It seems the combined value of all residential real estate in Australia is now over $9 trillion, from $8 trillion just five months ago.

Unlike previous booms, this one is being driven mainly by owner-occupiers, not investors.

In my mind, two factors have driven the current property boom.

There’s no doubt that lower interest rates have made it so much easier to afford a home.

If you think about it, if you can afford to pay $28,000 a year for your mortgage the banks will lend you $1 million.

But it’s more than that.

The pandemic has reminded us how important our homes are.

Now not only do we just sleep there. Now we eat there, watch TV and work out there and many of us work from home.

No wonder the market has become emotional about where we live – not just our home but also our neighbourhood.

But the regulators have also seemed to become emotional – they’re worried and the Australian Prudential Regulation Authority (APRA), the lending regulator, announced changes to lending rules for our banks.

They told banks and other authorised lenders that from November borrowers will need to be able to meet repayments at least 3 per cent higher than the loan product rate to receive a loan.

If, for example, you apply for a mortgage with an interest rate of 2.5 per cent, the bank must now assess that you will still be able to make repayments if the rate rises to 5.5 per cent – rather than the previous serviceability assumption of 5 per cent.

APRA’s decision reflects their growing concern that high-debt home loans among new borrowers could lead to financial instability.

But as you’re here in my chat today with Dr. Andrew Wilson, Australia’s leading housing economist, the justification for this intervention is paper-thin – once again!

And you’ll hear Andrew explain several of the other potential macro-prudential controls that APRA may introduce and one of them could well be higher interest rates for property investors.

Of course, APRA is yet again justifying interfering in housing markets on fears of higher interest rates – despite the RBA clearly and consistently pronouncing that rate will not rise until at least 2024.

And for interest rates to increase 3% above the current rate means the RBA would have to have 12 of the regular 0.25% increase rate hikes – now that’s really unlikely.

There’s lots of other property news to discuss this week so I look forward to my chat with, Dr. Andrew Wilson chief economist of My Housing Market in this week’s Property Insiders chat.

What should we do about the housing boom?

It seems like the regulators are aiming to gently apply the brakes to the housing market, rather than slam them on.

And interestingly the new 3 per cent buffer rate does not apply to non-bank lenders which could create a loophole for borrowers who want to enter the market before APRA includes them, possibly later this year.

Watch this week’s Property Insider video and you’ll hear us discuss:

- Why it’s likely there will be further macroprudential controls introduced.

- How APRA could consider raising interest rates for property investors.

- Despite the rising house prices in debt, overall repayments have fallen and there are very few delinquent mortgages.

- It’s going to be a delicate balance – we need consumer confidence and the wealth effect from rising home prices to kick start our economy.

- With a shortage of rental properties and rising rent, APRA should be encouraging property investors not discouraging them.

- How even though property prices have increased by around 20% this year, property prices have been flat overall since the previous peak in 2017, so the market is playing catch meaning over this property cycle average capital growth hasn’t been exceptional.

- The safest way to slow down rising house prices are house prices to keep rising – eventually, affordability issues kick in.

- The property market is working its way through the cycle with a lack of affordability naturally slowing capital growth over the last few months.

- Property values are likely to keep increasing for the next 3 years.

- Watch out for unintended consequences of macroprudential controls

Reserve Bank warns on ‘exuberance’

In its semi-annual Financial Stability Review, the Reserve Bank of Australia (RBA) said the banking system was generally sound and well capitalised, but a debt-fuelled surge in house prices needed to be watched.

“Higher prices have improved the financial resilience of existing indebted borrowers,” the RBA said in its 68-page update.

“However, there has been a build-up of systemic risks associated with high and rising household indebtedness.”

“Vulnerabilities could build further if housing market strength gives way to exuberance,” it added.

“Overall, there is only a small share of households and businesses that are both vulnerable to cash flow reductions and are heavily indebted. Lenders’ non-performing loan ratios are therefore expected to rise only modestly from currently very low levels.”

This week’s auction results – another weekend of strong auction results.

The first month of the spring weekend auction market is concluded with more remarkable results despite the burden of ongoing Covid restrictions in most capital cities.

Watch this week’s Property Insider video as we discuss how most Capitals continue to record generally strong results for sellers.

Sydney Auction Market

Record Sydney Spring auction market continues relentlessly.

Sydney’s booming weekend auction market continues to produce extraordinary results despite a surge in post-holiday listings at the weekend.

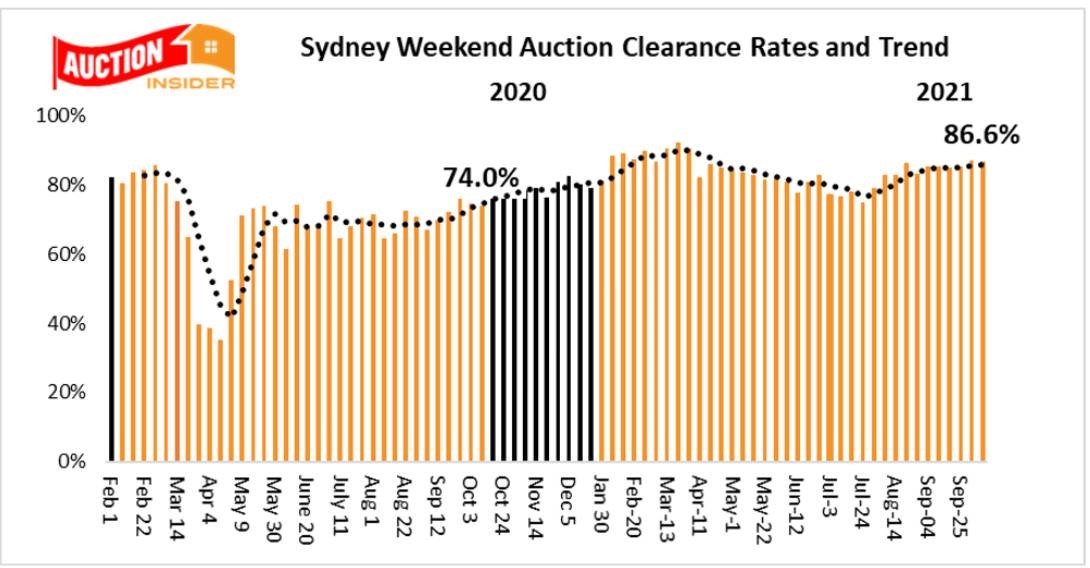

Sydney recorded another astonishing clearance rate of 86.6% on the weekend which was just below the previous weekend’s 87.1% and well ahead of the 74% recorded over the same weekend last year.

Sydney has now recorded 10 consecutive weekends with clearance rates above 80% and six straight weekends above 65%

The following chart from Dr. Andrew Wilson shows the Sydney auction clearance trend:

Melbourne Auction Market.

Melbourne auctions now surging as market rebounds.

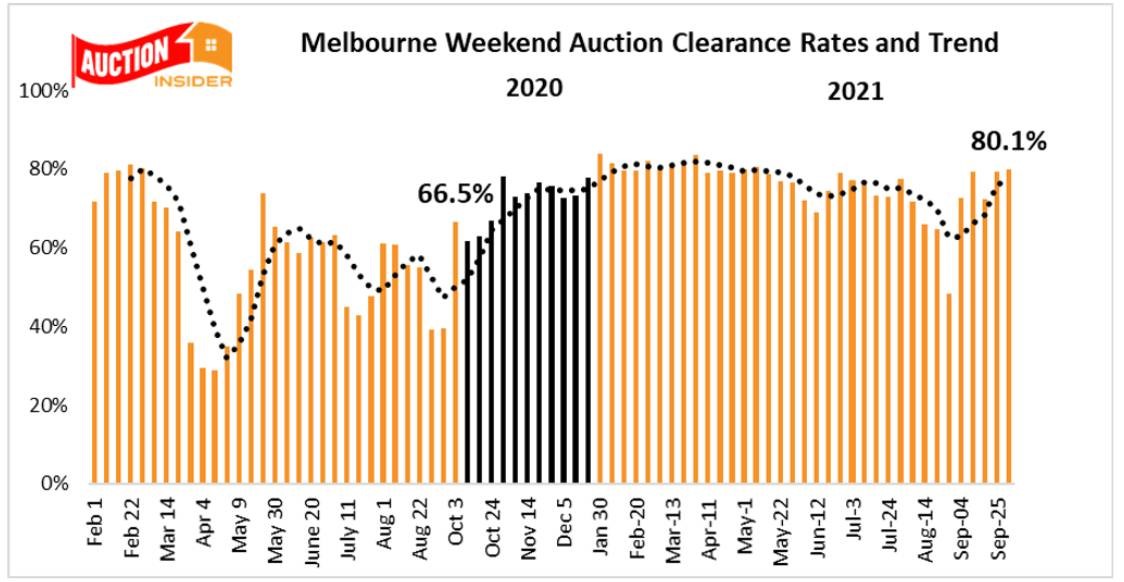

The recent easing of Covid property inspection restrictions has reactivated the Melbourne housing market with auction numbers now surging.

A wave of auctions at the weekend acted to push the clearance rate down providing buyers with significantly more choices – the most for seven weeks.

Melbourne recorded a clearance rate of 76.6% on Saturday which was lower than the previous weekend’s 80.1%, 61.7% recorded over the same weekend last year when the local market was still struggling with lockdown restrictions.

The easing of restrictions is now being reflected in consistently lower auction withdrawal levels with 12.9% reported the weekend, similar to the previous Saturday, and now will well below the withdrawal rate recorded throughout September.

932 homes were listed for auction at the weekend which was significantly higher than the 571 reported over the previous weekend and well ahead of the 57 auctioned over the same weekend last year.

The following chart from Dr. Andrew Wilson shows the Melbourne auction clearance trend:

..........................................................

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog and hosts the popular Michael Yardney Podcast.

Michael Yardney is a director of Metropole Property Strategists, which creates wealth for its clients through independent, unbiased property advice and advocacy. He is a best-selling author, one of Australia’s leading experts in wealth creation through property and writes the Property Update blog and hosts the popular Michael Yardney Podcast.