What will flooding mean for the Brisbane property market?

Flooding was supposed to be a once in a 100-year event and here we are just a decade out from the last round of floods.

In the past few weeks and the coming months, it is important to support those in need of assistance and provide a level of compassion.

But for property buyers and investors, one can’t help being anxious about what another flood event will mean for our property markets moving forward.

It adds another element of uncertainty in a rapidly changing landscape.

But, by understanding several key factors, you can gain back a greater level of control and certainty and move forward with confidence.

I believe the market will react and respond more positively this time around and I want to help you understand why.

Economic environment

To begin with, I believe that it is important to understand the current economic landscape when comparing it to 2011.

This is especially important when you examine the major factors that drive our markets.

The first thing to remember is that Queensland’s economy was already suffering and in recovery mode in 2011 following the GFC.

The other big difference was that the standard variable interest rate at the time was north of 7.5%, compared to record lows today in the 2%.

Two other ingredients that I have analysed previously are the number of jobs being created and the amount of migration taking place.

In a continuing theme, these figures are in stark contrast to one another when comparing the figures today, to just over a decade ago.

In 2011, there were barely any jobs being created and this trend continued with further natural disasters and mining downturns throughout the decade.

Employment growth then started to ramp up significantly from late 2017, with an estimated $16 billion dollars of infrastructure spending set to create 100,000 jobs alone in Brisbane.

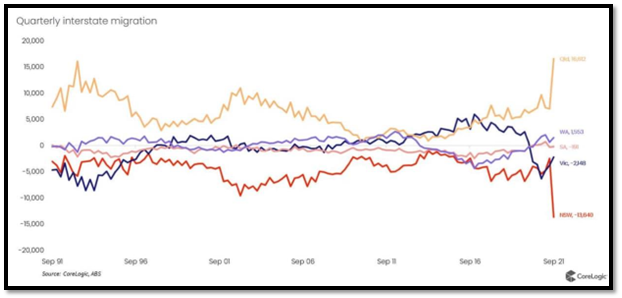

With jobs on offer migration steadily started to build from circa 5,000 in 2011, skyrocketing to north of 16,000 today and creating record demand for housing in a low supply environment.

Finally, the last piece of the puzzle is supply and demand.

Demand has been consistently at above-average levels for quite some time now, especially when compared to 2011, while supply has fallen.

I would not expect to see demand fall too much, but with the floods now taking a layer of supply away from the market these flood-free suburbs will just see greater demand.

Put simply, we are in a considerably better position to bounce back more quickly from these floods this time around.

History

While history can not necessarily predict the future, it can be a valuable tool in analysing past, similar events.

In a study following the 2011 floods, property economist Chris Eves from QUT found only a passing short-term effect on property prices.

Flooded suburbs only saw a small reduction in values after the 2011 floods, with middle to high-end homes rebounding after just 12 months.

It found that prices in both flood and non-flood affected suburbs fell in the first quarter following the floods, before steadily rising in the following three quarters.

The study also found that areas in higher value suburbs didn’t see prices fall as much as lower value suburbs and it highlighted medium value suburbs saw an increase after three months.

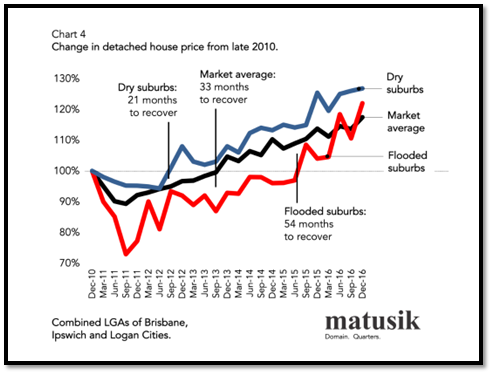

Another study from Michael Matusik also broke down the market to analyse how Dry suburbs compared to Flooded suburbs when compared to the market average.

Naturally, the dryer suburbs were quicker to recover from this event and went on to outperform both the average and the flood-affected suburbs.

Interestingly, while the Flooded suburbs took longer to recover, they eventually surpassed the market average after 5 years.

Investing with certainty

Investing with certainty

Moving forward, how do you invest with confidence in this post-flood environment, and what are the lessons from the past?

From a macro perspective, start with the bigger picture, understand the driving factors for property prices and invest with greater economic and employment activity.

From a micro perspective, do not take any chances and only invest only in dry, flood-free, and stormwater-free locations.

The council provides flooding and overland flow reports free of charge and it simply must form a part of your due diligence process.

Do not compromise on this, it is just not worth it.

Once our team identifies a property with flood or stormwater flags, we instantly rule it out.

It is ok to buy in a flood-affected suburb, but head to higher ground.

Chris Eves studies highlighted that the well-located, more affluent areas were quicker to be repaired and return to normal, which saw the flood stigma removed quickly and prices followed.

Another reason why understanding wages and demographics are the keys to investing.

Conclusion

Coming off the back of the 2011 floods, property prices took anywhere from 12 months (dryer suburbs) to 54 months (flooded suburbs) to recover.

But at the time, the economy was in recovery mode after a GFC, with economic and very little jobs growth.

These conditions are in stark contrast to what we are seeing today, especially in Brisbane.

We have a huge number of jobs being created in our inner-ring suburbs and migration is now officially off the charts.

This is still creating a huge demand for property in our inner to middle-ring suburbs in a lower supply environment.

I would anticipate that in these types of dryer locations, the flooding will have little to no impact on property prices.

While history will show us that areas that are flood-affected will still recover, it will just take time and in this environment, likely less than before.

It emphasises that property should be a longer-term investment and time in the market, in the best possible locations, is much more important than getting the timing right.

The right time to invest is when you are ready, this should not hold you back.

Just be sure to take the necessary precautions and you can invest with confidence and get it right.

....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.