Do you understand what your strategic advantage is as a property investor?

More importantly, do you know how to use it to your advantage?

By understanding more about your strategic advantage, it could dramatically change the way you plan to invest.

Not only that, but it could also significantly fast track and enhance your results!

To start with, it is important to understand that a very high percentage of property investors never create enough wealth to become financially independent.

Yet of those that do, they understand how to use their competitive advantage to maximise their results.

Would you like to know more?

Here are my thoughts on 4 Strategic Advantages.

1. Your Salary

I have explained before that your salary does not dictate your wealth.

Having said, that it can certainly be an advantage and perhaps your strategic advantage.

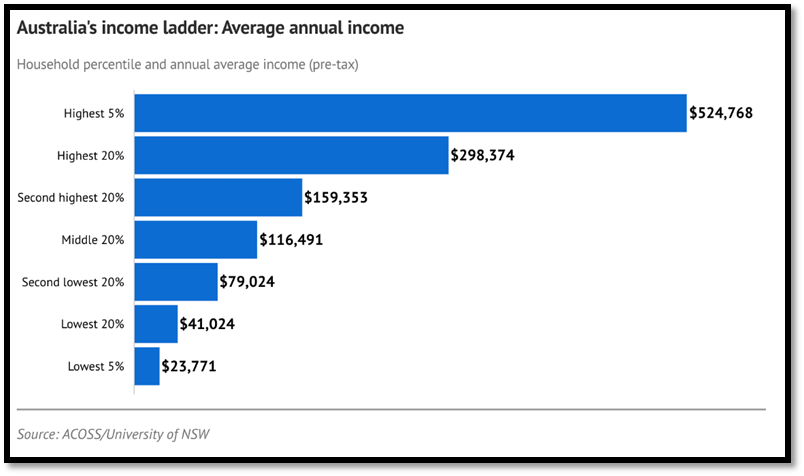

If you are in the top 25% of income earners in Australia as in the graph below, I would suggest that this is you.

If you fall into this category, your income is at a different level to the other 75% of Australians, so you must also invest at a different level.

Your income will allow you access to higher rates of borrowing and open up significantly greater opportunities to grow your wealth faster.

What I am primarily talking about here is the ability to add value up front.

Most investors will never get to where they want to be, so if you want to achieve a greater level of wealth you need to do things differently.

If you simply buy and hold a property like most investors do, you are missing out on a huge opportunity.

However, for a lot of our clients we recommend undertaking a renovation or preferably something more substantial like a small-scale development.

This type of project combines the benefits of an existing high capital growth location with substantial tax and depreciation benefits and a major boost to cash flow.

Then, rather than selling, this enables them to simply rent out, re finance and repeat the process.

This add value strategy is accessible to all investors and not just for that 25% of people with larger incomes, however it may involve holding until the budget allows for the upgrades to take place.

The strategic advantage here is that your salary may allow you to add value sooner to receive the many benefits faster, allowing you to then go again.

Here is some more information on how we use property development to create wealth.

2. 20 or More Years to Retire

In my opinion, in some cases your age can be a much greater strategic advantage than your salary.

I have seen many investors on higher salaries squander away their income, while those on much less income who invest strategically and take a longer-term approach achieve a greater level of wealth.

If you have a 20 year or more investment time frame, then your age is a strategic advantage.

You see it is time in the market that is a property investors best friend.

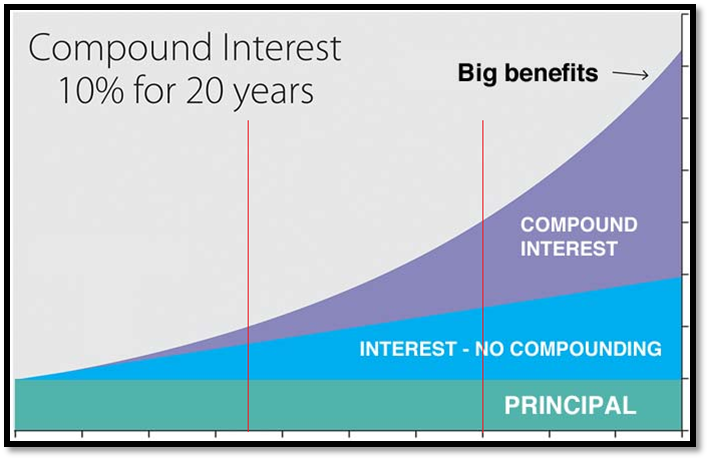

As the graph highlights, the longer you are in the market, the more you are able to benefit from compounding growth.

While the first period is good and the second period is better, the bulk of the compounding and your wealth is achieved in the final period.

It is that snowball effect and why time in the market is so important.

I feel the other strategic advantage for this age group is that they have more flexibility with employment, family, and life in general.

I would argue that 20- to 30-year-olds should really focus on growing their wealth and setting a strong base, rather than buying a home.

Rentvesting is a great option for this age group to consider also.

I have personally taken advantage of both of these options during my wealth creation journey.

3. 10 to 15 Years to Retirement

Firstly, it is important to understand that it is not too late to start.

While many think it’s too late to invest if they are 5 to 10 years away from retirement, I would strongly disagree.

Sure, you may not have the long runway like other age groups to benefit from greater compounding, but there are other advantages that you may be able to take advantage of.

I also know, that creating wealth is not just about me, it is also about my children and at some stage my grandchildren.

I would suggest that the biggest strategic advantage with this group is that they will likely have higher rates of savings, potentially other investments and also larger superannuation balances.

For beginning investors starting off, Superannuation etc is far less and as a result cannot be used strategically as yet.

However, for this group it can be a great strategic advantage in a number of ways.

Firstly, with a higher Super balance, some savings put aside and maybe some shares, it will buy you time.

You may only be 10 years away from retirement and may be thinking you are unable to use compounding of your property portfolio to its full effect like the example shows.

But perhaps your Super or Savings could buy you time, and maybe pay for your living expenses for the first 5 or 10 years of your retirement while your property portfolio continues to grow in value and then you’ll be able to access the cash flow from your rentals.

Another consideration may be using your Superannuation to buy a high capital growth asset, in this case a property.

Again, a larger balance at this stage in life gives you this opportunity that others may not have.

Leveraging even a $300,000 Super balance into a $600,000 or $700,000 property, could be the highest and best use of those funds.

Of course, I would strongly recommend seeking advice from a licenced professional if you were considering this option, but I can tell you it has worked very well for many of our clients.

4. You

At the end of the day, it all comes down to you.

You and more importantly your actions are going to be the deciding factor when accumulating wealth as an investor.

You can be the Strategic Advantage, but unfortunately for many property investors you can also be what holds you back.

If you are more willing to learn, educate and turn to mentors and professionals for help, you have a greater chance of success.

Getting outside your comfort zone, taking on some risk and most importantly taking action, can pay off handsomely.

I know there are many investors who are willing to do most of this but believe they can do it all themselves.

Usually, it is the people who have a very successful career or business, as they think those skills are transferable.

But they are the smartest person in their team, they do not understand that creating long term, wealth is very different from just investing and that is something that takes decades to learn.

So, if it is going to be, it is up to you and nobody else.

The Bottom Line

Understanding your strategic advantage can assist in building your desired level of wealth faster.

While all investors will have a competitive advantage, most fail to identify and unlock their advantage.

For higher income earners they need to use their additional income to access greater borrowing power and then prioritise assets where value can be added in the short term.

Access to greater cash flow, along with tax and deprecation benefits can be a game changer and something most investors cannot access right away.

Your Age is also a critical factor and while the younger you are the more time you have in the market to allow compounding to work, it is not too late for older investors.

They can use Superannuation and higher rates of savings and investment to buy time to access compounding or leverage further.

At the end of the day though the biggest advantage you can have as an investor is you.

Your willingness to take action and seek out a professional will greatly boost your chances of building wealth more efficiently.

Now is a great time to invest, but perhaps you should also consider how you should be investing more strategically.

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.