Virtually all of our major property markets experienced dramatic price rises during 2021, but the rate of growth is now starting to vary across our capital cities. Some housing markets are going into decline, while the rate of growth in others is accelerating. John Lindeman explains why this happens.

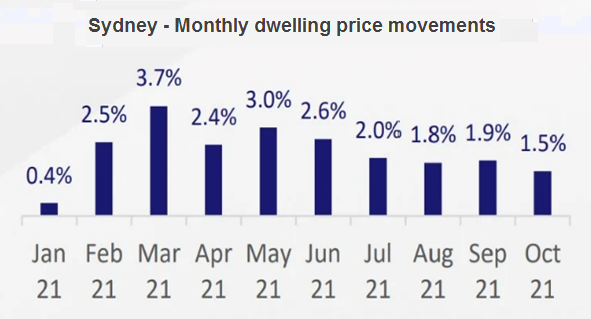

The recent price growth slowdown in Sydney, our most expensive housing market has prompted some experts to view unaffordability as the probable cause.

Unaffordability is not the reason

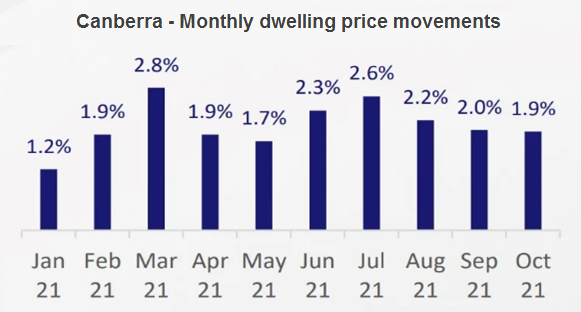

However, when we compare recent price growth in Sydney and Canberra, the nation’s two most expensive cities using CoreLogic’s dwelling price data, we see that housing prices in Canberra continue to rise at a monthly rate of around two percent, while growth in Sydney is declining. Clearly, affordability is not the culprit.

Small market size is not the cause either

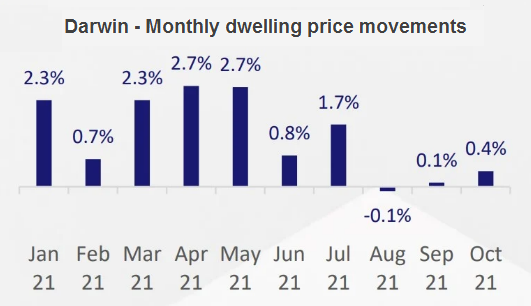

Other experts claim that it’s small market size that causes price volatility, because even tiny changes in buyer demand can lead to big changes in prices. However, CoreLogic’s dwelling price data for our two smallest capital cities by size, Hobart and Darwin, clearly shows that Darwin’s housing market has experienced far more volatility and even gone negative while Hobart continues to offer strong price growth to the city’s property owners.

Markets similar in price and size still behave differently from each other

Even when we compare price performance in capital cities with similar housing prices and population size such as Perth and Adelaide, we quickly discover that their performance can be very different. As the CoreLogic data shows, Perth’s housing market growth run appears to be over, while Adelaide’s is gaining strength.

If population or market size and affordability are not the causes of these price movements, what is behind them?

If population or market size and affordability are not the causes of these price movements, what is behind them?

The problem is that we are looking at the wrong causes. While market size and property prices obviously have an effect on demand, the real cause of price changes is the relationship of supply to demand.

As long as the supply of properties on the market is less than the demand for them, prices will rise. We can see this taking place in Adelaide and Brisbane. But, when the supply of properties for sale starts to exceed buyer demand, the rate of growth declines, as we see in Sydney and Perth.

So, performance is not about size or price, because property markets in cities with the same size and sale prices can behave very differently from each other. It’s all about the supply of properties compared to the demand for them.

Sources

Australian Demographic Trends, Australian Bureau of Statistics

CoreLogic published capital city housing prices

.................................................

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

Visit Lindeman Reports for more information.

He has well over fifteen years’ experience researching the nature and dynamics of the housing market at major data analysts.

John’s monthly column on housing market research featured in Australian Property Investor Magazine for over five years. He is a regular contributor to Your Investment Property Magazine and other property investment publications and e-newsletters such as Kevin Turners Real Estate Talk, Michael Yardney’s Property Update and Alan Kohler’s Eureka Report.

John also authored the landmark books for property investors, Mastering the Australian Housing Market, and Unlocking the Property Market, both published by Wileys.

To read more articles by John Lindeman, click here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.