According the ATO there are just over 2 million property investors in Australia.

Looking at it simplistically for every 100 people:

• 16 own an investment property

• 84 don’t

Of the 16 that own a property investment, again, using the 100 people as the base, then:

• 76 had a rental loss (they negatively geared)

• 24 had a net rental profit

• 71 owned just one investment property

• 19 owned two properties

• 6 owned three properties

• 2 owned four properties

• 1 owned five properties

• 1 owned six or more investment properties

A new study has revealed the average number of investment properties currently held by Australian property investors.

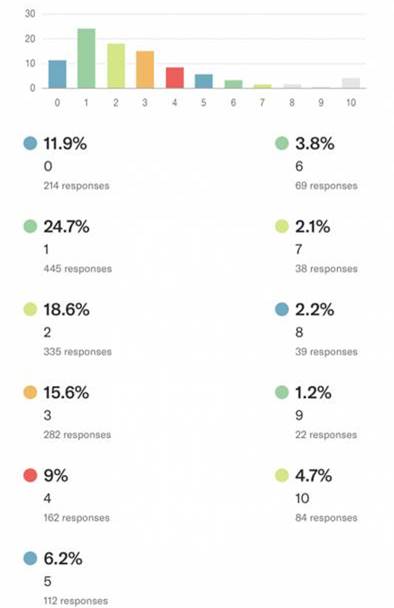

The 2018 Property Investor Sentiment Survey was conducted as a collaboration of Michael Yardney’s Michael Yardney’s Property Update, Your Investment Property magazine and onthehouse.com.au. 88% of respondents already own an investment property and 45% owned 3 or more properties. In fact 5% say they own 10 or more properties.

Clearly the ownership of "the 16%” differs from what the average Australian owns.

Now that’s not surprising – the survey subjects have an interest in real estate and many own a substantial property portfolio:-

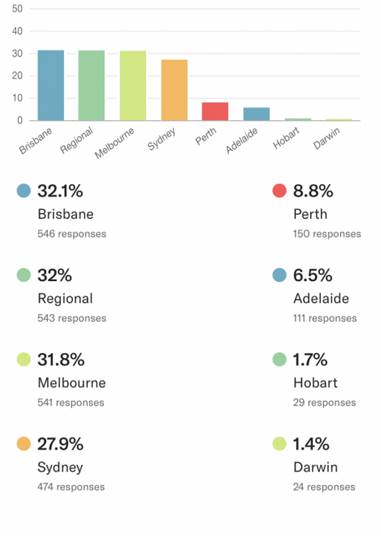

While the vast majority of respondents owned properties in our 3 big capital cities, almost a third own properties in regional Australlia:-

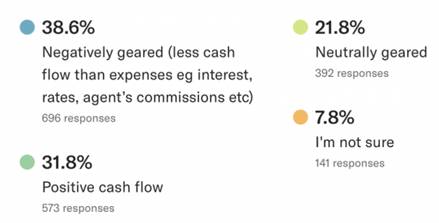

Despite the vast majority of these investors investing for capital growth, only 38.5% of investors held negatively geared properties suggesting that over time as rents increase, negatively geared properties become neutrally geared and eventually provide cash flow:-

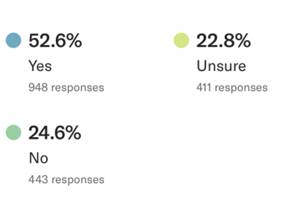

More than half of the respondents believe now is a good time to invest despite the fact that the vast majority of respondents (84%) believe that property prices will fall or remain flat over the next year. Clearly they are taking a long term view.

However this is significantly down from last year when 61% of respondents thought it was a good time to invest.

At the same time, the percentage that were unsure increased to 23% (up from 16% last year.):-

Finance is a problem for most.

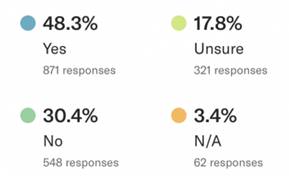

When asked if the recent changes in lending policies to investors has impacted their ability to purchase another property almost half of respondents said yes.

Interestingly this is only slightly higher this year (48%) than last year (46%).

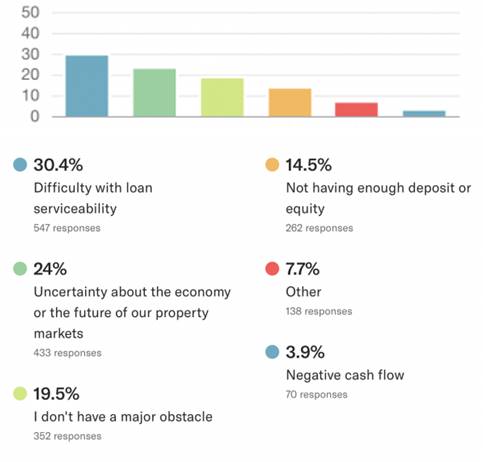

When asked what their biggest stumbling block to investing would be, here’s how the investors responded:

You can read the full survey results here.