Who will buy my property?

That’s the question you should be asking yourself if you want to create longer-term wealth through property investing.

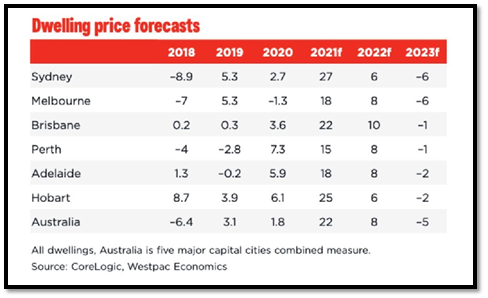

We have just seen two of the big banks, NAB and Westpac, come out with their revised forecasts for our property markets.

Although growth will continue for the next year or so, they are foreseeing a correction in 2023.

It is easy to look like a property guru when even an average house is increasing in value by up to $1,000 each week, but what happens when the tide turns?

What will happen when this cycle is over, demand drops, home buyers dry up and investors go back in their shells?

Those are the times that make or break your portfolio.

It will be the underlying demand for your property that dictates what happens next.

Here are my thoughts on the good, the bad, and the ugly.

The Good

In my mind, as an investor you should be targeting the type of property affluent homeowners are looking for.

I know at Metropole we certainly look for locations where the is a higher percentage of owner-occupiers over investors.

Homeowners tend to buy emotionally and the fact they pay too much and overcapitalise can be positive for an investor.

Alternatively in a downturn, they don’t just sell up as some investors do.

They would rather eat Maggi Noodles for six months to keep a roof over their family’s head than be homeless – they can be very resilient.

You should also target locations where there are large-scale employment hubs, quality schooling, transport, walkability, and green space.

These are usually the inner to middle ring suburbs of our major capitals and this is where we find underlying demand always remains strong.

This will provide less volatility and resilience in difficult markets as the resale market is still sound.

The real trump card has a combination of homeowner and higher incomes.

The Bad

If you are considering buying in areas with a larger ratio of investors, you may want to think again.

Particularly if they are speculators, short-term thinkers who have no real long-term strategy.

I always say investors buy more with their calculator and rarely get carried away or pay too much for the property.

In a downturn, they will think nothing of selling their property at a moment’s notice and move on.

This can cause significant price drops as investors sell up and property prices fall.

Just look what happened in the mining downturn more than a decade ago.

While that was an extreme case, there is no doubt these types of investor-dominated markets will suffer once demand drops.

This time around it will be the high-rise apartments or the house and land packages or dual occupancy properties in our outer suburbs that will see prices retract from their highs.

The supply of land or the supply of apartments will far outweigh demand, causing a major imbalance.

The Ugly

Staying on the investor-driven theme, the next type of investment could get downright ugly.

I am talking about those investors that have purchased brand new properties for depreciation benefits and yield.

Several years ago, the Government changed the regulations with regards to depreciation benefits for investment properties.

This means that now only a brand-new property will be eligible for depreciation benefits for investors.

This will have huge ramifications in the resale market where depreciation will no longer be available to prop up this type of investment.

Chasing yield will also be a potential hazard as higher yields represent of a lack of growth and higher risk.

These more difficult times are when the risk comes into play as both buyers and tenants disappear.

With all the traits of The Bad scenario, this type of investment will get very ugly over the coming market correction.

Conclusion

Our property markets are roaring along all around the country.

But as the saying goes “this too shall pass”

It is important to understand what the underlying demand for your property will be like at every stage of the cycle.

Ask yourself, who will buy my property?

Target more affluent homeowner locations in our inner to middle ring suburbs, where supply is low and importantly demand remains solid.

Avoid investor-dominated and speculative markets where buyers lean towards secondary considerations like depreciation, yield, or “gut feel”.

You want your property to fair well and recover quickly in a downturn, but some properties will be in for a very bumpy ride and take years to recover.

Good properties will hold their values, but bad properties are a risk and ugly properties will hurt many investors.

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.