In the five decades I have been involved in property, the role of investors has never been more scrutinised, and I have never seen as much of an "us versus them" mentality.

But amidst this debate, there's a critical aspect often overlooked: property investors are not the villains they're often made out to be. Instead, they're providing a vital service by housing a significant proportion of Australians who, for various reasons, either can't or don't want to buy their own homes.

Not everyone wants to be a homeowner

It's easy to assume that everyone aspires to own their slice of the Australian dream - the house with the picket fence. However, the reality is far more nuanced.

While home ownership has been a traditional goal for many Australians, a growing portion of the population is shifting away from this mindset.

According to a recent Australian Housing and Urban Research Institute (AHURI) report, only around 55.4% of private renters believe they will ever own property in Australia. For public renters, that figure drops to just 26%.

Even more telling is that 44% of public renters and 15% of private renters admit they don't ever expect to buy property.

This signals a significant shift in Australia, where the dream of owning a home is no longer seen as a given.

In fact, many Australians are recognising that renting offers them flexibility and lifestyle options that home ownership simply cannot.

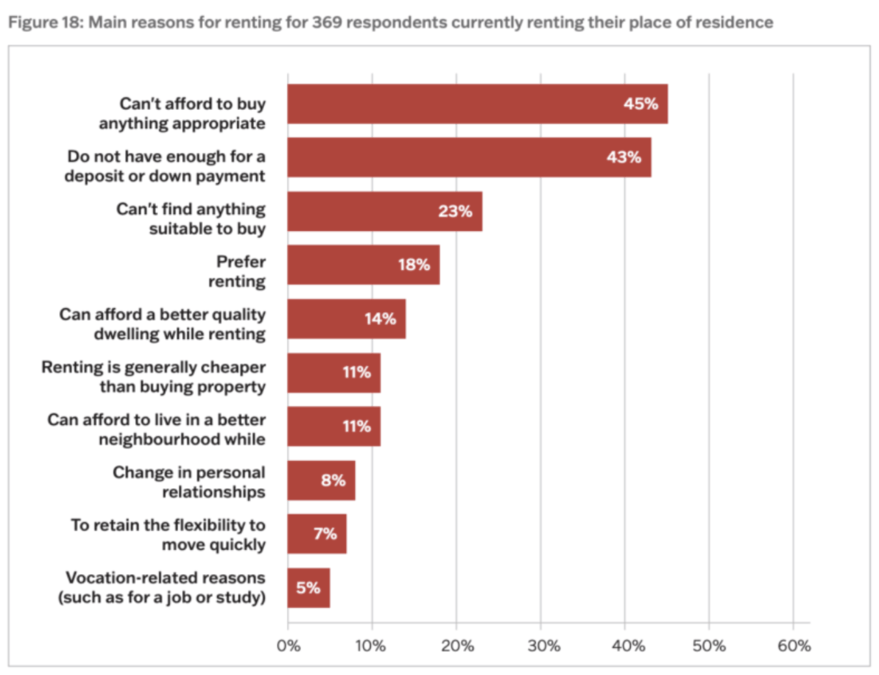

Financial constraints drive the decision to rent

While some renters may choose to rent for lifestyle reasons, the AHURI report makes it clear that financial factors are the primary motivator for most tenants.

Source: AHURI, Nov 2024

The findings in the chart above unmistakably show that not all tenants are keen to buy a home at present. This reinforces my comment that property investors provide an essential service for this significant portion of the Australian population.

- 23% were renting because they couldn't find anything suitable to buy at present

- 18% preferred renting to buying

- 14% found they could live in a better quality property when renting

- 11% found renting cheaper than buying

- 11% were renting in a better lifestyle location, and they could afford to buy

- 8% were renting because of a change in their personal relationships

- 7% were renting to retain flexibility

- 5% were renting for vocation-related reasons

Sure, the sample size was small, and if you add up the percentages, it suggests that many renters chose multiple reasons for investing. But the AHURI is a reputable organisation, and their study showed that many Australians are renting because they choose to, not because they have to.

Property investors as housing providers

Now, here's where property investors play a crucial role.

With a growing segment of Australians either unable or unwilling to buy a home, someone needs to provide housing. The government has been notably absent in filling this gap, especially with social housing falling short of demand.

This is where private landlords step in.

Property investors are effectively the residential property providers for millions of Australians. They offer homes to those who are not in a position to buy. Without them, the rental market would be in a dire state.

Yes, investing in property is a business decision, but it's also a service to a significant segment of the population that needs stable housing.

So stop picking on and demonising them!

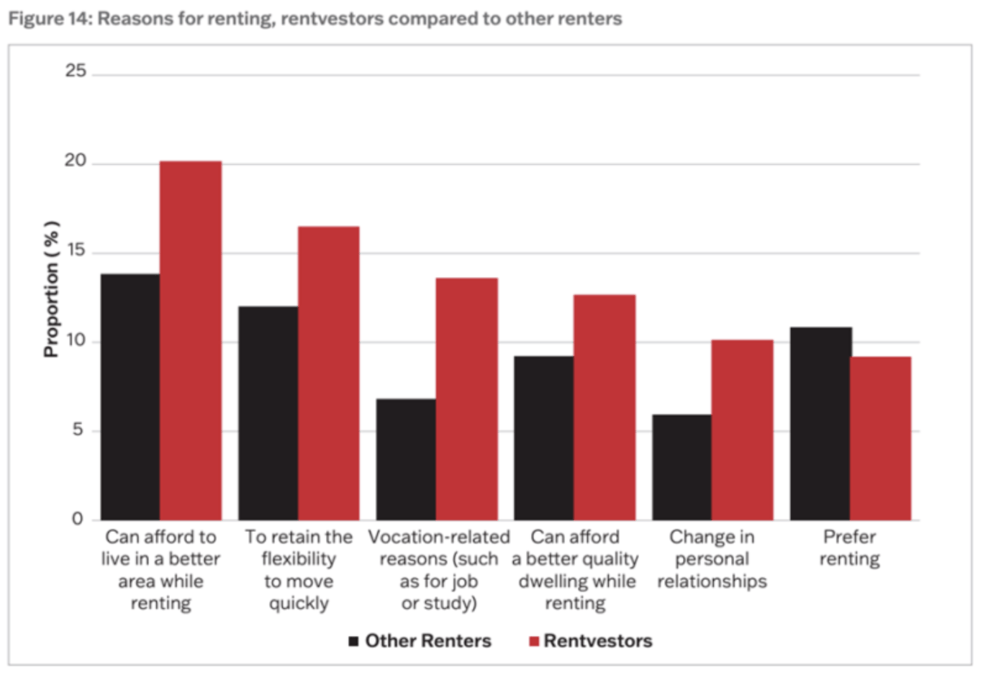

The rise of 'rentvestors'

Another interesting trend emerging from the AHURI research is the rise of rentvestors - people who rent the homes they live in while owning investment properties elsewhere.

These rentvestors are typically mid-career professionals with families, opting to rent for lifestyle reasons, such as living closer to work or in more desirable suburbs, while investing in properties that offer better returns elsewhere.

This trend challenges the traditional narrative that renting is purely a stepping stone to home ownership.

For rentvestors, renting is a conscious choice that allows them to leverage the benefits of property ownership without sacrificing their preferred lifestyle.

Source: AHURI, Nov 2024

The future of renting in Australia

So, where does this leave us?

The reality is that the Australian property landscape is changing.

With affordability barriers continuing to rise, renting is no longer just a temporary solution for young people saving up for their first home. It's becoming a longer-term option - even a lifestyle choice - for many Australians.

The AHURI report highlights that only half of Australians now believe they'll ever own a home. This shift in expectations and priorities means the demand for quality rental properties is only going to increase.

And who is best placed to provide that housing?

It's not the government, which has been slow to address the need for social and public housing.

It's the property investors who are willing to take on the risk and invest in the rental market.

Investors are part of the solution, not the problem

While it's easy to paint property investors as part of the housing affordability problem, the truth is they are a critical part of the solution.

By providing much-needed rental accommodation, they are filling a gap that the government and public housing sector cannot meet.

Yes, property investment is about building wealth, but it's also about providing a service. Without private landlords, where would the millions of Australians who can't or won't buy a home live?

In a country where the rental market is an essential and growing part of the housing system, investors are the unsung heroes, ensuring that people have roofs over their heads.

So, next time you hear someone bemoan the role of property investors, remember, they're offering a service that's more critical than ever in today's uncertain housing market.

And perhaps it's time we started appreciating the value they bring to the table.

Image by Freepik