There’s no denying it. The lending world is a different beast to what it was five or 10 years ago.

Introduction of the National Consumer Credit Policy has meant that banks, lenders and brokers alike have had to abide by responsible lending requirements. The result has been much more scrutiny of how the banks are lending out their money. Combine this with the current royal commission into banking and the Australian Prudential Regulation Authority’s interventions, and we’re now witnessing more lending scrutiny than ever before.

This eagle eye on the lending sector has led to banks saying no at a rising rate, with reports estimating that more than 3.5m borrowing applications are being declined each year. And this number is growing.

The people who are rejected definitely aren’t alone. But getting rejected doesn’t mean you need to give up.

So, while we will get to the possible solutions shortly, the best place to start is always with why. If your loan application has been declined or you’re concerned that it might be, it’s critical that we peel back the layers and get to the core of why the banks said no in the first place. To do this, it’s important that you understand the ‘5 Cs’ of how the banks assess you. So, why has the bank rejected your loan?

All banks and lenders have assessment criteria to determine whether or not someone will be a trustworthy borrower: if they lend you their money, can they rely on you to pay it back? In lending terms, it’s broken down into the ‘5 Cs of borrowing’. What’s critical here is that any time a bank declines an application, they will have reason, and this reason will correlate to one or more of the 5 Cs.

The 5Cs of borrowing money

The first one is Character.

Character, in the way banks look at it, is all about assessing the features and traits of your individual circumstances and history. First and foremost, banks want you to be a secure and reliable borrower. They’re going to want to know: Are you stable in your job? Have you had a good employment history? How has your credit history been over time? Ultimately, the loan is for a long-term period, so someone with a history of five jobs in five years might be assessed differently when compared to someone who has held the same position for five years. It’s all about your stability.

The second one is Collateral.

Collateral is all about asset security, meaning that the banks protect their interests by securing their lending against a property Source: Propertyology, August 2018 or land. They do this by assessing the asset that’s underpinning the borrowing. The thing to remember here is that not every property is created equal. So if your lending is secured against student accommodation, for example, banks may be less inclined to lend against this type of collateral compared to a standard, standalone home, because it represents greater risk devaluation. This is crucial for borrowers to consider not only when applying for finance but also when purchasing the next investment property.

Capacity is at the heart of why most people are rejected for loans. This is all about the ability to repay the loan

The third one is Capacity.

Capacity is at the heart of why most people are rejected for loans. This is all about the ability to repay the loan. It refers to servicing of the loan – the borrower’s ability to service the debt based on the serviceability calculator the lender might be using. Each lender has a different servicing calculator, so this is why, in some cases, there are situations in which one lender might say no but another says yes. The biggest takeaway when it comes to your capacity is that you should be money smart with your income and expenditure story, and trapping your surplus.

The fourth one is Conditions.

This relates to the type of credit policy conditions that exist. Lending criteria vary between lenders, which means your application is assessed differently, depending on the lender’s credit policy. For example, some forms of income may be accepted, but not others. Also, banks may have conditions around length of employment, the types of properties they’re willing to secure against, and so forth. For this reason, it’s in a borrower’s best interest to be aware that the conditions of the credit policy play a role in the overall outcome; or to get an investment-savvy mortgage broker on their team who knows which lender does what.

Finally, the fifth C of borrowing is Common sense.

With the tightening of lending policy, it can be argued that we’re seeing this less and less from lenders. But banks do – or at least they should – use a common-sense approach when assessing an application. So if you can mitigate areas that fall outside maybe one condition of the loan assessment criteria, and back this up with a valid reason, banks are likely to use practical judgment in their assessment.

Three big reasons banks say no

When you get your head around the 5 Cs you can start to see the criteria taking shape – these are what the lender is assessing you against. But the three big reasons the banks will say no to a borrower boil down to income, current commitments and collateral.

Each lender has a different risk appetite for the income story coming in. What this translates to is not simply Do you have sufficient income to service the borrowing? but rather Do you have sufficient income that the bank recognises as income to service the borrowing?

While being quite a mouthful, from a lender’s point of view this means that not every income is deemed as reliable. Depending on your chosen lender, this may or may not include fluctuating income, such as bonus income or commission income. This is also the case when it comes to assessing contractual or self-employment income.

The key takeaway here is to keep a close eye on where all of your income is coming from, and how often and reliable it is for the banks to want to lend you money.

To help with this, we’ve created a seven-step money management system – Money SMARTS – that, once set up, will make this simple and easy for you.

2. Current commitments

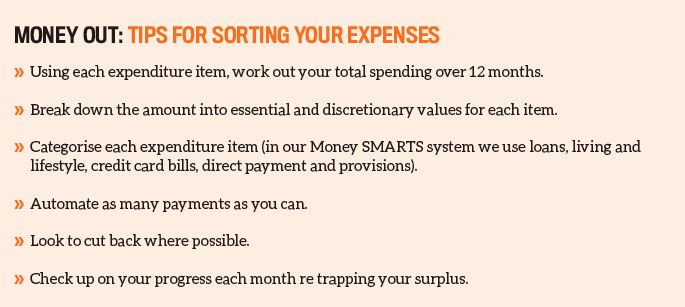

Your current expenses and exposure to existing debt is also critical. The banks will hold a microscope to your expenditure story to see the entirety of your living costs and spending habits in order to assess your serviceability requirements.

Remember, the world has changed. Banks are casting a very detailed eye over where your money is going and how much surplus cash you have left over for more borrowing, while also having something in reserve.

Basically, if the bank is uncomfortable with the asset underpinning your loan – the security – it won’t work favourably for your application. The reason why is simple: if something were to go wrong, the bank would need to know if it could sell the property to get its money.

Ask yourself, “If something were to go wrong and the bank had to sell your securitised property to recover their funds (and costs), would they be able to do this quickly, easily and with low risk?

What can you do when your loan is rejected?

There are seven things you can do when the bank declines your loan application, or to avoid being declined in the first place.

Shop around

Just because one bank says no, it doesn’t mean that every other bank will. This is also true for non-bank lenders – commonly referred to as second-tier lenders – as these lenders often have the appetite to lend you money, even when the big banks say no. They usually distribute their loan offering via a mortgage broker, so get a broker to do the shopping around for you.

Review existing debts

Close out or consolidate your debts to reduce your monthly outgoings – this will result in a greater monthly surplus. This greater surplus should correlate with being able to borrow more money and potentially turn that no into a yes.

Classic examples are high credit card debts and short-term personal loans, such as car loans with really high monthly repayments. By consolidating these payments into a longer-term mortgage loan, you can reduce them significantly and potentially open up your ability to borrow more.

If your loan application has been declined… it’s critical we peel back the layers and get to the core of why the banks said no

Review your spending

We briefly touched on the expenditure lever earlier. A best-of-breed money management system breaks down your expense items into essential and discretionary spending, and in doing so you can stumble upon significant savings. This is particularly evident when it comes to your discretionary spending.

Do a review several months (six months is best) before you put forward your application. If you then cut down on your spending significantly, this will be a game changer. Why? Well, as part of the lending process the banks will look into your transactional banking and credit card spending to see what you’re spending your money on.

So if you can be a ‘super saver’ and reduce your discretionary spending during this time, it will absolutely increase your chances of getting that loan approved and maximise your borrowing power.

Family partnership

As we mentioned, one of the biggest challenges is servicing evidence. So, let’s say we have a young couple who are applying for a home loan.

Unfortunately, even with their combined income, they just don’t have the servicing capacity required to borrow the amount they need now. Their incomes will grow in the future, but they want to act now. In this instance, they could potentially talk to their parents, who might be interested in investing in a small share of the property. What would happen here is that the parent/s would also be on the title. As a result, the lender will include their income when assessing serviceability.

So, if the opportunity is too good to pass up, a joint undertaking with parents could be considered.

Add an income hustle

This is what we call a side job. If you’re applying for a loan and are dead keen on securing the funding, and you’re also willing to get a second or third job, you can increase your borrowing power. Some lenders will assess a permanent part-time PAYG income immediately, which would mean this income stream is added to your servicing right away. Note: a casual ‘side hustle’ may require a minimum amount of time in the job before it’s considered assessable income.

Lift your eyes and look outside the square

Look at solicitor funds or private lending options. Yes, you’re going to be paying a premium for this money, but if you think the opportunity is worthy of the price tag for the higher interest and fees, by looking outside the traditional banks and non-bank lenders you could find yourself in a position to access the lending you’re after. Just make sure you do some very sound due diligence first, OK?

Ask for a little bit less

Let’s say you really want to borrow $500,000 but the bank is only willing to approve $450,000. Sure, it’s less, but it’s still enough for you to invest with. So, instead of thinking, “Well, that’s it. I can’t invest because I can’t get approval”, you might need to adjust your expectations on the type of investment property or location you can buy.

Realistically, if you really want the banks to say yes to your loan application, often the smoothest road to approval is to control what you can control. Often the overlooked answer lies in your ability to manage your own money.

At the end of the day, regulation changes and macro interventions look like they are here to stay. So if borrowers can prioritise how they organise, plan and spend their hard-earned money, they can effectively trap more of their surplus cash. And with a greater surplus, you have a greater chance of approval. It really is that simple.

At the end of the day, regulation changes and macro interventions look like they are here to stay

Ben is the founder and Bryce is a partner at Empower Wealth.

As well as co-hosting ‘The Property Couch’ podcast, the pair are bestselling authors of The Armchair Guide to Property Investing and Make Money Simple Again.