My husband and I would like to increase our property por tfolio with the dual purpose of growing our income and purchasing a bigger family home in the future.

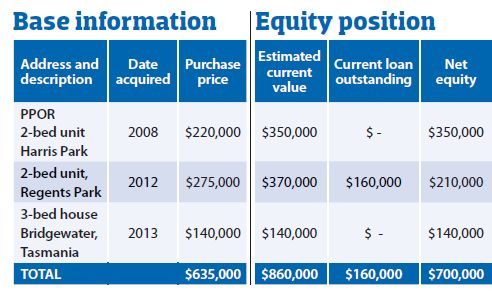

We live in Sydney and would love to stay in Sydney but I am concerned about being priced out of the market. We currently own three properties, all solely in my name:

- Two-bedroom unit in Harris Park (PPOR)

- Two-bedroom unit in Regents Park, NSW

- Three-bedroom house in Bridgewater, Tasmania

My husband earns roughly $40,000 pa in a permanent job and I have some casual work but not enough and not formal enough to be considered by banks for the purpose of servicing a loan. We also have about $20K in savings, and can save about $5,000 per month.

I'm stuck. I don’t really understand how to access equity in our exis ting properties – since they are in my name and I am not employed – but I really want to keep going.

Do we transfer the properties to my husband's name and refinance in order to free up cash to use for deposits for future properties?

What would you suggest?

Many thanks,

Britney

To help the team at Your Investment Property with this task, we enlisted the help of our resident investment coach, Brendan Kelly, director and coach, RESULTS Mentoring, to come up with a practical and actionable plan.

BRENDAN KELLY’S PLAN

Great property investors are greate problem solvers. And for Britney to achieve the investing success she's after, these problems will require solutions. Fortunately, solutions for her are not so hard to find.

Britney’s strengths

While exploring some of the different ways she could keep moving forward, Britney has a few things working in her favour.

- She's already paid off her primary place of residence (PPOR) as well as her Tasmanian investment property.

- Her Regents Park property has a 'loan to value ratio' (LVR) of under 45%. Fantastic!

Britney’s challenge

While the equity position is admirable, progress depends upon cash flow. And this is where Britney faces an uphill battle.

Banks generally will not lend money to people who can't demonstrate the ability to pay them back - and Britney's casual income does not make the grade, according to the bank she's seen.

In broad terms, it's suggested by lending institutions that up to approximately 30% of your gross household income can be applied to servicing debt before you might begin to feel symptoms of mortgage stress.

So, in order to understand how much the household might be able to borrow, let's do some calculations:

Britney’s husband’s income: $40,000 per annum.

Debt servicing: 30% of $40,000 =$12,000

This is the amount of money we might be able to dedicate to servicing debt without pushing any boundaries on lifestyle

Estimated amount they can borrow:

If we then take our $12,000 and divide by the current interest rate, you get:

$12,000 / 5.5% = $218,000

Given that the household has an existing debt of $160,000, this doesn’t leave much to go again.

Just $58,000!

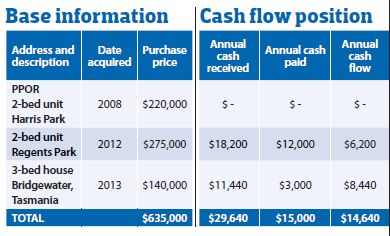

But what about the rental income?

Referring back to our lending institutions, it’s often accepted that 75% of the gross rental income can be directed to servicing debt. So let’s look at the rental income and expenses for the existing portfolio:

So if 75% of $29,500 = $22,125, then what might this dedicated funding allow us to borrow?

$22,125 divided by 5.5% = $402,000

$402,000= $29,000 x 0.75 /0.055

When looking at the table above, if we spend $22,125 on servicing debt, but only have $14,640 in positive cash flow, then we’d need to come up with an additional $7,485 every year to sustain their current lifestyle.

Fortunately, being able to save approximately $5,000 per month, Britney’s household will be able to comfortably cover any shortfall experienced by the additional servicing requirements.

So, if we now combine what we know, our total available borrowing becomes

$58,000 + $402,000 = $460,000

This means that the household could afford its next investment property: A house worth approximately $350,000!

Getting around the bank’s policy on Britney’s income

Britney’s dilemma is that the banks will not recognise her income, and she’s still thinking of buying property in her own name.

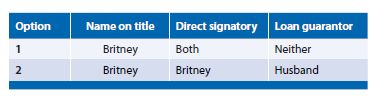

This problem is not as difficult as it might seem to solve. Because Britney is married and it’s her husband that is generating their living income, it is possible for Britney to purchase the property in her own name so that she alone is on the title, while both her and her husband appear in the loan documentation.

Does this mean that the value of our next purchase needs to be restricted to somewhere between $350,000 and $460,000?

Not necessarily. Remember our next property investment purchase will also attract a rental income.

Playing with the numbers and pushing boundaries, if we assume a rental income of just 5%, it means we’d be able to afford purchase price in excess of $1,000,00 with current interest rates of approx 5.5%.

$1,000,000 x 5% = $50,000 rent

75% of $50,000 = $37,500 directed for servicing debt

$37,500 divided by 5.5% = $680,000 of borrowing capacity

$680,000 + $460,000 = $1,140,000 worth of borrowing

Practically speaking though – it’s not often wise to push the borrowing capacity this hard. What it does mean, though, is that Britney can be confident that she’ll be able to go again.

Loan structuring

There’s more than one way to accomplish this. Here are two loan structuring options:

If Britney wanted to be the sole owner of the property, it would be possible for her to be the primary signatory of the loan, and have her husband as guarantor of the loan as additional security for getting the loan across the line. This would solve the dilemma of not being able to use her casual income, and still allow her to purchase in her own name should she want to continue to do so.

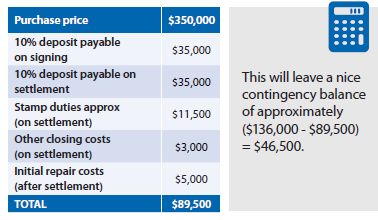

Seeing the possibility to go again, Britney’s next move might be to visit her bank and apply for an increase in the loan amount for her Regents Park property.

If she took her husband along as guarantor, she would be able to increase the debt against her Regents Parks property from $160,000 to $296,000 (80% LVR). This would allow Britney an amount of $136,000 that could sit in a redraw or line of credit facility until she needed it.

The $136,000 line of credit is sufficient to cover a 20% deposit, settlement costs, and some initial repairs should the property need it – with change!

For example:

Having established our funds for deposits and settlement costs by establishing our line of credit by drawing on existing equity, it’s time to consider our purchase and subsequent borrowing.

Once Britney has completed her due diligence, found the property in the area she wants that yields the outcome she’s after, she would go back to the bank armed with a current rental appraisal that would allow her to get a loan for $280,000 using 75% of the rental income dedicated to servicing debt, and her husband’s $40,000 income guarantor.

75% of this = $13,000 approx

Divide by 5.5% = $236,000 approx

Only a small portion of Britney’s husband’s salary needs to be attributed to servicing debt for her new property investment.

Frankly, there’s possibly enough in equity and borrowing capacity to buy a second one following the same approach. However, it’s important to note that these are simple broad calculations written to explore Britney’s options and possibilities. While the numbers show how very real and comfortable this option may be for Britney, the leg work still needs to be done to confirm that the path she actually wants to take will work for her prior to any exchange of contract.

Looking at the big picture

Stepping back for a moment though, there is more to Britney’s circumstances than just the need for funding to go again. There is a bigger picture we may need to consider.

Britney’s equity position is quite extraordinary for the time she’s been ‘playing the game’, and she has every right to stand proud on her fantastic accomplishments, however it would be wise for her to keep in mind the rate of growth in property prices we’ve observed over recent years is not sustainable.

If we consider units in Harris Park, for example, we can see that demand for property in the area is hot. By simply looking at median price movement, you’ll notice the unit growth averages about 4% over the long term. Last year it was 15%. Of that, in the last quarter alone, it was about 7%. Now is the time to enjoy riding this wave of growth.

However, if the average growth over 10 years is 4%, then while there are times in the market where growth is well above 4% (like right now!), there will be times in the market where prices are going to be well below 4%.

If we look similarly at houses in Bridgewater, the average 10-year growth is 10.9%. On the face of it, this is a more enticing location to consider investing into. However, last year Bridgewater suffered a median price movement of approx -21%! That said, there is currently some insignificant bounce back with a median price change of +4.6% in the three months leading into March 2014.

The point here is that property investing is all about creating equity in order to sustain a reliable income for retirement – whenever you choose that to be. While Britney is working very well at creating massive equity injections into her portfolio by riding waves of growth now, the trap for Britney having only experienced such great outcomes, is being lulled into a false assumption that such growth will continue forever. The consequence here is holding on to these properties for longer than is wise and finding herself in a market where median price movement reverts to negative numbers.

As a minimum, when she sees the median suburb values for those properties in her portfolio decline from their heady quarterly highs to just above annual averages, it might be time to further investigate suburb trends and seek qualified advice about what's happening in that market, and if necessary– be prepared to sell – and buy back into areas of pending significant growth.

Britney has done very well with her investing to date and has the right to stand proud. If she continues to apply herself and maintain her diligence, there will come a time when the concern for her casual job will become a thing of the past.

This feature is from the September issue of Your Investment Property Magazine. Download the issue to read more.