John and Jane are a couple with no dependants. Their household income is $140,000 per annum, and they are currently paying off their own home, as well as holding two investment properties in their SMSF. Most of their equity is tied up in the two investment properties, although they also have around $50,000 of available equity in their owner-occupied home, and $50,000 in savings.

The couple are interested to find out if they are able to purchase any more property outside of super by accessing equity in their super or home.

THE PLAYERS: JOHN AND JANE

INCOME: $140,000 pa combined

PORTFOLIO VALUE: $1,650,000

LOANS: $1,120,000

EQUITY: $50,000 CASH SAVINGS: $50,000

Initial assessment

John and Jane seem to be in a good position. They are paying off their own home, and have also managed to build some wealth through direct investment in property within their SMSF. Based on serviceability, their borrowing capacity is healthy, and they have a couple of options for coming up with the deposit. They are keen for the next property to be individually held, though wouldn’t be averse to tapping in to their SMSF equity to fund the deposit, if this were permissible.

Existing portfolio

A broker’s perspective

On paper, John and Jane look strong. They have built up plenty of equity across their three properties and manage their finances well, with little non-deductible debt other than the mortgage on their principal place of residence. Their borrowing capacity for a further purchase is a healthy $650,000. However, although they appear to have plenty of available equity, they may not have as much as they think. They can easily borrow up to 80% of the value of their home, minus any outstanding mortgage, which would give them $50,000 in equity release, as long as a bank valuation supports their estimated value.

However, within an SMSF the same rules of leverage do not apply, and they would not be able to leverage against their existing equity.

In terms of financial structure, they are fairly well set up, but I could make a few suggestions. Firstly, their cash savings are not currently offsetting their home loan, but are parked in a very low interest bearing account. Transferring this cash into an account that would offset their mortgage interest payments by 100% would be a good move and save them money. I would suggest they retain this cash in the short term as a buffer, and use any existing equity first in order to maintain maximum tax efficiency. Also, by reducing their SMSF mortgage payments to interest only, and putting any spare cash into an offset account against these mortgages, they could potentially build up enough cash over time to make a further purchase within their SMSF if they wished.

One further consideration would be ownership structure. As John is on a higher marginal rate of tax than Jane, a property in his name only would result in a slightly improved cash flow after negative gearing. Jane could still be a guarantor or co-borrower for the mortgage, which would help their capacity, and of course it would still be a joint matrimonial asset regardless of whose name appears on the title deed. I would suggest that John and Jane seek advice from an authorised person on which ownership structure would be best for them.

With an equity release of $50,000 for the deposit, plus funds to complete, their actual borrowing capacity is going to be a bit lower than their theoretical limit. With a 10% deposit, and allowing for sufficient funds to complete, the price range they should be looking at would be in the high $300,000s to low $400,000s bracket. A house and land package with a construction loan would offer significant stamp duty savings and therefore allow the purchase price to be a little higher. Equally, an off-the-plan purchase in Melbourne could also qualify for stamp duty exemptions and push their budget a little higher.

Suggestions

-Transfer their $50,000 savings into a 100% mortgage offset account

-Retain savings as in investment buffer

-Use equity as the deposit to maintain maximum tax efficiency

-Reduce SMSF loan payments to interest only to free up cash for deposit

Although John and Jane have a short-term goal of purchasing another investment property, they do not appear to have in place a specific long-term plan for financial independence. It is important to remember that the property is not the goal, it is merely the vehicle that will help them reach their long-term goals, and in order to be focused and directed in their acquisitions they need to have a good idea of what they are hoping to achieve through property.

Knowing what you want and when you want it is all part of a strategic approach to investing. Without this John and Jane could drift slowly in the right direction but never actually end up where they ideally would like to be. It also makes it much harder at any given time for them to review and confirm that they are on track to achieving their long-term goals.

The best strategy

The wonderful thing about property is that there are lots of ways you can use it as a vehicle to create wealth. For beginner investors, this advantage can appear to have the opposite effect and often leads to confusion. It is easy to get bogged down in the detail when there is too much choice, too much information, too much confusion. So it makes sense at the outset to devote some time to exploring the various strategies available, and choosing the one most suited to your risk profile, cash flow requirements, etc.

Although John and Jane do not have dependants, at the moment their lives are relatively hectic. Work and social commitments take up much of their time, and they do not have much spare time to devote to strategies that could be very demanding of their time. They are basically low risk, and are looking for an affordable investment that will pay for itself, go up in value over time, and not take up too much of their time. This rules out a number of options such as property development, structural renovations and land subdivisions.

I have always had a low-risk ‘set and forget’ strategy for my own portfolio that targets new properties and premium tenants, and I think it would suit their circumstances really well. As this strategy is very hands off, it means they can de-risk even further by building up a geographically diverse portfolio that will continue to perform well over time as the property markets go through their individual property cycles.

Build a team

John and Jane have made a good start to their property portfolio, and have already built up a useful amount of equity. Their initial purchases appear to be slightly random, so it could be more to do with luck than judgment that they have arrived in this fortunate position. Going forward, they would be wise to invest some time in building a support team around them in order to benefit from the expertise of others.

Professional service providers such as mortgage brokers, property managers and solicitors can play a key role in helping John and Jane reach their financial goals as quickly and easily as possible. A mentor is also critical to success. They need to find someone who has already achieved the kinds of results they are looking for, having used the same strategy as the one they have chosen. Just as you need the banks for financial leverage, leveraging from a more experienced investor is equally important in order to optimise your opportunities and fast-track your results.

Timing the market/where to buy

Generally speaking, any given area tends to be in one of four stages of the property cycle. It is either just about to enter a growth phase, or in a growth phase, nearing the peak, or in a correction phase.

Many less experienced investors tend to jump into a property market when there has already been substantial activity. This means they are often paying a premium and buying near the top of the market. This kind of investor needs to ‘see it before they believe it’, and this can result in poor decision-making. Typically, a doubling cycle, whether that be seven, eight, nine or even 10 years, tends to experience around three years of strong growth, with the remaining years of that particular cycle being much more subdued.

When buying close to the top of the property cycle there is a good chance that you will not see any significant growth in the first few years of ownership. Indeed, values may even drop in the short term. If you are relying on short-term growth to release equity to fund future purchases, buying at the wrong stage of the property cycle will mean it could take much longer for you to reach your financial goals.

Buying just before the growth phase is scary for less experienced investors because they are often investing in areas that have not experienced significant growth for an extended period. Yet if you can identify the known drivers of growth in that area, such as population growth, public and private infrastructure development, new job opportunities and a favourable supply/demand dynamic, the chances of short-term growth are much higher.

John and Jane also need to bear in mind that property growth has become less predictable in recent times. We have experienced unexpected volatility in some areas that no one had predicted, and other areas have remained flat for much longer than we would normally have expected. Other areas have completely fallen off a cliff and any recovery in these markets could be a very long way off. In order to minimise risk and stay within their stated low-risk profile, John and Jane need to stick to the capital cities and largest regional centres. Large populations and diverse economic bases translate into less volatility. The old adage ‘safety in numbers’ definitely applies here.

So John and Jane need to focus on the main cities that are at the right stage of the property cycle, but they also need geographic diversity to further de-risk their portfolio. Properties in their current portfolio are all in the same state, and indeed the same region. If this area continues to do well, their asset base will perform well, but when the area enters a slower phase the effect is compounded, and could mean years of no growth across their whole portfolio. Taking advantage of great opportunities in other areas with unsynchronised cycles means that at any given time they should have at least some of their portfolio showing strong growth, even when other areas are having a bit of a rest.

What to buy

Just as there are many different strategies available to the investor, there are also a range of different properties available – new and old, houses and apartments, with huge price differences separating the most expensive from the least expensive. Capital growth will largely depend on resale demand, so it makes sense to purchase properties that will appeal to the largest number of potential buyers.

If you purchase a well-built property in a blue-chip area and spend between $400,000 and $500,000, you should end up with a quality growth asset.

These are what I would term ‘standard’ properties and would appeal to both investors and owner-occupiers, who make up the greatest number of purchasers in the given price range.

However, there are a number of investment opportunities available that I would term ‘niche’ products, and these should be avoided.

-Student accommodation

-Studios

-Serviced apartments

-Retirement villages

The specifics

John and Jane currently only have exposure to the NSW market. As this market has experienced a strong growth phase in recent years, they have done well, which is reflected in the equity they have built up in their properties. However, even the strongest of markets cannot continue to outperform the average indefinitely, and the next few years are likely to see a marked slowdown.

Getting exposure to new areas that are countercyclical to the Sydney market would be a good strategic move, both complementing and de-risking their current portfolio. Targeting other areas interstate would bring other benefits, such as paying less land tax, and tapping in to areas with higher gross yields, meaning better cash flows.

TIP

Getting exposure to new areas that are countercyclical to the Sydney market would be a good strategic move , both complementing and de-risking their current portfolio.

Our broker has given a price range from the high $300,000s to the low $400,000s, based on a deposit of $50,000 taken from an equity release.

Based on John and Jane’s current situation, I think Southeast Queensland would be a good place to start their research. After experiencing a fairly protracted period of slow growth, properties there are very affordable, particularly compared with those in Sydney and Melbourne, and going forward they should perform steadily. There is certainly potential for localised oversupply, particularly of apartments in certain inner-city suburbs, but careful research will highlight the areas that need to be avoided. The suburb of Newstead would be an example of where not to buy, as the current underlying demand will not be able to absorb the pipeline supply in the short term in the coming years.

For their budget a house and land package in the Western Growth Corridor would be a good choice. The City of Ipswich is at the heart of the Western Growth Corridor of Brisbane, and Ipswich LGA has a projected average annual growth rate of 3.1% compared to the Queensland average of 1.9%. The average purchase price for a new house in the western corridor is $355,000, compared to the $430,000 Queensland average and $569,000 in neighbouring Brisbane.

House and land packages in new estates are only a short drive from major employment generators such as the Amberley RAAF base (5,000 jobs), Amberley Aerospace (3,500 jobs), and the Ipswich Riverheart Urban Renewal project (with a capacity for over 49,000 jobs). In fact, by 2031 up to 76,000 jobs are expected to be created in the area, increasing the total workforce of Ipswich LGA to around 143,000. Infrastructure development includes a $2.85bn Ipswich Motorway upgrade, a $1bn Ipswich City Centre Urban Renewal project, a $154m upgrade to the Orion Shopping Centre, a $130m expansion to Ipswich Hospital, and a massive upgrade of the RAAF base at Amberley.

Source: CoreLogic RP Data, February 2016

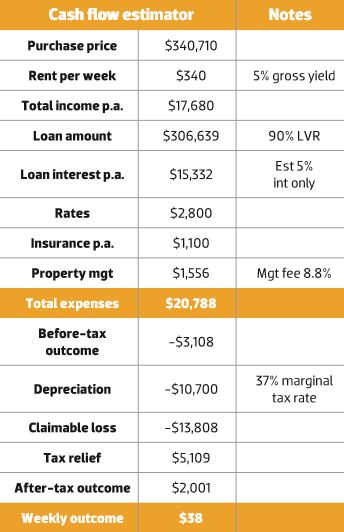

PROPERTY EXAMPLE 1

House and land package LOT 621, IPSWICH, QLD $340,710

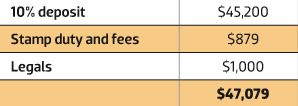

Buying costs

Assuming a 90% loan-to-value ratio, John and Jane will require a deposit of just over $34,000. Other funds to complete will include stamp duty on the land component (around $3,000), plus transfer and mortgage duty, as well as conveyancing. The total upfront cost will come in at just under $40,000 – well within their $50,000 maximum.

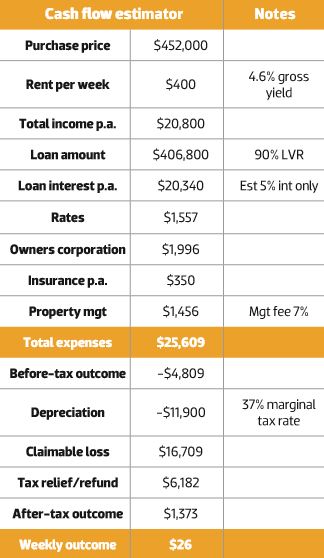

As an alternative, John and Jane may wish to consider an off-the-plan apartment in Melbourne. I have just purchased one for my own portfolio in the inner-northern suburb of Moonee Ponds, approximately 6km from the CBD. Melbourne has been voted the world’s most liveable city for the past five years (Global Liveability Ranking), and is predicted to grow to become Australia’s largest city by 2055, with a population of 8.1 million.

At almost 3% annual economic growth, Victoria outperformed both NSW and Queensland in the year to May 2015. Melbourne’s median annual apartment growth of 5.1% over the past decade is even higher than Sydney’s, yet in spite of this Melbourne remains considerably more affordable. In addition, stamp duty savings significantly reduce buying costs. For example, for a $500,000 off-the-plan purchase, stamp duty payable in NSW would be $17,990, and in Queensland $15,925. In Victoria, for the same value apartment, you would pay less than $1,000 ($879 to be exact).

The reasons I chose to invest in Moonee Ponds are numerous. To start with, 90% of residential land in the suburb is zoned ‘neighbourhood’ – the most protective residential zoning, with higher density only allowed near the train station and commercial hub. Forecast population growth is stronger than in neighbouring suburbs, yet the median apartment price is lower, and there is also less supply. Growth in median rents for one- and two-bedroom apartments in the suburb have increased by over 6% per annum over the past decade. In terms of convenience, WalkScore.com gives my apartment a rating of 98, which is extremely high and means that dining, groceries, shopping, errands, parks, schools and entertainment are all on your doorstep.

PROPERTY EXAMPLE 2

MOONEE PONDS VIC

Off the plan: $452,000

1 bed, 1 bath +parking

Buying costs

John and Jane are in a strong position and can definitely afford to buy another property to add to their existing portfolio. However, much of their equity is tied up in SMSF-owned properties, and therefore is not available to fund future purchases. They do have cash, but this would be better utilised as a ‘buffer’, and retained in a 100% offset account in order to reduce non-deductible mortgage payments.

Based on a valuation of their own home that supports their estimated value, they will be able to release sufficient equity to afford a quality property in a good growth area, which will attract a premium tenant and give them great tax benefits, and hopefully years of trouble-free ownership and long-term capital growth.

In the short term I would encourage them to put some time aside to think about why they are investing and what they hope to achieve in the long term. It is important to have a specific timeframe and financial goal, otherwise it is difficult to ever know whether your property investing is actually on track.

I believe that John and Jane are in a position to build a substantial portfolio in the coming years, as long as they are focused and buy well-researched properties in good locations. Geographic diversity should continue to be one of their strategies to de-risk their portfolio, and choosing different styles of property according to the requirements of their target tenant is also an important consideration. If they stick to these basic guiding principles, completely devoid of emotion, I believe they will do very well, and wish them the very best of luck on their property journey.

.JPG)