31/10/18

With so much information freely available these days, do you really need a property advisor? Are they just in it to make money for themselves and line their own pockets with investor commissions – or can they genuinely help everyday Australians create wealth?

In simple terms, a property investment advisor lays the foundation for your investment.

A property investment advisor should, before anything else, spend their time gaining an understanding of your personal considerations, obtaining a financial snapshot of your current situation, and openly discussing your individual objectives and circumstances.

The more someone spends their commercial time getting to know you and understand your needs, the more they should be able to then explain a cross-section of property investment strategies. Just as importantly, they should be able to demonstrate how each one would work towards helping you achieve your individual goals.

By detailing and balancing the pros and cons of each strategy and assisting you in assessing these impartially, they will be able to help you make an informed decision about the best next option for you.

You might start off with one particular strategy or pathway and evolve into more sophisticated ones over time. Equally, you may only ever need to focus on one strategy. The main goal is to not only understand the variety of options available but to also have them tailored to your individual circumstances.

This is crucial at the time of investment, as well as during the lifetime of your portfolio, to ensure there is flexibility to match your changing life circumstances so that your portfolio grows effectively with you over time.

The most important thing is that you are not working with someone who is a cookie-cutter advisor offering a one-size-fits-all strategy or history.

But how do you determine whether someone is an ethical and experienced professional property advisor – someone who has the potential to help you exponentially grow your wealth – as opposed to a ‘spruiker’ who is simply trying to flog you any old property to line their own pockets?

The big question is, how does the property investment advisor get paid?

With so much ‘free’ advice available (of varying quality), many investors are resistant to or reject the option of paying for advice, and prefer a product model in which no fees are charged.

Without having a business model that accommodates these clients, businesses are placed in a compromising position. Like advice offered by experts in any other industry – such as architects, doctors or mechanics – there is a considerable financial and time investment in education and ongoing development. To become a reputable expert and keep accreditations relevant, there is a commercial cost to providing such advice.

People don’t highly value what they get for free, so even when they receive free advice they don’t tend to follow it

Conversely, it’s an unfortunate aspect of human nature that people don’t highly value what they get for free, so even when they receive free ‘advice’ they don’t tend to follow or implement it. In essence, while they have saved you the cost of paid and qualified advice, they have actually lost, because the advice they went with wasn’t held in any regard.

Every week I speak to a vast number of people who enquire about our services, wanting to understand what we do and what our fee structure is. There are a consistent number of people who want a service but who do not wish to pay anything for it.

At We Find Houses, we have an independent standalone property investment advice service that comprehensively educates clients on the varied property investment pathways. We explain the fundamentals of property and financial markets, along with cash flow modelling of these options as they pertain to the client’s individual criteria, risk profile, budget and time frame. For this education, we charge a modest fixed fee.

We spend our time educating them about the difference between a free service and a paid service. However, it is a commercial reality that not being able to provide a service to these people is a lost commercial outcome in a market that is very competitive – and in which clients can easily fall victim to unscrupulous practices.

For those who are still seeking a free service, consider this: a reputable professional advisor will be able to help you clarify your investment strategy by taking into consideration your own individual circumstances, such as risk profile, desired outcome, time frame, budget, etc. A buyer’s agent then goes to the market to cherry-pick the right properties through a methodical process of research and market analysis that identifies locations and properties that are in line with your overall investment goals.

"Genuine property advisors are in the business of providing a professional service to clients, not flogging a property."

I constantly say that affordability is not an investment strategy. The analysing of data, research, identification and the due diligence process require access to multiple tools and many hours, which in the busy lives we all live now is a massive task. Therefore, many people are turning to the professionals as they would rather outsource the task well than pile it onto an already busy daily schedule.

This is where the true value of working with an accredited property advisor and buyer’s agent lies. Ask yourself: is it really worth missing out on an additional $50,000, $100,000 or more in capital growth on each property deal for the sake of haggling over a couple of thousand dollars in fees?

People will often make a big deal out of how much they were able to negotiate off the asking price. However, what is most important is the true value of the property, and the upside to you of securing the right property for your portfolio. If someone is asking $600,000 for a property worth $500,000, and the buyer negotiates $80,000 off the price, they are still paying too much. If the seller was asking $450,000 for the same property and the buyer paid above the asking price at $480,000, they are still getting a good buy.

How to spot a fake

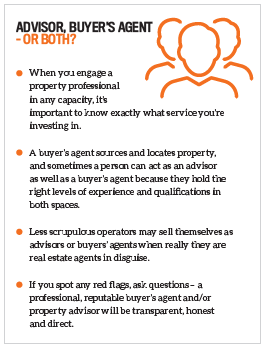

Property investment advisors should be focused on providing a professional, independent service to clients who engage their services. This is a very different role to that of a real estate sales agent who has a list of properties to sell and their only concern is whether a buyer can get the finance to fund the purchase.

Genuine property advisors are in the business of providing a professional service to clients, not flogging a property.

The reality of the situation is, the more information I know about a potential client, the more I can serve them and the more personalised we can be in the way we help them. Property investment advice should be independent; it should not involve the discussion of one strategy, one property or one location. The advisor should have extensive knowledge of the market, along with an educated knowledge of a diverse range of property markets, locations and property investment strategies.

Unfortunately, I hear horror stories every week that suggest the level of advice some businesses provide is wholly focused on whether the client can afford the property they want to sell. The service provider knows what properties they are going to pitch before they even know the name of the client. This is not a property advisor – this is a real estate agent dressed up as a property spruiker, and I can guarantee they have only their own best interests at heart.

Here is the bottom line: if a client wants independent advice and education, and the ability to assess independent data on locations, financial modelling and strategy, then they should expect to pay separately for such a service.

If ‘advice’ is being offered for free, or if the client wants advice but does not want to pay for it, then they need to understand that the cost of that advice and commercial time needs to be factored in somewhere. If it is done for free, then the amount of commercial time spent on providing that advice should be questioned – because, at the end of the day, everyone needs to pay the bills. If you’re not paying them, who is?

Similarly, with a buyer’s agent’s service, along with their comprehensive knowledge of location, there is a considerable investment of their time in research, negotiation of the deal, conducting of due diligence, settlement of the property, as well as referrals to qualified and reputable property managers, solicitors, landlord and property insurers and quantity surveyors. All of the services the buyer’s agent provides are designed to protect your interests and your investment. They bring to the role years of hands-on experience and knowledge of property markets, an unemotional perspective during negotiations, and an impartial assessment of the pros and cons of a particular property in line with the strategy you have chosen to follow.

And yes, all of this comes at a price. If it doesn’t, again you should be asking: how are they making a living if they are providing advice without getting paid by you?

As reputable property advisors and buyers’ agents, we operate with a high degree of transparency in all our dealings with clients, particularly when it comes to fee structure. We have a fixed buyer’s agency fee structure that is dependent on the type of property purchased, and not tied to the value of the property. For the majority of our clients we are locating existing/established properties; the fee for this type of property is disclosed to the client before they commit to using our services, and again prior to buying a specific property, so it is factored into their decision-making process.

The flat fee is the maximum the client will pay. In some cases, as part of the negotiation process we have been able to obtain part of our buyer’s agency fee from the vendor or selling agent, then the fee our client pays is reduced by the same amount. We also offer a developer direct service for buyers whose strategies suit brand-new properties – in doing so we disclose that, in most cases, there is no fee at all payable by the client. More often than not, we can negotiate for the developer or vendor to cover our buyer’s agency fees for this type of property so that we don’t then double dip and also charge our client a fee. The reason the developer is happy to pay these fees is that they don’t have to spend an exorbitant amount on marketing and advertising.

Meanwhile, our clients don’t end up paying anything for our services, which ultimately cover researching the ideal investment location to suit their needs, price and terms negotiation, conducting due diligence, project management of the build, finance drawdowns, and pre-settlement handover inspections. Once you own the property, our service then extends to referrals to reputable property managers, landlord and property insurers, and quantity surveyors.

Our goal is to ensure your investment is supported and protected from the outset, and our approach results in a win-win outcome all round. This is an example of how the industry can work with optimal transparency and professionalism for the benefit of all involved.

Paul Wilson

is the founder of We Find Houses,

which provides investor education,

coaching and mentoring,

finance and buyer’s agent services.

Disclaimer: The advice contained in this article is for general information only and should not be taken as financial advice. Please make sure to speak to a qualified professional person before making any investment decision.