Listings carried higher rent prices over the past month, as evidenced by the shrinking pool of properties renting for under $400 weekly.

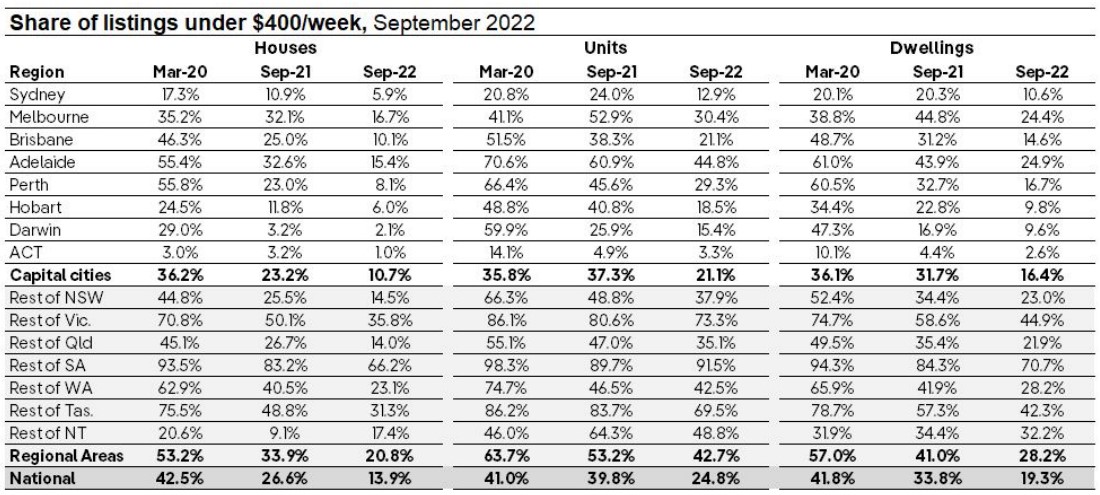

According PropTrack, the share of properties for rent below $400 weekly fell to 19.3% in September across Australia, the lowest share on record. This represents a huge drop from the 41.8% recorded in March 2020.

In the capital cities, only 16.4% of rental properties were listed with a rent of under $400, down from 36.1% in March 2020.

The decline is apparent in regional areas too, with the share falling from 57% to 28.2% during the same period.

The ACT, Hobart and Darwin all have the lowest share, with less than 10% of listings in each city under $400/week. In Sydney, one in five rentals were advertised under $400/week a year ago, falling to one in 10 in September.

PropTrack director for economic research Cameron Kusher said the shortage of rental supply in Australia is impacting all renters but it is acutely affecting lower income households.

“With supply of rental listings continuing to tighten and competition for stock heating up due to low levels of first home buyer purchasing and increasing migration, we expect the supply of affordable rental listings to reduce even further over the coming months,” he said.

Rents could surge 480% by 2050

Property Club president Kevin Young said rents and property prices could potentially surge by over 480% in 2050 as the rental crisis continue to deepen, particularly in some states like Queensland.

“The rental market in Queensland is now recording very low vacancy rates and this is putting an upward pressure on weekly rents — our cost of living tracking survey clearly shows that this rental crisis in Queensland will not be a temporary phenomenon but will continue for many years to come,” he said.

Real Estate Institute of Queensland CEO Antonia Mercorella said while there are no overnight solution to the supply shortage, it is time for the state governments to take an approach that would maximise the existing supply and encourage more investors in the market.

“There are immediate actions we could be taking now to tap into existing supply through incentives, such as providing stamp duty relief to downsizing over 55s – a win-win which allows them to move to easier-upkeep homes, while opening up housing stock for younger-growing families,” she said.

“Stamp duty reductions could also be offered to long-term investors in exchange for a minimum time commitment to keep an investment property on the long-term rental market.”

Ms Mercorella said it is high time for governments to start discussing stamp duty reform and transition to a long-term smoothed land tax model.

“In order to deliver increased housing supply to those who need it most, we encourage changes to tax settings to stimulate build-to-rent developments, like we’ve seen with the land tax concession in Western Australia,” she said.

“We’d also like to see new and innovative housing solutions and concepts, such as co-ownership and rent-to-own initiatives, explored through the establishment of a Housing Innovation Forum.”

—

Photo by Ian Samkov on Pexels.