“May you live in interesting times” - for those of you don't know this was a Chinese curse.

Well…we are clearly living in interesting times.

In my 67 years I can’t remember a time when there has been as much panic and fear created in such a short time, but I guess it’s related to the way the media and in particular social media delivers news today.

There seem to be two extreme schools of thought:

• Some are wondering what all the fuss is about. Isn’t this just a bad strain of the flu and the media is beating all this up and making the most of the situation?

• The other extreme think this is a major problem and life will never be the same again.

Most likely truth is somewhere in the middle, but as we are in the early days of Australia’s experience with Covid 19, no one really knows.

Having lived through a number of difficult and challenging times and experiences, I recognise that those who work their way through these times with an optimistic outlook do much better than those who can only see the dark side.

As property investors, business owners or entrepreneurs, it’s our job to look for the silver lining in the current situation and take advantage of the opportunities that arise – not take advantage of the people - but there are always opportunities at times of adversity.

Unfortunately there are a lot of things we can’t control at the moment so there’s no benefit in worrying about what we can’t control.

Instead worry about what you can control.

For example this is an important time to look after yourself and your immunity by eating well, exercising well, having extra vitamins and lowering your stress.

Here’s my thoughts about what's ahead.

There is no doubt that the economy will suffer in the months ahead.

And it is important to recognise that feeling nervous and unsure at times like this is normal - after all you are human.

But it’s not right to make important financial decisions based on fear.

It’s not right to make 30 year financial decisions based on the last 30 minutes of news.

Of course it is important recognise that there are so many unknowns at present that we can’t be sure what’s ahead, however we can look at the past to get an idea of what could happen this time round.

It is unlikely the government's Fiscal Stimulus Package will lift spending enough to avert a recession, because of poor consumer and business confidence will make people stash their cash.

Recession or not, we are going to have a major disruption to our economy and to many people’s cash flows and confident businesses.

Another major disruption will be to people’s confidence.

However this is unlikely to be like previous recessions.

This disruption has not occurred at a time of major excess, or at a time of high interest rates - factors which in the past of lead to a recession.

This means it is likely that our economy will recover quickly once we get through the ravages of social isolation.

And this time our government is hellbent on not allowing our economy to go into recession. They don’t want to be known as the government that made Australia going to recession after 30 years.

Particularly since they have tried to pin recessions on Labor government and keep suggesting the Coalition is more economically responsible.

Similarly with an election year in the United States, it’s hard to imagine the Donald Trump will want America to go into recession.

Looking back gives us clues…

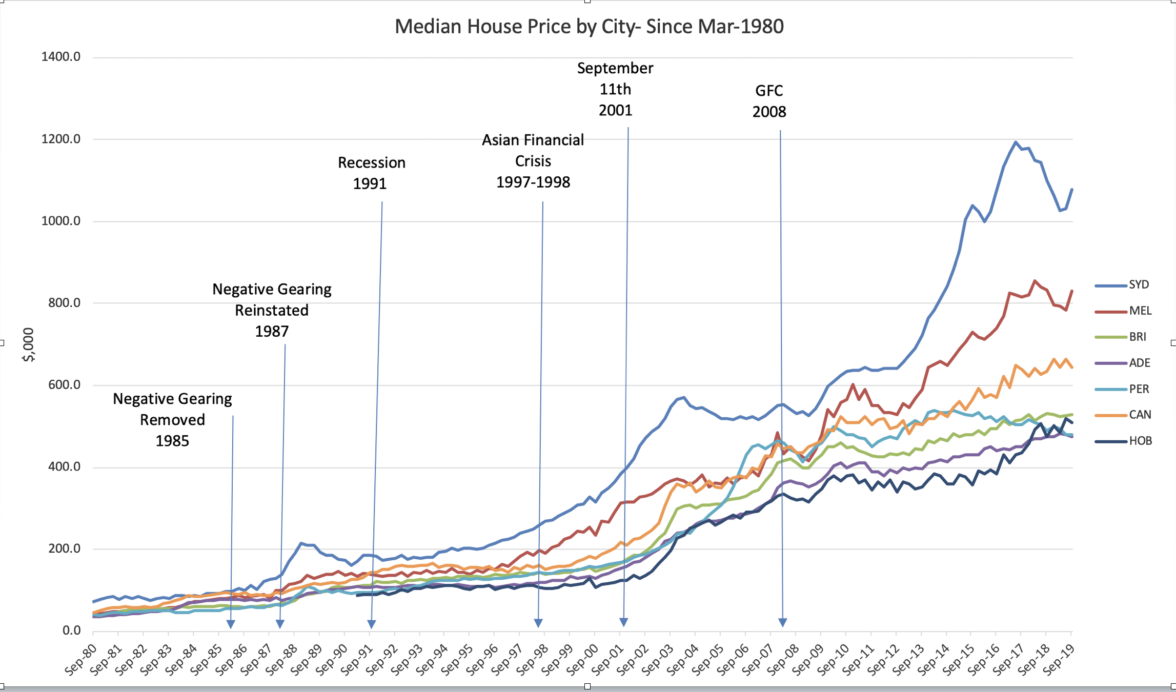

It’s important to remember that after each stock market crash Australia has experienced in the past, the property market has boomed.

In fact in the last recession of the early 90s property values didn’t drop other than in Melbourne where our local economy suffered the most.

This was a time when even a number of our major financial institutions in Victoria almost collapsed.

Just look what happened to our property markets over the last 40 years despite history having thrown all sorts of obstacles at it.

And just like before, once we get through our current challenges, there’s no reason to imagine that there won’t be a flight to quality assets again.

And this will be not only from Australian residents, but also from foreign residents who will again see Australian residential real estate as a sound, secure, relatively less volatile asset class.

In fact buying during the Global Financial Crisis, or at other times of general concern, proved to be a smart move for those who were brave enough to go against the "heard."

So if you're looking at buying a new home or an investment property now is a great time just take advantage of the current markets by setting yourself up and getting the right strategy in place, organising your finance and setting up the right ownership structures.

And if you have a secure job and a steady income you should consider taking advantage of the opportunities that will arise in the short-term before the market undoubtably once again moves upwards.

You’ve probably heard that Warren Buffett, undoubtably the most successful investor in human history, said: "Be fearful when others are greedy be greedy when others are fearful."

That’s because he always took a long-term view of the markets.

So if you're currently a buyer, with your finance pre-approved and security in your job, you are in a very lucky position.

An opportunity like this doesn’t come up very often.

Clearly there is a level of fear that is going to dissipate at some time in the near future, so right now you have the ability to buy a home or investment property that you may not be able to choose when the market gets strong again.

Another reason you should consider getting into the market now is there is likely to be a greater chance than an anxious vendor will accept your offer.

But don't try and be smart and time the market.

We’ve learned over the years that it's just too hard to pick the market bottom.

How did that work for people who tried to do it in 2019?

Or at the bottom of previous property cycles?

If you find the right property that suits your long-term strategy, suits your budget and fits in with our six stranded strategic approach to selecting an investment grade property, my suggestion is to take advantage of the opportunities the market is giving you.

The great thing is you’re going to be buying with less competition – only a few weeks ago there were so many buyers for every investment-grade property that at Metropole we had real difficulty securing great properties at what we may consider a fair price.

Our research, based on previous cycles, suggest that when the situation dissipates there is going to be so much pent-up demand, and you will again be competing with many other buyers.

I can understand why you may have concerns about getting into the market at present, but if you think about if there are always concerns, and you can always find reasons not to get into the property market.

Just look back over the last couple of years…

Last year many people were concerned about the removal of negative gearing, others were concerned about potential changes to capital gains tax, others were waiting for real “proof” that the property market had bottomed.

This year some held back because of the bush fires.

And these were all reasons not to get into property in the last 12 months alone.

We can go back year after year - there were always reasons not to get in the market, but times like this – times of uncertainty - have always been a great opportunity to set yourself up for lifetime wealth by buying well located properties at a time when others were sitting back nervous and hesitant.

After events like this, the property market always rises because people revert to bricks and mortar.

They seek the comfort of a safe haven in an asset class that is underpinned by the fact that 70% of Australians own their own home and this of course leads to the stability of our property markets.