Fresh out of uni and into property investment, teacher Branden Sarafov set himself the lofty goal of supplementing his wife’s $70,000 a year salary through property investment. At just 25, he has fast-tracked his investment career to a six property portfolio and a new career as a buyers agent.

As an undergraduate uni student, Branden Sarafov already knew the traditional 9-5 wasn’t for him. With his partner Tiarn, they set themselves the ambitious goal of replacing her salary with cash flow from property investment.

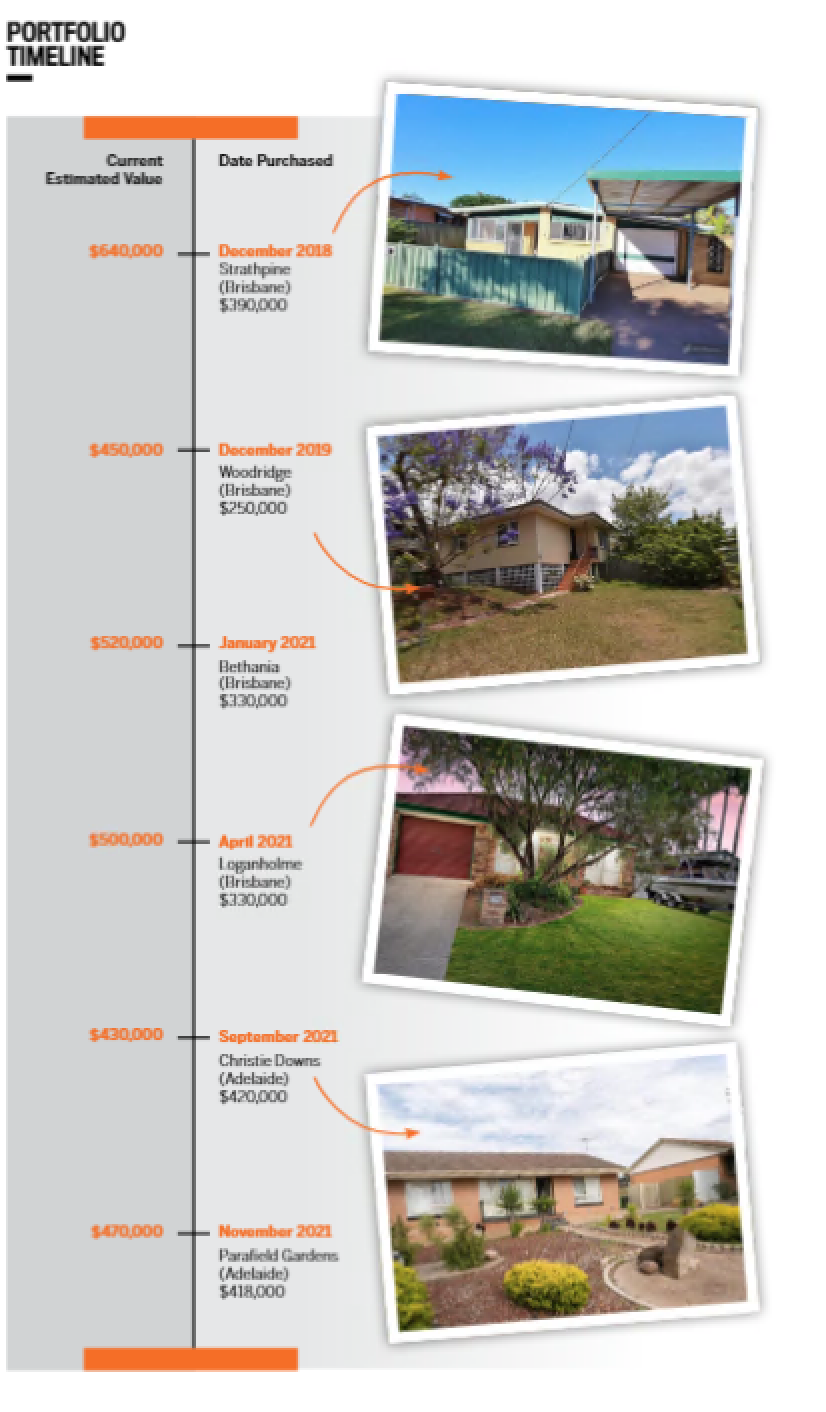

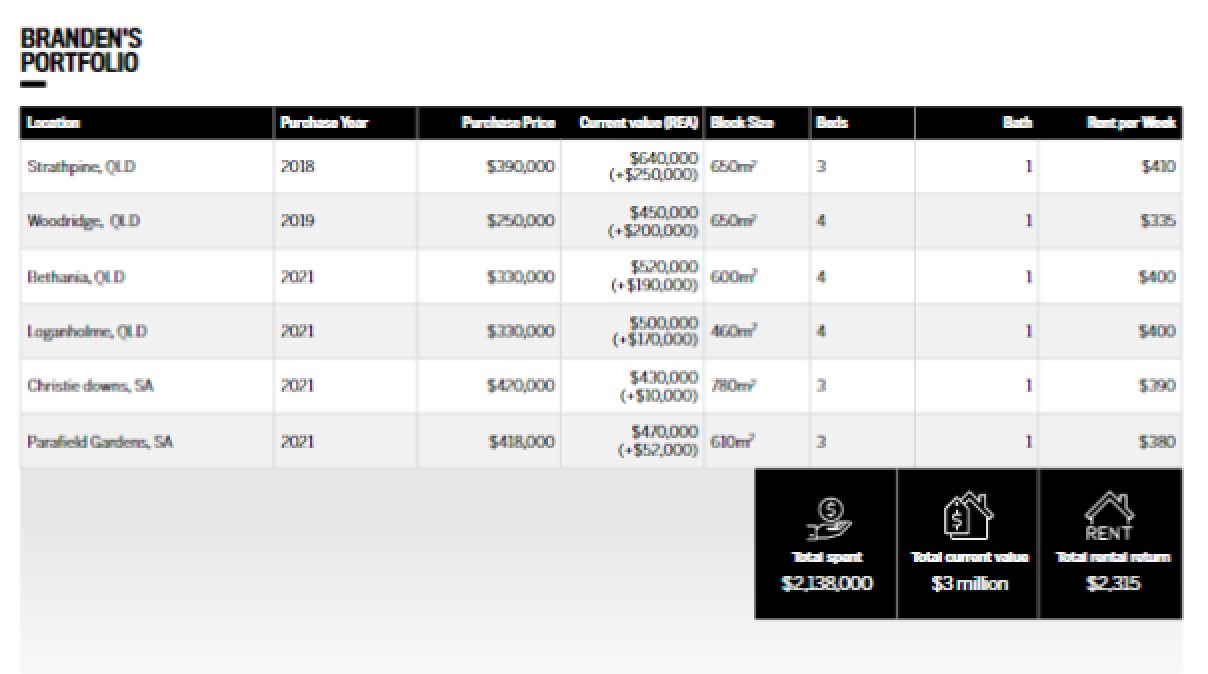

In December 2018 they bought their first property in Brisbane’s northside. Fast forward three and a half years and the couple now boast a portfolio of six investment properties, at a combined estimated value of $2.7 million.

A self-taught investor, Mr Sarafov tapped into “clues” left behind by successful investors.

“Rather than trying to reinvent the wheel, I look at someone that is in a position where I want to be and try to replicate everything they do in order to get myself to that same sort of position,” he told Your Investment Property magazine.

“That’s how we were able to reverse engineer to this goal. Essentially reverse engineering what our overarching goal initially was, because the goal we set for ourselves was to replace my wife’s ($70-80k) income, that would be sufficient for us in order to live moving forward.”

AT A GLANCE

Current number of properties in portfolio: 6

Years investing: 4

Portfolio value: $2.7 million

Branden attributes his success valuing the market to his university study habits, which translated into not only a financial strategy but now his own business.

“I think one of the biggest learnings I took from going to university is my ability to understand how to research,” he said.

“I thought, well, if I can apply that in the same way I've been applying it to my tertiary studies, I can get a better understanding of how the property market works, and make better-educated decisions that way.”

Branden has recently launched his own buyer's agency as he aims to help others climb the property ladder.

“I realised I actually had a massive passion for that after building my portfolio. I said to myself, well, if I enjoyed this so much, I might as well see if I can actually make a career out of it.”

In a market that has moved quicker than many anticipated, Branden’s success has come from an ability to find undervalued properties and debunk property investing myths around negative gearing and buying expensive properties.

He says his overall strategy has changed drastically over time as his goals shifted from targeting new builds to established houses.

“When I first started getting into property, I said I'll buy a new house so I won't have any maintenance issues or any problems moving forward,” he said.

“After doing a lot more research and getting better at studying the market, I realised I should be focusing on finding properties that are in high demand.

“Purchasing established properties means I can purchase properties on typically a larger block. It also means I can add value to them over time.”

Mr Sarafov said the land a property is on is where the real value lies.

“I knew I was getting the land value attached to it, which is obviously the true asset in what you're buying. So we narrowed it down into what was a very concise type of property that we look for.

“We look for established properties in high-demand markets.”

Mr Sarafov reinforced the importance of “getting the first one right” when starting your investing journey.

“You essentially want to be taking progressive steps towards the goal that you have,” he said.

“But if you get that first one wrong, then you've got to kind of go back to ground zero and start again. And it might cost you in the long run, in terms of the opportunity cost, as well as the funds that it might cost to get you out of the property. That's why I spent so much time researching before we pulled the trigger.”

In 2021, Mr Sarafov bought four properties, taking his total portfolio to six.

“I suspect my portfolio is around $20,000 cash flow positive. I always like to do projections moving forward. Towards the end of next year, I'll probably be $40,000 positive,” he said.

“I want to, hopefully, buy two more in the next 12 months. I don't think I'll ever stop purchasing.”

Mr Sarafov also shared his belief in investing with the goal of positive cash flow, saying unlike many other investors, tax incentives are low on his list of priorities when investing.

“It's probably further down on my criteria in terms of importance, because for me, the most important thing was to purchase something that had strong demand that also aligned with what we were trying to achieve.

“Buying properties that did provide us with a cash flow obviously makes it easier to hold. I know a lot of people that suggest you should only buy negatively geared properties and I don't understand that at all.

“For me, the biggest benefit to property investing is capital growth. And then after that is cash flow. And so if that's the biggest benefit, and tax depreciation is kind of just like the icing on the cake, it wouldn't make any sense to just go out and just purchase based on tax incentives.”

Mr Sarafov has bought all six properties for less than $420,000 each, a strategy that has proved you don’t necessarily need a huge nest egg to get started.

“Buying expensive properties is a false belief within property investing which I don't agree with at all. I don't think it matters. As long as you're buying with all the other fundamentals, you're going to see a return on what you purchase,” he said.

“Some people say you don't want to purchase that $400,000 property because you're not going to see growth. But I could show them my entire portfolio and many other people who have done that, and see the extraordinary growth.

“But also with purchasing at a cheaper price point you also typically have higher yields, so it makes it easier to hold more property. So you know, someone might spend a million dollars and be able to get $600 a week in rent. Whereas I could spend $500,000 and get $900. Or if I bought two properties at 500,000 be able to get $900 a week from those two properties.”

He says in terms of a cash flow position, he’s holding the same amount of property and has been able to diversify his portfolio in two different locations with two different incomes.

“For me, that just makes a lot more sense and that's the approach we've taken. It’s enabled us to be able to build the portfolio to where it is.

“In terms of borrowing, if we were to originally go out and buy an $800,000 - $900,000 property, we might be maxed out by then. But the fact that we can buy at a cheaper price point and have a higher yield means we can then borrow more and build a larger asset base than what we could have visited.”

Sharing his story is something Mr Sarafov hopes will inspire more young investors to get into the market. He believes the key is strong research habits, connecting with like-minded people, and ignoring external noise.

“If I listened to everybody else's opinion, I wouldn't be in the position I am today.”