The gateway to Queensland’s tropical north, Cairns is an attractive city with an abundance of assets, but, more importantly, it’s also pegged to become Australia’s next property hotspot.

“If we were to draw a line in the sand at January 2018, I believe that the property market of Cairns will perform better than most locations in Australia over the next three years, including better than the state’s capital city,” says Simon Pressley, head of property market research at Propertyology.

Pressley, who was inducted into the Australian Real Estate Hall of Fame in 2015, says there are a number of key indicators that suggest impressive growth is on the near horizon for Cairns.

“Commencing in 2018, we anticipate a jobs boom to drive employment growth, local confidence and property prices for a few years.”

The major developments include a $475m investment in three renewable energy projects, and a $120m investment by the federal government to expand a major naval base in Cairns – initiatives that are likely to create a significant number of new jobs for the region.

Additional domestic and international students are also expected to flock to Cairns as both James Cook University and CQ University have recently expanded their infrastructure.

“There is also a $120m port expansion, three new five-star hotels and a $650m eco resort,” adds Pressley, who has recently invested in the area himself.

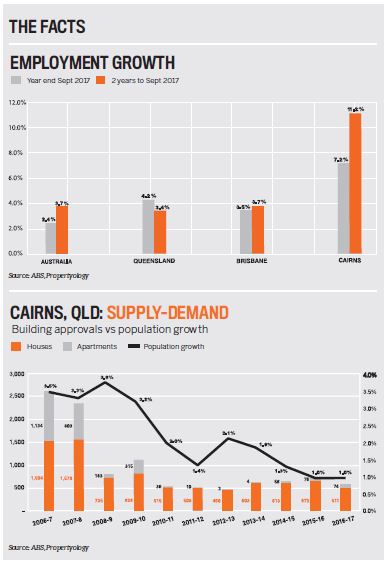

In fact, the jobs boom predicted by Pressley has already begun: an additional 11,700 new jobs were created in Cairns over the last two years, representing an increase of 11.2%. The figure is well above both the Queensland average of 3.4% and the national average of 3.7%.

Despite the booming labour market and a burgeoning education sector attracting an influx of jobseekers and students, Pressley says housing supply has remained surprisingly tight in Cairns.

“Residential vacancy rates have been consistently below 1.5% for five years, easing even further over the last 18 months to the current rate of 1.3%,” he says.

“Since 2010, only 450–700 new dwellings have been approved each year – this low volume of new housing supply, combined with affordability and jobs-driven demand, is the perfect combination for property price growth.”

With so many promising signs of future growth, it might be assumed that Cairns is demanding a high price point, but that’s just not the case – investors can pick up a three- to four-bedroom house for a little over $400,000.

“With rental yields of around 5%, the annual holding costs are so affordable that even those borrowing 90% only have to find $3,000 per year, and the potential for growth is as exciting as anything in Australia,” Pressley says.

Propertyology is a national property market researcher and buyer’s agency.

Managing director Simon Pressley is a REIA Hall of Fame inductee and a three-time winner of the REIA and REIQ Buyer’s Agent of the Year award.

Visit: www.propertyology.com.au