There’s been a great deal of talk about whether repeated and prolonged lockdowns will impact housing prices, but the fact remains that the two “lockdown” cities have experienced recent price booms, while those with the weakest price performance have been lockdown free.

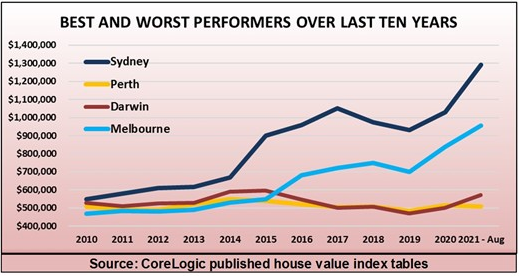

Since the onset of the COVID-19 virus with all those lockdowns and restrictions on movement and assembly, Sydney’s house price has grown by 25 per cent and Melbourne is up by 14 per cent. This graph shows the difference between the two best performing capital cities and the two worst performing cities, Perth and Darwin.

Note especially how the performance gap has widened in the last two years when Sydney and Melbourne suffered from repeated lockdowns, unlike Perth and Darwin.

So, if lockdowns have had any effect at all, it would seem to be the exact opposite of what most experts expected. The answer to this dilemma is that we shouldn’t be looking at lockdowns to explain housing market performance. This is because lockdowns and other restrictions have lowered both the number of properties listed for sale and the number being purchased - at the same rate. As a result, there has not been any significant change in the balance between potential seller and potential buyer numbers, and no net impact on prices.

This boom has been caused by cheap and easy housing finance

The housing market has been pumped almost everywhere in Australia over the last year by the availability of cheap and readily available housing finance. The banks have had access to huge amounts of newly minted money from Treasury Bonds issued at 0.1 per cent interest fixed for three years, while interest rates generally are at record lows..

When it became obvious that we weren’t going into a recession this year, the banks also lowered their floor rates (by which they measure your loan repayment capacity) by about two percent. This allowed more buyers to enter the market and gave them the ability to secure bigger home loans.

House price changes are all about changes in supply and demand

Early this year I predicted that cheap and easy housing finance would result in overall price growth of around twenty five per cent in 2021. (You can read my blog here). Naturally, some cities are doing better and others worse; it all depends on whether there’s enough housing supply to meet the growth in demand or not.

The lower price growth in Perth and Darwin is not related to the absence of the COVID-19 virus, but because there are sufficient properties available on the market to meet buyer demand. This could all change again in the future, but lockdowns won’t have any part to play in the outcome.

.................................................

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

Visit Lindeman Reports for more information.

He has well over fifteen years’ experience researching the nature and dynamics of the housing market at major data analysts.

John’s monthly column on housing market research featured in Australian Property Investor Magazine for over five years. He is a regular contributor to Your Investment Property Magazine and other property investment publications and e-newsletters such as Kevin Turners Real Estate Talk, Michael Yardney’s Property Update and Alan Kohler’s Eureka Report.

John also authored the landmark books for property investors, Mastering the Australian Housing Market, and Unlocking the Property Market, both published by Wileys.

To read more articles by John Lindeman, click here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.