One factor that causes people to pause before pulling the trigger on a property investment is the fact that there are plenty of tax expenses attached.

There is capital gains tax on the gain in value, ongoing income tax on the rental profits, and unless your property is in the Northern Territory, another levy to be paid is land tax.

It is generally levied by the local state government on investment properties that have a total taxable value above the land tax threshold.

“Land tax is marketed by state governments as applying only to the large-scale property tycoons, but it can often affect mum-and-dad-style investors. It’s becoming increasingly important to state governments as a major revenue raiser, so one would imagine that it will be increased over time,” says Kym Nitschke, managing partner at Nitschke Nancarrow Chartered Accountants.

“It needs to be considered and planned for when choosing what structure to use to purchase a property. A carefully considered tax structure can minimise its impact in most cases.

”Land tax needs to be paid every year; the amount you pay is usually based on the type of land you own, its use, and its overall value at the end of a set period – which can be the end of the financial year or the end of the calendar year. Foreign investors may also be subject to certain surcharges.

Nonetheless, there are some instances in which a property owner can be exempted from paying land tax. Typically, you won’t be taxed if a dwelling is regarded as your principal place of residence (PPOR), or if the land’s taxable value is below the threshold.

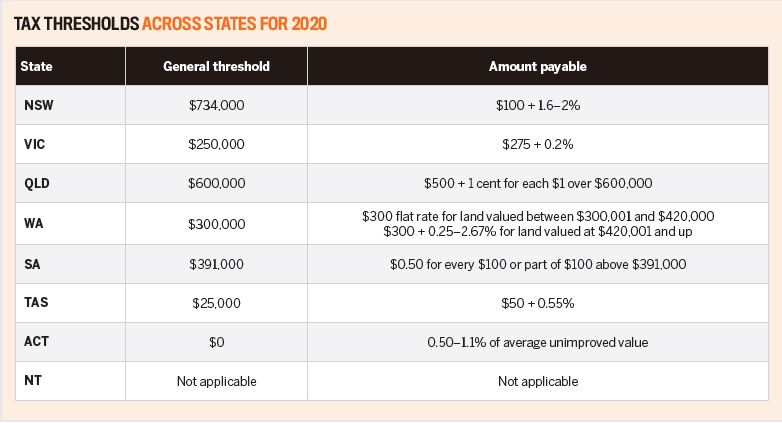

The land tax regulations differ in certain respects across Australia’s states. Some of the differences are explained here.

State-by-state guide to land tax

NSW - In this state, land tax applies to urban and rural vacant land; land with a property attached; holiday homes; investment properties; units under company titles; all types of units, including car spaces; and land that was rented from the state government.

Tax is applied regardless of whether the land earns income, although your PPOR remains exempt. Other exemptions include farms, which are considered primary production land, and land with a value below the tax threshold, which is published by the Valuer General every October.

The amount of tax you pay is determined based on the total value of all taxable land you own as of midnight on 31 December annually. Foreign property owners are subject to a tax surcharge.

Land tax rate: $100 plus 1.6% of the land value above the threshold of $734,000, up to the premium threshold of $4,488,000. After this the premium applies, which is 2% of the land value above the threshold.

VIC - As in NSW, the amount of land tax payable in Victoria is calculated based on the total value of the taxable land owned as of midnight on 31 December in the year prior to the assessment period.

If the property is used to generate income – for instance, if what was initially your PPOR has since been leased out – it will become subject to land tax.

Land tax rate: $275 plus 0.2% of the taxable land amount equal to or exceeding $250,000.

Even if you were not the owner of the land for the entire fi nancial year, you will still bear the tax burden if you take possession of a property before 30 June.

“Land tax is marketed as applying only to the large-scale property tycoons, but it can often affect mum-and-dad-style investors”

Land tax rate: After reaching the land value threshold of $600,000, you’ll pay $500 plus one cent for each $1 over $600k.

WA - As in the case of Queensland, land tax is calculated based on the taxable land value as of midnight on 30 June. The Valuer General computes for the unimproved value of land in the state, which corresponds to the market value of the land under normal sales conditions, without structural improvements.

Land that is held in trust is usually not exempt from land tax unless it is held in trust by the executor or administrator of a deceased estate and is being occupied by a beneficiary as a PPOR, or the land is held in trust for a disabled benefi ciary who is living on the land.

Land tax rate: $300 flat rate for land valued between $300,001 and $420,000. From $420,001 to $1m, a rate of $300 plus 0.25% applies. This percentage increases in increments to reach 2.67% when the combined land value exceeds $11m.

Exemptions from land tax can be claimed if the land is used for primary production purposes, such as farming. Off -the-plan apartments are also exempted.

South Australia recently introduced changes to its land tax policy: the Land Tax Amendment Bill 2019 cut the top tax rate from 3.7% to 2.4%. However, it also made changes to its aggregation rules. Investors will not therefore be able to use separate trust and company structures to avoid paying tax.

This means that it will no longer be possible for an investor to hold several properties in several separate companies or trusts and not pay a single dollar in land tax. The tax reform includes a $25m transition fund over the next three years for investors who might be hit by the changes, which take eff ect in July of this year.

Land tax rate: $0.50 for every $100 or part of $100 of land valued above $391,000.

TAS - In Tasmania, land tax is levied based on ownership as of 1 July each year. However, exceptions are made if the land is set for use in religious activity, Aboriginal cultural activities, a charity, or it caters to retirees (ie the site of a retirement village). Land tax is also waived if the land is used for a medical establishment, excluding GPs, or is protected by a conservation covenant.

Land tax rate: $50 plus 0.55% of land valued above $25,000.

ACT - In this state, land tax is levied on all properties that are not your PPOR. This includes properties held in trust and subdivided properties on the same land as your PPOR that are being leased out. Foreign property owners also need to pay a specific surcharge.

Land tax is assessed quarterly – on the first day of July, October, January and April each year.

Land tax rate: On land valued up to $150,000, a rate of 0.50% of its average unimproved value applies. This percentage increases in increments to reach 1.1% when the combined land value exceeds $2m.

What investors need to look out for

Given the cost of land tax, some investors will be seeking to minimise the amount they have to pay. One way to do so is to put properties either under individual or joint names. However, Kym Nitschke has another tip that could work out better in the long run.

“Whilst more expensive initially, sometimes using a corporate trustee of a family trust may prove to pay for itself over time because of the ability to save on land tax and income tax over time,” he explains.

Nitschke also advises investors to stick to the property structure they originally put in place.

“Land values generally increase over time, so while a property might not be subject to land tax now, it needs to be budgeted for over time”

“Changing structures to minimise land tax can trigger stamp duty and capital gains tax,” Nitschke explains.

When renting out a property, landlords can also give the responsibility of paying land tax to the tenant.

“In some commercial lease agreements it can be written into the lease that it’s an outgoing which is paid for by the tenant, as opposed to the landlord.”

As investors build their portfolios, they should be prepared for increases in their tax rates.

“Land values generally increase over time, so while a property might not be subject to land tax now, it needs to be budgeted for over time,” Nitschke says.

“As investors build up their portfolios, they fall into a higher category of land tax and the rates go up substantially through the categories. It can be a huge cost to pay for successful property investors.”