Marlon Sayer is hoping to retire within six years through smart property investing. To help him achieve his goal, we enlisted our resident expert, Brendan Kelly, to map out his investment game plan.

On many levels, Marlon Sayer has made it. With a million-dollarplus home in an exclusive suburb of the Isle of Capri on the Gold Coast, as well as five other high-performing investment properties in Australia and overseas, Marlon has an impressive portfolio by any standard.

Now aged 49, Marlon is looking to capitalise on his $4m property portfolio to be able to retire on a passive income of $100k per annum when he turns 55 in six years’ time.

“I’m a hopeful investor, and I already have a few properties under my belt here in Australia, but I’m not entirely sure on the next step,” Marlon wrote to Your Investment Property.

“My goal is to retire on a passive income, and focus on property purchases, renovations, and then selling. Ideally, I’d like some expert guidance on how I can achieve this.”

Marlon’s investment journey

Marlon says he instinctively knew that property would be the best and safest way to build his riches. “I decided to invest in property because it seemed historically to produce better capital gains than shares, or other ‘typical’ investment strategies. And it seemed to be the one type of investment that I didn’t ever lose any money out of,” he says.

After building enough equity in his first property – his principal place of residence – using his $30,000 savings, he bought his first investment property.

“I bought a one-bedroom unit opposite Scarborough Beach in Perth for $65,000 just using the equity I built up on my home,” says Marlon.

“I still have that property, which is now valued at $540,000.”

Six properties later, Marlon has accumulated a property portfolio worth $4m without taking into account taxes and expenses. He estimates his net worth to be around $3m.

His investments span states and continents, with two located in Western Australia, three in Queensland and one in Vancouver, Canada.

Marlon says he was able to build this impressive portfolio using his proven formula:

-Buy with none of my own money

-Buy at a brilliant price. I always believe that you make your money when you buy, not when you sell

-Buy something that I can add value to and not something that someone else has done all the work on already and is selling for a premium

-Buy in areas of good capital growth potential and that are also positively geared, whenever possible

Mistakes, regrets and lessons learned

Despite his impressive property holding, Marlon says he made a few mistakes, regretted some decisions and learned a few lessons along the way.

Marlon Sayer is hoping to retire within six years through smart property investing. To help him achieve his goal, we enlisted our resident expert, Brendan Kelly, to map out his investment game plan.

“My biggest mistake was on a share purchase, based purely on listening to someone else and not having done my own research,” Marlon explains.

“I purchased $10,000 in that company, and it eventually went into liquidation, and I lost it all. The lesson in that is not to listen to others to tell you what (or where) to purchase. Do your own research and follow your instinct. When it comes to investment property, do not purchase it with emotion – it doesn’t need to suit your lifestyle, but does need to suit your target tenant.”

Most successful property deal

“My most successful property transaction was the property that is now my current principal place of residence, on the Isle of Capri on the sunny Gold Coast, Queensland. I got it for a bargain price at the time, but the house needed a lot of work. It was probably close to being the worst house not just on the street but on the entire island!

“Over time, we saved up and completely gutted and renovated one room at a time. We then added a second storey, knowing we wouldn’t be overcapitalising. Our total outlay (including the original purchase price) was probably around $800,000 – and we’d probably get close to $2m for it if we sold it now.”

If he was to start investing all over again, what would he do differently? “I would start earlier, and not be afraid to venture out of my current surrounds, but explore good property purchase opportunities nationwide. I was more focused at the time on following the adage of trying to pay off my entire home mortgage before I did anything else.”

While Marlon is generally happy with how his portfolio is going, he wants to fast-track his investments so he can retire within six years. To help him do this, our resident coach, Brendan Kelly, maps out the following plan.

The Game Plan

The expert: Brendan Kelly is an active property investor, RESULTS mentor and property author. He has coached over 600 property investors from all walks of life, sharing his experiences of being able to quit his day job, thanks to property.

Coach’s assessment

Marlon’s vision of retirement

To effectively answer the question of Marlon’s life, we’ll need to get a little more of an insight into what retirement means to him – and it turns out he’s given it some worthwhile thought!

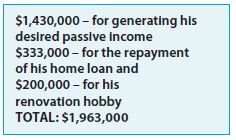

Marlon’s ideal retirement includes paying off his home loan of $333,000, living off a passive income stream of $100,000p.a. before tax, and having enough cash to follow through on a hobby he wants to take up – the buying, renovating and selling of $500,000 homes!

To know if this is possible for Marlon, we’ll need to know what it would take to live this sort of lifestyle, and then to know Marlon’s financial position to get a idea of how far he would have to go to achieve it. Firstly, let’s take a look at what it might take to live such a life.

Passive income

Earning a passive income is simply a matter of accumulating an asset base and allowing other people to use your capital for a fee.

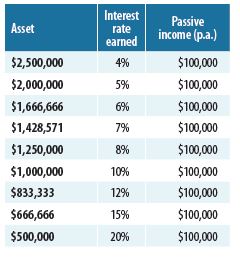

For example, if you have $1,000 and you want to generate a passive income from it, you can put your asset base into a term deposit at your local bank. The bank will then use your funds for whatever purpose they like, until the end of the term deposit. For the right to use your money, the bank will pay you for it in the form of interest. Hey presto! Your $1,000 is now earning you a passive income (a very little one perhaps but passive income none the less)! For Marlon, the question becomes ‘What does it take to earn $100,000 of passive income every year?’ If we look at the table below, we’ll see a number of different ways we can achieve a passive income of $100,000p.a.

As you can see, the better the rate of return that we can achieve, the less capital we will require to get our desired $100,000p.a. of passive income. If we purchase properties with a higher rental yield, it means we will need to own fewer properties to achieve the same passive income. However, if we choose a conservative 7% rental yield, then we’ll need to purchase about $1.43m worth of debt-free property.

Total capital requirement

If we now look at the rest of Marlon’s retirement plan, we’ll need an additional $333,000 to pay out the outstanding home loan, plus enough cash and borrowing capacity to buy and renovate another $500,000 home. When looking to undertake a cosmetic renovation, typically you’ll need to have about 40% of the purchase price available in cash or equity to cover the hard costs through to completion, and about 80% in borrowing capacity. However, it can be difficult borrowing money in retirement as there is no gainful employment for a bank to refer to as a means of repaying the debt. Does this mean Marlon will need about $600,000 in cash to buy and renovate this $500,000 home? Perhaps not!

At the moment, let’s just say Marlon will need access to about $200,000 (40% of the purchase price) to take on and complete his renovation project. All up then, Marlon will need approximately:

We now have a clear understanding of what it will take for Marlon to ‘live the dream’. At this point, it’s a good idea to take a look at Marlon’s finances to see how far he has come with just six years left to go!

Current financial position

There is no mistaking it – Marlon has an impressive property portfolio and should be proud of what he has accomplished (see box at right). Through what he has learnt over the last 25 years, and how he has applied this knowledge, Marlon has accumulated a substantial equity position that has the capacity to afford him the freedom he is after. Congratulations, Marlon! That is a fantastic outcome worthy of recognition. And how is this portfolio performing for him?

Marlon’s $3.345m is earning him a positive cash flow of just $7,683p.a. Even if we remove his home loan repayments, he is still just earning over $44,400p.a. from his properties. Under these circumstances, it is easy to see why Marlon might doubt being able to achieve the financial outcome he wants for his retirement in just six years.

Growth

One of the key reasons for any property purchase is the capacity for it to grow in value over time, and Marlon believes his properties are no exception. While Marlon believes they will continue to accumulate wealth, he suggests that the markets in which his properties are held have different growth forecasts. This is the growth Marlon expects to achieve in the next 12 months:

To earn $287,000 in just 12 months is a great outcome – an annual increase well in excess of Marlon’s retirement income needs.

But while Marlon expects capital appreciation in the next 12 months to exceed $280,000, the idea of drawing down on this growth and living a retirement lifestyle off borrowed funds carries with it some significant risk – a risk not borne when living on a passive income. Marlon has proven himself to be a wise and careful investor and recognises the security that his passive income will provide.

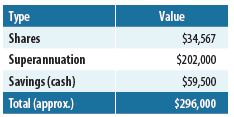

Other assets

On top of his property investing, Marlon has also dabbled in other investment classes, which will allow him to access additional financial reserves should he require them to meet his retirement goals.

The question becomes – Is it possible for Marlon to ‘live the dream’ by the age of 55?

Marlon is currently employed and likes his job and he feels no desperate rush to leave the workforce. With a net asset base in excess of $3.46m, he certainly has options; however,

Marlon has suggested that he would like to plan a more considered transition from the workforce into retirement. Marlon is open to the possibility of taking on a part-time consulting role if it would help to make a smoother transition.

Brendan’s game plan for Marlon

In order for Marlon to live his dream retirement he’ll need to pay out his home loan, have at least $1.43m earning 7% p.a., and also have in excess of $200,000 available for his hobby renovations. To achieve this, Marlon may need to think differently about his current property portfolio.

Looking at the portfolio, it’s important to consider cash flow and growth for each property. If we are expecting high growth in the immediate future, it might pay to hold the property for a little longer before selling it, even if the cash flow is negative. If we are expecting no growth but are enjoying a yield in excess of our target of 7%, and if it’s a relatively low-maintenance property with a low-maintenance tenant, then there may be merit in holding on to it. However, if we find we are stuck with a property that has low growth prospects and poor rental yields – like Marlon’s property in Vancouver – then it may be wise to sell it, release the capital and buy something that will serve us better!

It appears that Marlon is already thinking along the same lines and has just listed his Vancouver property for sale to release some capital so he can pay out his home loan plus change.

During our conversation, Marlon also revealed that he had recently purchased his second Isle of Capri property. An advocate of buying well, Marlon had negotiated a fantastic purchase price by allowing a very stressed vendor to solve their problem quickly. This afforded Marlon an instant equity gain of more than $200,000.

While this is a fantastic addition to his portfolio, the real beauty with this property is that it requires cosmetic renovation – the perfect introduction to Marlon’s retirement hobby.

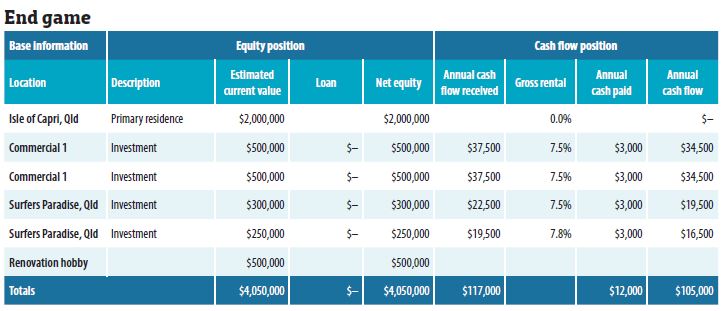

So, getting started, Marlon’s portfolio might change as shown in the following table:

The transition

As an idea, leading into the renovation of his first hobby reno, Marlon might like to take the opportunity to scale back his working obligations by moving to a three-days-per-week consulting role. This would allow him more time to oversee the renovation process and build his skills while retaining the security of being gainfully employed.

Once the renovation is complete, Marlon has suggested that the property could achieve a sale price in the order of $1.5–$1.6m. After paying out the loan, Marlon would have released approximately $800,000 worth of equity. He could then use this to pay out the loans for the two Surfers Paradise units if he chooses to keep them.

The total remaining available funds might then be used to purchase a commercial property for approximately $500,000 with a yield in excess of 7% – no loan! Rather than owning residential rentals on which rents are conservative, outgoings are covered by the landlord, lease periods are short, and lease agreements favour the tenant, income might be more passive with a commercial property on which yields are generally higher, outgoings are paid by the tenant, leases are longer and leases are governed by commercial law. Of course, Marlon would be encouraged to get a good commercial lawyer and great accountant on his team of professional advisers.

At this point, selling both WA properties would release approximately $800,000 in equity after 12 months of growth and selling costs. If Marlon then purchased another $500,000 commercial property with a yield in excess of 7% and no loan, he would end up owning two $500,000 commercial properties and two units in Surfers Paradise with no debt and earning in excess of a conservative 7% yield, or more than $105,000p.a. passive income – with approximately $300,000 left over!

By cashing out his shares and super fund, Marlon would have in excess of $500,000 to put towards his hobby!

Living the dream

Within 12 to 24 months, Marlon could be the proud owner of a debt-free property investment portfolio worth more than $1.55m, offering him in excess of $100,000p.a. passive income, a $1.75m home with no loan, and in excess of $500,000 of play money for his renovation projects. So, is it possible for Marlon to retire before he’s 55? Absolutely

Disclaimer: The views provided are of a general nature and should be considered as general information only. This is not financial advice and it is not to be acted upon without advice from a qualified professional who understands your personal circumstances.

.JPG)