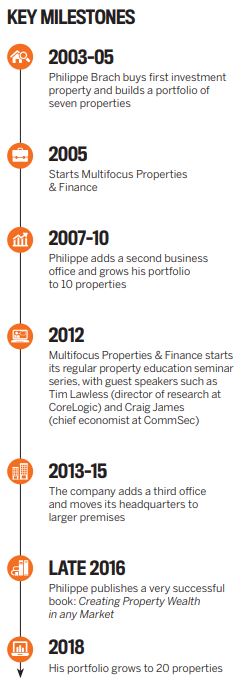

Since 2005, Multifocus Properties & Finance has been working to help clients invest in their own future and build lasting wealth through real estate. To find out more about the company’s data-driven approach to investment, Your Investment Property sat down with CEO Philippe Brach.

"One of the most common reasons people call us is because they realise their superannuation is never going to be enough for retirement"

Your Investment Property: How does Multifocus Properties & Finance work with clients to assess their finances and create goals?

Philippe Brach: Our approach is 100% driven by data; that’s how I run the business and that’s how I prepare strategies for clients. So it’s important for people to understand whether property investment is right for them before we start talking about properties.

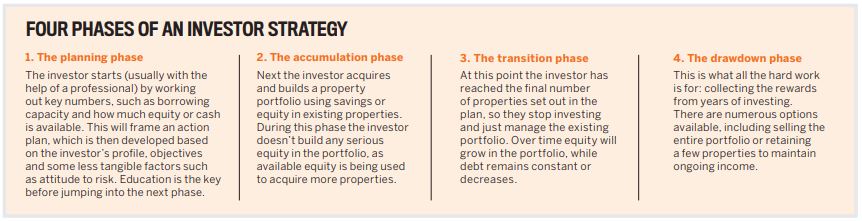

The first thing we do with any new client is analyse their personal situation and goals. What are their wider circumstances, assets, liabilities and income? Are they employed or self-employed? Do they have a spouse or kids? Once we’ve got this information and the relevant numbers have been crunched, the next step is to look at a long-term strategy, how the acquisitions will be structured, whether to draw on equity or cash for the deposit, and how to structure the investment loan to optimise cash flow and taxation.

After all of this is done, then we can start talking about which properties may suit the client. This is covered in detail in my popular book Creating Property Wealth in Any Market.

PB:

Most people realise this when they are in their mid-30s, but it’s not uncommon to have people in their 50s coming in with only $300,000 in superannuation.

Now, the investments that are readily available to us mere mortals are shares, properties and cash. You can think about cryptocurrency, gold and others, but for the most part cash, shares and properties are the most common options.

“Ultimately, you want to make sure you can cope with an unexpected economic situation that’s thrown your way”

The key is to have a balance so that you’re not overly reliant on one type, but one of property’s great strengths is that it offers particularly high potential for leverage and low price volatility. Leverage is great for people who are looking at accelerating wealth creation (to catch up with their retirement goals, for example), but it also comes with increased risks. So, low volatility helps. Property also tends to be a lot more comfortable psychologically for people; they are buying bricks and mortar, which are tangible.

click here to see enlarged image

YIP: What are some of the primary risks around investing in property, and how do you mitigate them?

PB:

The right location solves this and will generate capital growth too. Locations that are within commutable distance to a capital city’s CBD offer great opportunities, both for the investor and the tenant.

“Doing nothing is a major risk in itself,” says Philippe Brach on the risk versus rewards of investing in property to build wealth for retirement

“Doing nothing is a major risk in itself,” says Philippe Brach on the risk versus rewards of investing in property to build wealth for retirement

But in my mind the biggest risk is interest rates. It is the biggest expense by a factor of 10 and therefore has a major impact on your cash flow, especially if your leverage is high. So it’s crucial for any investor to have a clear understanding of what effect an increase in rates will have on their cash flow.

We provide our clients with 10-year projections to show them what happens in varying economic environments. It is then a matter of creating buffers to provide them with some peace of mind about what may lie ahead.

Last but not least, doing nothing is a major risk in itself. Given that the maximum single person’s government pension is just under $24k per annum or $36k for a couple, that should put things in perspective for your own retirement!

Ultimately, you want to make sure you can cope with an unexpected economic situation that’s thrown your way. With the right approach, you’ll be fine in the long term.

FOR 30% OFF RRP! Order online www.multifocus.com.au/yip-book-offer

ABOUT THE EXPERT

To find out more about how Multifocus Properties & Finance can help you meet your investment goals, visit www.multifocus.com.au