BEFORE THE PROPERTY IS PURCHASED

Generally, there are only limited tax deductions available to property investors on expenses incurred before an investment property is purchased, unless the investor is carrying on a ‘property leasing business’ and the expense is a business expenditure that is not capital or private or domestic in nature. It’s a general rule that any pre-purchase expenditure is incurred too early for there to be a direct link between the expense and the income-producing activity (which only arises when the property has been acquired and becomes available for rent). However, some of the costs may be included in the cost base of the property for future capital gains tax purposes.

What are the deductions?

- Body corporate fees

- Council rates

- Utility bills

When are you eligible for the claim?

• You are generally eligible for the claim to the extent that the expense is related to the period after the property settlement on purchase during which the property is available for rent.

What is a reasonable claim?

• If the property is intended to be available for rent immediately after settlement, the settlement adjustments are generally wholly tax deductible. This is so even if the property is not physically rented out and remains vacant.

• However, if the property is not immediately available for rent after settlement, eg you opt to live in the property for a period before it is rented out, you will need to apportion the settlement adjustment amounts in order to claim the portion of these amounts that relate to the period during which the property is available for rent.

What to look out for when making the claim, to satisfy the tax office's scrutiny?

• If a settlement adjustment amount is capital in nature, eg a subsequent adjustment to the contract price after the contract was signed, the adjustment amount will not be tax deductible.

• If the period to which a settlement adjustment amount is related includes a period during which the property is not rented or available for rent but the full amount is claimed as a tax deduction, it is likely that the tax office will amend the relevant tax return if the issue comes to light, in order to apportion the amount accordingly and impose general interest charges and penalties.

DURING OWNERSHIP OF THE PROPERTY

What are the deductions?

MAINTENANCE COSTS

Maintenance costs to maintain the physical state and condition of the property, eg for cleaning, gardening, pest control, repairs and maintenance, etc.

When are you eligible for the claim?

• Generally, most maintenance expenses incurred for the purpose of maintaining the physical state of the property are tax deductible, provided that the expense is not capital or private in nature.

A capital expenditure usually relates to the acquisition of something that has an enduring value over a number of years. Such capital expenditure is normally not tax deductible upfront, but may qualify for depreciation or capital works deductions over a number of years.

What is a reasonable claim?

• If the entire expenditure is related to the maintenance of an investment property that is not capital in nature, the full amount of the expense will generally be tax deductible. However, it is not always easy to differentiate whether an expenditure is capital or otherwise, or capital works deductions over a number of years.

• Under the tax law, any work done on something that goes beyond merely restoring it to its original condition when it was acquired by the taxpayer is an ‘improvement’, which is capital in nature. Likewise, the replacement of an entirety is of a capital nature.

• Further, the cost of a freestanding functional unit that is not affixed to the land or building is also capital in nature and is usually dealt with under the depreciating assets provisions.

• Interestingly, if you incur repair costs that are not capital in nature when you first purchase the property, these ‘initial repair’ costs are treated as capital even though they are normally considered deductible repairs if these costs are incurred at a later stage. The initial repair costs or other improvement costs will instead be included in the cost base of the property.

Therefore, any claim you make must be reasonably apportioned between these different types of expenditure that are often bundled up as ‘repair costs’, and the correct tax treatment must be applied to each type of expenditure accordingly.

What to look out for when making the claim, to satify the tax office's scrutiny?

• On the basis of the above, if you incur an expenditure that includes multiple components, and some of those components are capital in nature, a reasonable apportionment of the expenditure is required to ensure that you are only claiming a tax deduction on the maintenance costs that are not capital or private in nature.

For instance, if a tradesperson repairs part of an existing deck, supplies and installs a new stove, adds extra shelving to the existing shelving in the kitchen, and replaces a stand-alone external protective wall, it is advisable to obtain a detailed invoice showing a reasonable breakdown between the different types of work done.

• Assuming that the repair to the deck is not an initial repair and is attributable to wear and tear caused by your tenants, it will be tax deductible upfront.

• The new stove is a depreciating asset that is a functional unit in its own right and will need to be depreciated over its effective life.

• The additional kitchen shelving will be an improvement to the existing shelving, which will also need to be depreciated.

• The replacement of the stand-alone external protective wall amounts to the replacement of an entirety, which again is not tax deductible upfront due to its being of a capital nature, but the corresponding expenditure may qualify for the capital works deduction over a number of years.

• Failure to apportion the total expenditure between the various components on a reasonable basis and apply the tax rules

correctly to each component may draw the ire of the taxman.

What are the deductions?

MANAGEMENT COSTS

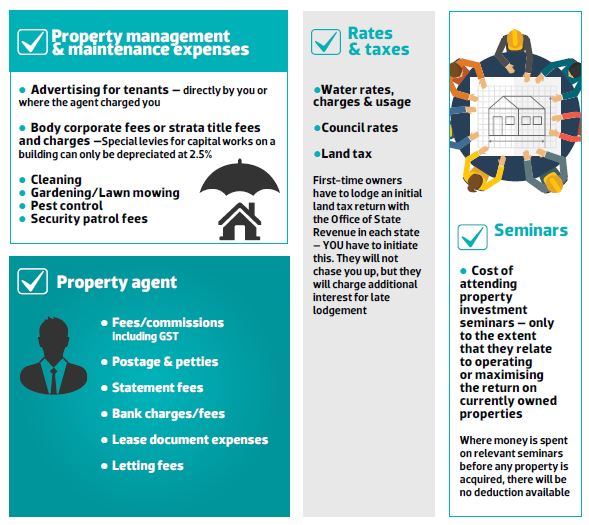

Management costs to manage the administrative aspects of the investment property, eg accounting and bookkeeping, tax affairs management, advertising to procure tenants, property management, financial planning and related advice, legal advice, quantity surveyor, etc.

When are you eligible for the claim?

• Generally, all costs related to remunerating your property manager to look after the day-to-day operation of the investment property are tax deductible, again to the extent that the expenditure is not capital or private in nature.

What is a reasonable claim?

• The reasonableness of this type of claim is ultimately determined by the underlying services acquired, to ensure that none of the claim is attributable to work done by others that is capital in nature.

• If a particular cost includes both capital and non-capital components, the expenditure must be reasonably apportioned such that you are only claiming the costs in relation to the non-capital component, albeit capital components may qualify for capital works or depreciation deductions in some instances.

What to look out for when making the claim, to satisfy the tax office's scrutiny?

• The day-to-day accounting and bookkeeping costs are generally tax deductible as they are incurred, as well as tax affairs management costs.

• Property management costs are usually immediately deductible, as they are generally related to the property manager dealing with tenants and coordinating maintenance work on the property if required.

• Care must be taken as it is common for property managers to incur capital expenditure on behalf of owners (eg purchase of a new oven), which is then on-charged to the owner. Such expenditure is often disclosed as ‘repairs and maintenance’ in the annual statement issued by the property manager, which may form the basis of tax deduction claims in the hands of most owners.

• If the owner inadvertently claims the capital expenditure in their tax return, they will run the risk of non-compliance with the tax law.

• Professional costs such as legal and financial planning fees will need to be carefully analysed, as the nature of the precise work done will dictate the character of the relevant cost as being non-capital or capital in nature, which will in turn affect the tax deductibility of the cost.

• As such characterisation and, if required, cost apportionment can be technically complex, it may be advisable to defer the exercise to your tax accountant to determine how the relevant cost should be treated for taxation purposes when your tax return is prepared.

• For completeness, the cost of engaging a quantity surveyor to prepare a capital works and depreciation deduction report is tax deductible when incurred.

What are the deductions?

OWNERSHIP COSTS

Ownership costs that are incurred as a result of one’s ownership of the property, eg body corporate fees, council rates, insurance premium, land tax, etc.

When are you eligible for the claim?

• With a few exceptions, most ownership costs relate to the day-to-day maintenance of the property and are tax deductible as they are incurred.

What is a reasonable claim?

• To the extent that the relevant cost is not capital in nature, it will be reasonable to claim the entire cost as a tax deduction.

• Sometimes the cost you incur that falls under this category of expenditure is essentially a ‘prepayment’. For instance, if you pay the insurance premium on your landlord insurance policy during the year, a part of that cost is technically related to the next income year.

• Provided that you are not carrying on a property leasing business, which is likely to be the case if you only have a limited number of investment properties, the prepaid portion of the expenditure is generally tax deductible as it is incurred, as long as the prepaid portion does not relate to a period that exceeds 12 months after the end of the income year. In this case you will not be required to apportion the expenditure and delay claiming the portion of the expenditure that relates to the following income year.

• Land tax liability is usually imposed on landowners by the relevant state or territory at the start of a year (for land tax purposes) based on land owned by the relevant landowner at midnight on the last day of the previous year. For instance, if you own land in Queensland, you incur a land tax liability if the relevant statutory threshold is reached in the year ending 30 June 2015 based on your landholdings at midnight on 30 June 2014. Accordingly, even if you have not physically paid the land tax liability by 30 June 2015, you are still entitled to claim the land tax as a tax deduction in the year ending 30 June 2015.

What to look out for when making the claim, to satisdy the tax office's scrutiny?

• Generally, a body corporate fee may include multiple components that are for general maintenance, as well as a contribution to a general sinking fund to enable the body corporate to deal with future maintenance costs on site. Such a body corporate fee is usually wholly tax deductible when incurred.

However, if a body corporate fee, or part thereof, relates to a contribution to a special sinking fund that was established for a specific capital maintenance expenditure, eg the special sinking fund may be established to build a special structure on the roof to accommodate a new mobile phone tower, then the contribution will not be tax deductible to the owner.

• Some owners may have multiple insurance policies taken out to cover various investment properties as well as other personal assets (eg home, motor vehicles, life insurance, etc). Therefore, if an insurance premium paid is related to multiple policies and no apportionment is made to remove the amount of premium that is related to a capital or private purpose, it is likely that the tax office will amend the relevant tax return, if the issue is found, to deny the non-deductible portion of the premium, together with imposing general interest charges and potential penalties.

What are the deductions?

FINANCING COSTS

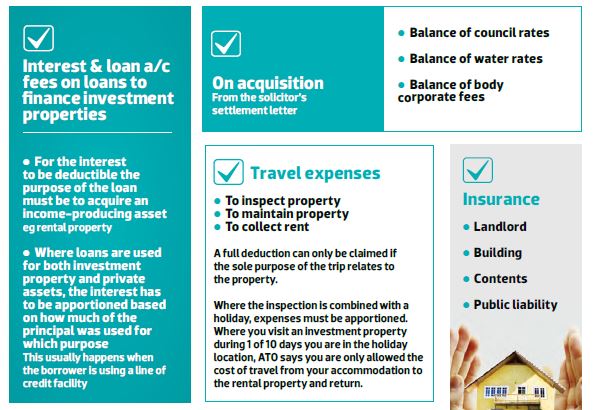

Financing costs in relation to the finance arrangement entered into for the purchase of the property, including bank fees, borrowing costs, interest on loan, etc.

When are you eligible for the claim?

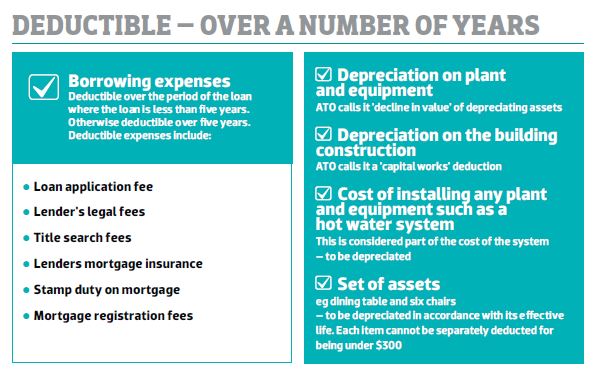

• Costs incurred that are associated with obtaining finance to purchase an investment property are generally borrowing costs, which are not tax deductible upfront. However, borrowing costs can usually be claimed as a tax deduction over the shorter of the term of the loan and five years.

• In contrast, interest incurred on a loan that was drawn down to fund the purchase of an investment property is wholly tax deductible when incurred.

What is a reasonable claim?

• Again, the reasonableness of a deduction claim for interest or borrowing costs is dependent on the purpose for which the corresponding loan was drawn down. To the extent that the purpose of the loan is wholly related to producing income, the interest will generally be tax deductible and borrowing costs can generally be claimed progressively, as discussed above.

What to look out for when making the claim, to satisfy the tax office's scrutiny?

• While it may be relatively easy to prove than a loan was originally drawn down to buy a specific investment property, if some or all of the loan has been repaid and is subsequently redrawn, the deductibility of the interest after the redraw will depend on the purpose for which the redrawn amount was used.

• Further, once the purpose of a loan is mixed, any future repayment of that loan will need to be apportioned between the mixed purposes, which may in turn affect the subsequent tax deductibility of the interest expense incurred.

• For instance, if you draw down a loan of $500k to buy an investment property, pay the loan down to $300k, and redraw $200k to fund your home renovation costs, while interest is still being accrued on the original loan amount of $500k, the income-producing purpose of the loan was reduced to $300k/$500k = 60% after the redraw. Therefore, you are allowed to claim 60% of the interest on the loan after the redraw. If you subsequently make a repayment of $100k towards the loan, the repayment will also need to be apportioned such that $100k x 60% = $60k will reduce the income producing portion of the loan on which future deductible interest will be calculated.

• To that end, the tax office has been on the lookout for certain ‘split loan’ facilities where the loan arrangement effectively allows interest to be accrued on interest capitalised on an income-producing loan while loan repayments are wholly directed to repay a private loan. Be exceptionally careful if you are engaged in such an arrangement as some of the interest on the income-producing portion of the split loan may not be tax deductible. Professional advice is highly recommended if this applies to you.

• For completeness, if bank fees are incurred that are related to an income-producing loan or bank account, the bank fees may either be wholly deductible upfront or need to be treated as borrowing costs, as discussed above.

What are the deductions?

OTHER DEDUCTIONS FOR DEPRECIATION, CAPITAL WORKS, ETC.

When are you eligible for the claim?

• You are entitled to claim depreciation and capital works deductions for a long as the property is available for rent and the particular asset has a tax ‘written down value’ at the beginning of the income year.

What is a reasonable claim?

• For depreciating assets, you need to ensure that you either adopt the Commissioner’s published effective life for the specific asset or self-assess the effective life of the asset. If you choose to self-assess, you will need to ensure that your assessment is defensible if challenged by the tax office. You are also allowed to choose between the straight-line method and the diminishing value method in calculating the depreciation claim.

• Capital works deduction is perhaps simpler to calculate. In most cases, you are simply entitled to 2.5% of ‘construction expenditure’ associated with the capital works, which includes any structural improvement that is affixed to the land and buildings.

What to look out for when making the claim, to satisfy the tax office's scrutiny?

• If you buy a depreciating asset during the year, you need to ensure that depreciation claim for the asset prorated in the first year such that you are only claiming depreciation for the period after you bought depreciating asset to the end of the income year. Also, once the ‘written down value’ of the asset exhausted, no further depreciation can be claimed on the asset. Further, if you sell the asset and the proceeds you receive from the sale exceed tax written down value, the gain on sale will need to be brought account as assessable income.

• In respect of the capital works deduction, it should be borne in mind that the purchase price of the property is not the same as the ‘construction expenditure’ in relation to the property and, similar to the treatment of depreciating assets, once the entire expenditure has been claimed over time as capital works deductions, no further deduction will be available.

Construction expenditure essentially refers to the original cost of constructing the building and improvements. Therefore, you should always ask the vendor if they can pass on details of any previous capital works claims or a capital works and depreciation report that was previously prepared by a qualified quantity surveyor. If you have trouble obtaining such information, you should consider engaging your own quantity surveyor to provide the report. As previously mentioned, it is helpful that the cost of the report will also be tax deductible upfront, together with the capital works and depreciation deductions for the year.

MAKING SENSE OF DEPRECIATION: WHAT YOU CAN CLAIM AND WHAT YOU SHOULDN’T

By Tyron Hyde, Washington Brown

Just like you claim wear and tear on a car purchased for income-producing purposes, you can also claim the depreciation of your investment property over time against your taxable income.

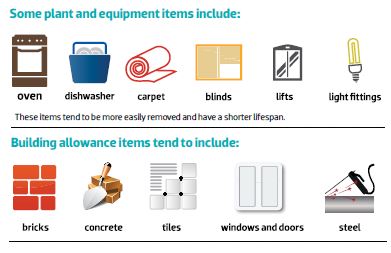

There are two types of allowances available: depreciation on plant and equipment, and depreciation on building allowance.

These items are more permanently fixed into place and have a lifespan, according to the ATO, of 40 years from the time they were fixed into place.

3 danger zones for investors

1. Incorrectly claiming the building/developer's profit as a deduction

You can only claim the builder’s profit where you engage a builder directly to build your house. You cannot claim the development profit a speculative builder has made as a building/construction cost.

2. Assuming you can claim the 2.5% building allowance based upon the purchase price

This is where you need a quantity surveyor to estimate the construction costs. The building allowance deduction must be based on the original construction cost.

3. Getting your accountant to prepare the depreciation schedule

Accountants and real estate agents are not allowed to estimate constructions costs. Quantity surveyors like Washington Brown have been identified in Tax Ruling TR 97/25 as appropriately qualified to estimate the construction costs where the costs are unknown.

When is depreciation not worth claiming

There are very few occasions when claiming depreciation is not worth it. The only time I would suggest that it isn't is when you have purchased a property that was built prior to 1985 and have owned it for five years and now want to start claiming depreciation.

In this case, the depreciation benefit may have already been used up and you have left it too late.

So the moral of the story is ... if it’s an investment property of any age or purchase price, get a quantity surveyor’s report immediately after settlement and it will always be a worthwhile exercise.

The building allowance refers to construction costs of the building itself, such as concrete and brickwork. Both these costs can be offset against your assessable income.

CHECKLIST

Tax deductible expenses you can claim on your investment property

by Shukri Barbara, property tax specialist

THE EXPERTS

Eddie Chung

Eddie Chung is partner, tax & advisory, property & construction, at BDO (QLD) Pty, and resident tax expert at Your Investment Property

Tyron Hyde

Tyron Hyde is director at Washington Brown Quantity Surveyors, a successful investor, and author of Claim It!, a book about depreciation and the only one of its kind in Australia

Shukri Barbara

Shukri Barbara is CPA & principal advisor at Property Tax Specialists

.JPG)

(1).JPG)