There are many excellent opportunities for investing in regional Australia. And getting the finance right the first time can save you a lot of time, stress and, most importantly, money. John Hilton chats to the experts to find out how to do this

You buy your first investment property in a popular inner-city area. You get great tenants and the rent is flowing in. The purchase is such a success that you plan to be a bit more ambitious with your next purchase. You decide to look outside your local area for a house producing excellent rental returns, and conclude that a regional property is your best bet.

But there’s one problem: you live in Sydney and you’re hoping to buy in Lismore. And as anybody who has bought in the country will tell you, it’s a totally different ball game. In particular, there are a range of considerations, risks and limitations regarding financing properties in regional areas, which many investors don’t realise before it’s too late.

Safety first

Marilyn Coles is a mortgage broker at Smartline and specialises in regional areas of northern NSW, such as Lismore and Coffs Harbour. During her working life, she has seen the many benefits as well as risks of investing in country property. One example is buying in a regional area with limited economic drivers, which can make the banks worry about lending.

“In Grafton, for example, the government has pulled the jail out of the town, which has had a significant effect. I recently had a client who had to reduce the price of her house by $60,000, and she put it down to the jail closing, which hit employment in the town.”

One shortcut to determining whether or not a particular area is suitable is to use a buyer’s agent, says Coles. “A lot of people don’t realise that buyers’ agents are actually available in regional areas. They see them on the city programs but don’t realise there is that availability. So if you don’t have knowledge in a regional area, it’s a good idea to use a buyer’s agent.”

Luke Easton, general manager products at ME Bank, agrees that investors should be mindful of areas that don’t have a diversified local economy, as property prices, rental returns and your potential for borrowing will fluctuate with the dominant industry’s fortunes.

“Regional areas that have greater economic depth and breadth are more resilient to changes within industries,” he says. “Geelong in Victoria is a good example, where the loss of some manufacturers has had a smaller impact on the local market.”

Easton also places strong emphasis on planned and existing infrastructure, because a regional area is generally not desirable for tenants if it’s too remote. In particular, good roads and rail networks can help minimise risk for investors.

“A new bypass can affect some through-trade, but it can also make a town more appealing as a place to live. Road improvements between a regional area and a nearby city can shorten travel time and increase the desirability for tree-changers. Rail service changes can have similar impacts.”

Mind the climate

As a number of regional suburbs in Queensland, NSW and Victoria have had the misfortune to experience over the past few years, Australia can be quite prone to flooding.

“In Lismore we’ve been lucky and haven’t had a flood in recent times. But investors do need to be aware of that factor, because if the flood is capable of damaging that property, then it’s unlikely lenders will take on that security,” says Coles.

“There are large premiums if you buy in a flood area to get that property insured.”

Coles adds that when people build in regional areas many councils will ask for bushfire reports if they are building near a lot of trees.

And as the climate changes, with floods and fires potentially becoming much worse, this is something that could be a factor in regional areas in the future, says Easton.

“While there has been increased talk about the impact of our changing climate on some areas, it’s too early to say whether it will have a material impact on the desirability of specific areas. It’s an area to watch.”

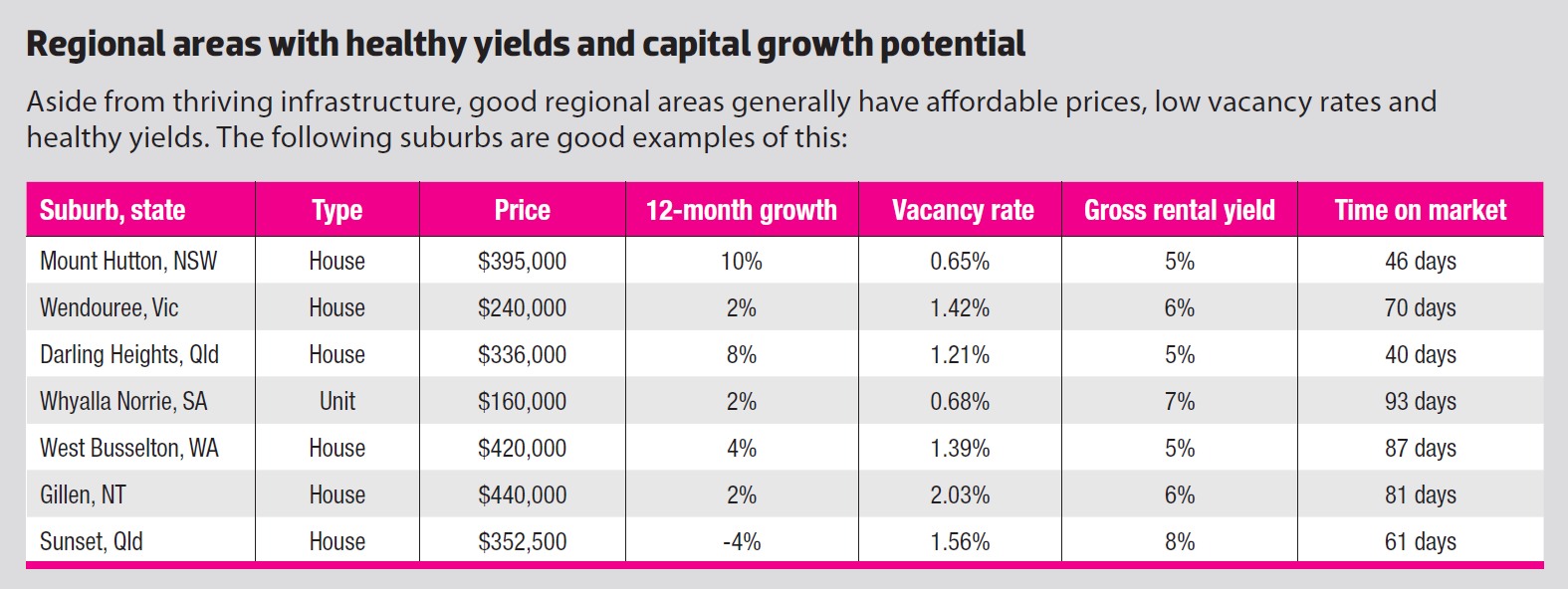

Regional areas with healthy yields and capital growth potential (click to enlarge)

If you can answer yes to most of the following questions, you’re on the right track to securing and paying off a profitable investment property in a regional area:

- Does the area have a diversified economy?

- Is the area near the coast?

- Does the area have good infrastructure and transport?

- Does the area have stable employment?

- Does the area have a decent population size?

- Does the area attract a wide demographic?

- Is the property size less than 10 acres?

- Are you using a buyer’s agent?

- Are you using a mortgage broker?

- Have there been multiple recent sales in the area?

- Is the property away from flood-prone and bushfire-affected areas?

- Can you afford the LVR?

- Have you considered the policies of a range of lenders?

- Have you got full approval from a bank before

- making a financial commitment?

- Will you be financially stable if you struggle to get a tenant for a number of months?

- Will you be financially stable if major industries pull out of the area and the property takes a hit in value?

A broker can help make sure investors have the right amount of savings and income to purchase an investment property in a particular region, says Smartline’s Marilyn Coles. They can also save investors a lot of time comparing options.

“We know the different policies of the lenders and which lenders prefer which types of properties, or which types of borrowers they prefer. Not all lenders require a valuation, but if they do, because of our local knowledge we will know if there are going to be any issues with regard to that.

“I have seen a buyer miss out on a certain property purely because they have chosen one lender.”

Coles has been contacted by investors from across Australia, many of whom are trying to avoid their local cities.

“I am currently dealing with Victorian clients that are looking to invest in our local area. They want to come up here in five years’ time to have a better lifestyle. We have people that work in the city and live in the country on weekends. I really think it’s the lifestyle we offer which attracts them here, rather than the hustle and bustle of the city.”

Why size matters

A number of lenders will restrict the size of the property that investors can borrow against, so this is something people should consider before even thinking about a large acreage, says Coles.

“Some lenders don’t like large property which they call a farm loan or a business investment. We do have a couple of lenders who are fine to go up to 150 acres, but the majority of lenders really want to stay under 25 or 10 acres,” she says.

“Acreages may not have the best rental return, but some people look at them as a long-term investment and as a place to retire. They want to live in the cities for now but have the regional lifestyle down the track.”

Another factor lenders look at is recent sales in the area you’re buying in, says Coles.

“If they require a valuation on that property and there have not been recent sales in the last three to six months, they may not accept it as a security because of that risk.”

Indeed, Easton says selling periods are another risk worth considering because they can be up to two years in some areas.

“This can be an issue if an investor needs to exit quickly. Selling periods can be much longer in towns with smaller populations, due to the depth and quality of the buyer market,” he says.

Goodbye city life

There are a number of reasons why, for many, regional areas are far more appealing than cities. One is that they are much more affordable, says Easton.

“As property prices in major cities such as Melbourne and Sydney continue to rise, so does the incentive for investors to look further afield. This trend is likely to continue,” he says.

Indeed, Coles has recently had a very happy investor pick up a property for as little as $130,000.

“You can typically get good investment properties for around $300,000, and the great thing is that the rental return is normally going to repay that interest for you.”

Coles says getting regional property deals over the line can be more difficult than it is for property deals in cities. Apart from floods and fires being not as common in city areas, there is also more evidence of transactions in urban areas.

“You would have more sales evidence in the cities, whereas in regional areas there is sometimes not the turnover of sales,” she says.

Moreover, she says it’s important to be aware of the differences in LVRs between metropolitan and regional areas. “Whereas cities might go to 95% of the value, in some regional areas they may drop it back to 90%. And the reasoning is that they see the regional area as a slightly higher risk.”

Easton also advises investors to be mindful of how much they will be able to borrow, and encourages them to get full approval before committing to the property deal.

“Banks will require lower LVRs for properties that are particularly isolated or below a certain a size. It’s advisable to get full approval from a bank for a loan on a remote property before making a financial commitment,” he says.

This article is from the December issue of Your Investment Property Magazine. Purchase the issue to read more.