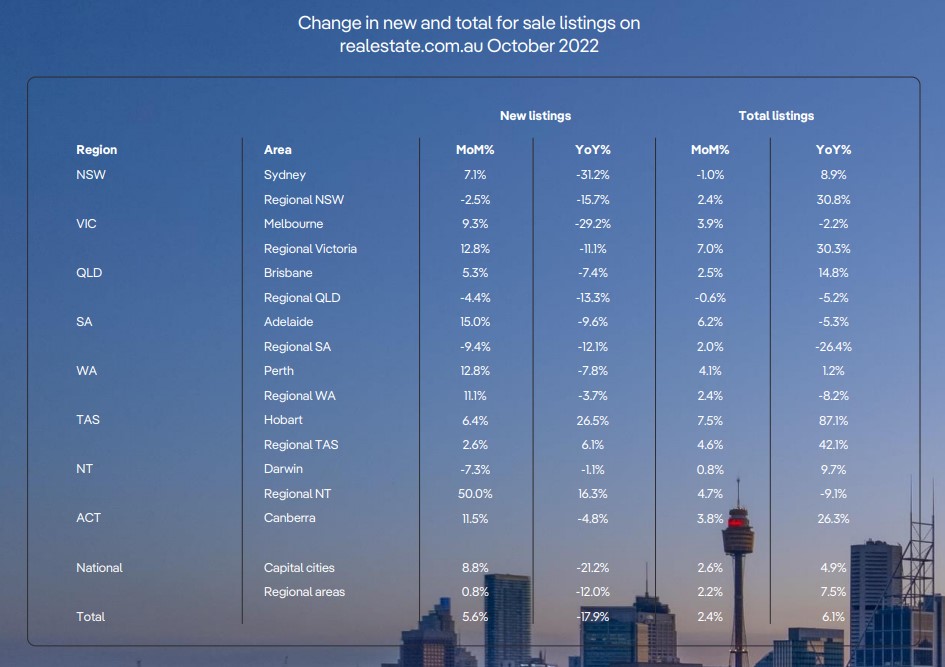

According to PropTrack, the number of property listings across Australia increased 2.4% monthly and 6.1% year-on-year in October.

PropTrack economist Angus Moore said new listings also picked up month-on-month but eased compared to the level seen last year.

“Choice for buyers has improved significantly during 2022 — this will come as welcome news for those searching for a new home this spring,” he said.

“Sydney, Melbourne, and Canberra are all offering greater choice compared to 2020 and 2021, and all three cities now have more properties available for sale than has been typical in the past decade.”

Mr Moore said home prices have been declining in most cities after the gains realised in 2021. In fact, prices are already down 3.5% from the peak in March.

The Reserve Bank of Australia’s monetary policy decisions over the next few months will further impact how prices will behave.

“The RBA is likely to keep raising rates over the course of 2022 and into 2023 — that will further reduce borrowing capacities for prospective buyers, and we expect this to continue placing downward pressure on home prices,” Mr Moore said.

Cash-rate hikes slowing down new home sales

Separate data from the Housing Industry Association (HIA) showed a 22.8% decline in new home sales over the month.

For the three months to October 2022, new home sales in Queensland were down by 31.9%, Victoria down by 22.8%; New South Wales down by 19.6%; and Western Australia down by 9.1%.

South Australia saw the only increase, up by 13.9%.

HIA chief economist Tim Reardon said sales of new homes had already fallen 15.8% over the third quarter of the year, due primarily to the increases in the cash rate since May 2022.

“The increase in interest rates is compounding the rise in the cost of new home construction and further reducing the capacity of borrowers to finance the build of a new home,” he said.

Still, there remains a significant volume of home construction under way, ensuring that work on the ground remains strong through next year.

“But it is very clear, even before the October and November increase in the cash rate start to impact on sales, that this building boom is coming to an end,” Mr Reardon said.

“The full effect of the November 2022 increase in the cash rate is not likely to flow through to new home sales fully, until June 2023.”

—

Photo by Lalu Fatoni from Pexels.