Victorian resident Kristian Palumbo and his partner are keen to get into the property market while interest rates are still low. So what’s the best option for these first-time investors?

There are two things many parents discover when they have their first child. Firstly, it is the scariest and most exciting experience of their life. Secondly, kids can cost a lot of money.

Indeed, when you factor in accommodation, education, food, clothes, and entertainment (often right up until they decide to fly the nest), dollars can really start to add up.

Thankfully for Kristian and his partner (who will be planning to have kids over the next few years), they realise this and are getting on the front foot. In essence, there are two key goals they want to achieve through property investing.

“Our long-term goal is to create a passive income to ensure a healthy and easy way of life for when kids come around,” he says. “Our short-term goal is to get into the property game while interest rates are low.”

Ideally, they would like to achieve their long-term goal within the next 10 years.

They are currently paying off their principal place of residence (PPOR) in Thomastown, Victoria, but are willing to invest anywhere in Australia.

“My main reason for investing is because of how quickly property prices are going up, and I don’t want to miss the boat,” Kristian says.

With $35,000 in savings and an annual household income of $125,000, they are in a healthy financial position. However, at the moment they have no investment properties besides their own home.

“We only have the house we live in at the moment, but are planning to move into something bigger in the next three years."

As many first-time investors have realised, there is a lot to learn when you first start investing. Consequently, Kristian and his partner could benefit greatly from getting advice from somebody who has done it all before. This is where our expert, David Brewster, comes in.

Age: 27

Occupation: Construction worker

Marital status: Partner of six years

Existing properties: Only their PPOR

Annual household income: $125,000

Total amount in savings:$35,000

Total amount in debt: About $300,000 left on current property

Total amount in equity: $500,000 (combined)

Goals

Invest in property while interest rates are low. Create a passive income to ensure a healthy and easy way of life for when they decide to have children

The game plan

"When considering a game plan for Kristian, I wanted to look at a strategy that would not only give the opportunity to create cash flow over a 10-year timeframe and upgrade the family home, but also provide a substantial nest egg and income for retirement. So together with Arthur Vlanes, senior planner and fellow director of Financial Planning Direct, we came up with the following scenario."

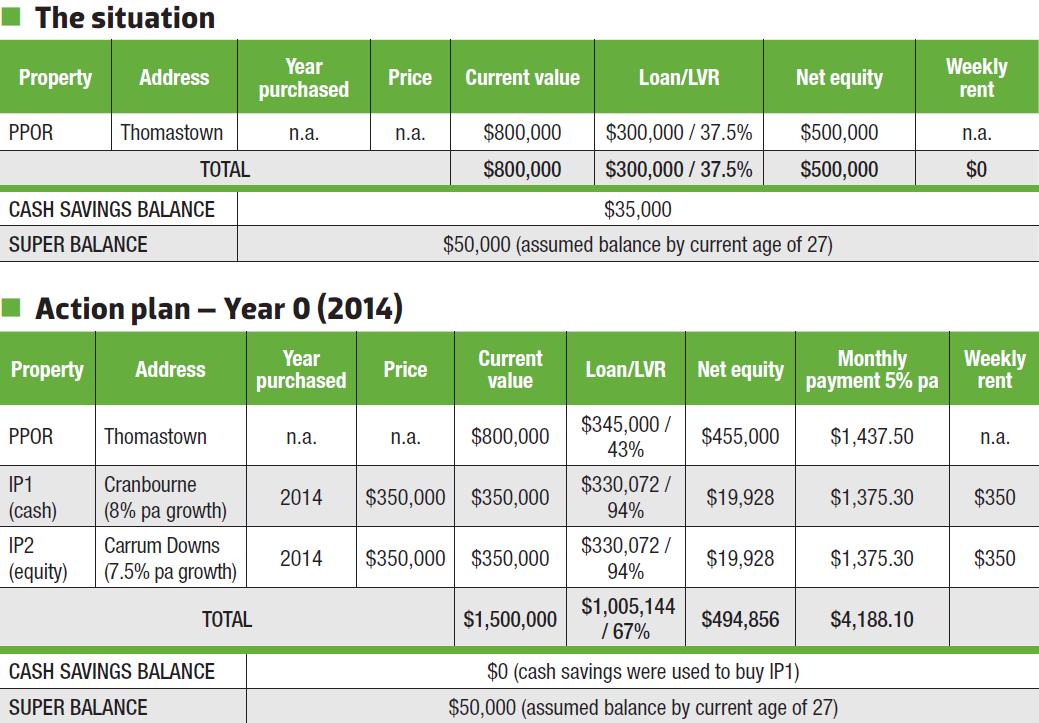

Assessing the situation

Let's take a look at the number.

Kristian and his partner have a wonderful equity position, with a solid household income and a nice savings base to work with. they currently have no dependants, which gives them an impressive borrowing capacity; however, it will be important not to overload them as they plan to start a family and purchase a new PPOR. you will notice that we will also start keeping track of their super balance, as this will eventually become an option down the track and will help achieve a passive income for their longer-term retirement plans.

(Click to enlarge)

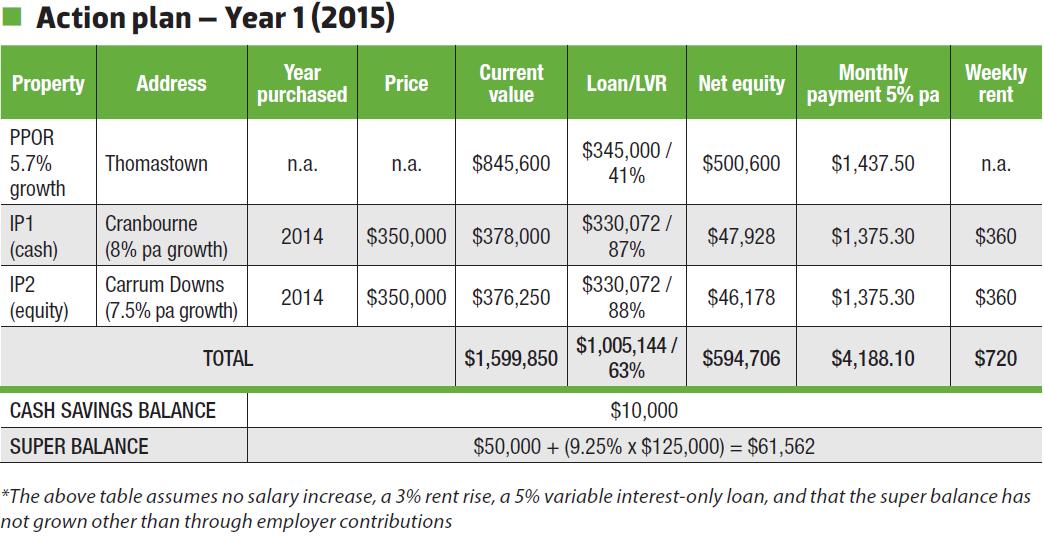

Action plan - Year 0 (2014)

- Kristian's current PPOR has a fantastic equity position, providing him with immediate funds to begin investing in property without the need to save for an additional cash deposit.

- Convert the current PPOR to an interest-only loan (and/or refinance if a better rate can be secured). This is not Kristian's end residence, so there is no point paying further principal. right now, it is more important for Kristian to have cash flow for his investment activity, and he will find the monthly budget is boosted by over #300 per week (assuming a 5% 30-year variable loan).

- Release $45,000 enquity from this PPOR by increasing the LVR to 80% (which would avoid paying lenders mortgage insurance (LMI) on the PPOR). The equity funds should be released into a separate redraw account against the PPOR. This account will now cover stamp duty and the deposit, and top up the cash savings portion to fund this first purchases.

- Purchase investment property #1 using equity from the PPOR:

- $350,000 for a three-bed townhouse/villa in a high-growth location (eg Cranbourne) that has an average growth of 8%

- 10% deposit + approx. $5,000 stamp duty

- Finance: 5% per annum variable interest-only to maximise cash flow. LVR=90% with LMI capitalised into the loan.

- Purchase investment property #2 using $35,000 in savings and $5,000 in equity funds.

- $350,000 for a three-bed townhouse/villa in a high-growth location (eg Carrum Downs) that has an average growth of 7.5%.

- Install the same finance structure.

- This will be a holding year for Kristian, in which no additional properties are purchased; however, there is still much that will be achieved. Each of his properties, including his PPOR, will have 12 months of growth. Likewise, he will have another 12 months to restore his cash savings, which he has already demonstrated he has the ability to achieve. With a solid income of $125,000, and the first two properties positively geared and contributing $100 plus per week, we believe a balance of $10,000 is achievable by Year 1.

- Kristian’s super balance will also hae received another 12 months of contributions.

(Click to enlarge)

Action plan – Year 2 (2016)

- Kristian's first two investment properties have grown in value and increased in equity. While we could top up the LVR to the original 90%, this would incur another LMI fee. In Year 2 we are looking to purchase another investment property, and will again use equity ($45,000) in his PPOR to fund the deposit/stamp duty.

- Kristian’s super balance will have received another 12 months of contributions. Again, we take into consideration the growth of his managed fund, which is very likely to be higher than the value shown in the table.

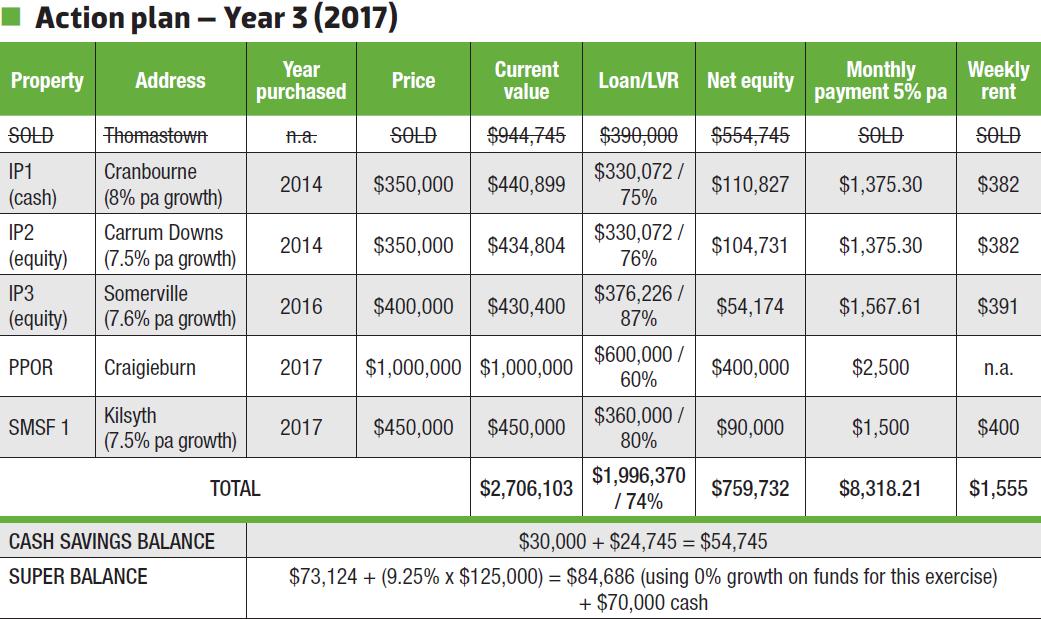

- Year 3 is the game changer for Kristian, with significant changes to his property portfolio.

- The need to purchase a new, larger family home requires him to sell his current PPOR, which he does for the forecast market value. After paying off his mortgage, he has $554,745 in cash. This will be used as follows:

- $70,000 super cash contribution

- $60,000 new PPOR stamp duty and costs

- $400,000 new PPOR deposit

- He will purchase a larger family home for $1m, taking advantage of the next suburbs to the north, such as Epping and Craigieburn, where a house and land package will offer substantially better value for money. Another alternative is for Kristian to purchase another established home in Thomastown but use his personal construction skills to add value to his new PPOR. His new PPOR will require $55,000 in stamp duty costs, and the remainder of his cash equity will be used for the deposit. It will be important to have a second offset account attached to this mortgage, with all rental income and tax savings paid into this account, reducing the interest payable on his PPOR, which is non-tax-deductible. It is important that this offset account is separate to the original redraw account so that interest payments on the investment properties are quarantined.

- Kristian’s super balance has now grown to almost $85,000, and will be boosted by a $70,000 cash injection to be a very healthy $150,000 plus. This could make him suitable for establishing a self-managed super fund, but it will be vital that he receives professional advice from a financial planner. Property may be a suitable asset for his investment strategy, and he could easily purchase a $450,000 dwelling with a 20% deposit and stamp duty/purchase costs. The remaining money could be used to cover the establishment/admin costs of the funds, and also to secure cash or shares to diversify his investment portfolio. Again, he would be guided by his financial planner.

- The remaining $24,745 could be used to pay down investment #1; or be held in an offset account to use for children’s expenses; or be combined with cash savings to purchase investment #4. Due to his new home purchase and desire to have children, we recommend Kristian keep this money as a buffer for upcoming expenses, leaving it in his offset account to reduce interest. The compounding effect of the offset account holding monthly rental income, plus his cash lump sum, will help pay down his new PPOR faster.

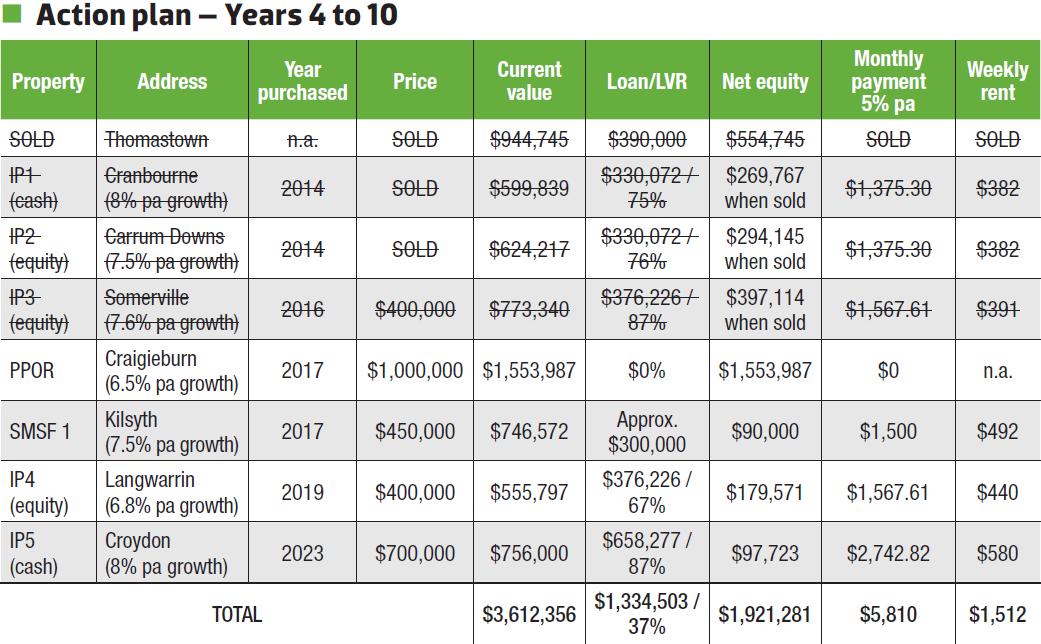

Action plan – Years 4 to 10

Year 4 (2018): Holding year.

Year 5 (2019): Purchase investment property #4 using the Year 2 strategy, releasing equity from his new PPOR in Craigieburn.

Year 6 (2020): Holding year.

Year 7 (2021): Sell investment property #1 as deductions will be slowing down; but, more importantly, use profits to reduce the PPOR mortgage.

Year 8 (2022): Sell investment property #2; use profits to reduce the PPOR mortgage. It is also presumed that the kid(s) will be approaching school age, therefore some of the investment sale profits could be set aside in the offset account for these expenses.

Year 9 (2023): Sell investment property #3 as deductions will be petering out, then purchase a new investment property with a cash deposit using those

profits and cash savings.

Year 10 (2024): Forecast for Year 10 is shown in the table below.

Summary

- Achieved purchase of multiple investment properties while the market was strong and funds cheaper.

- Achieved the purchase of a new family home in Year 3.

- Secured cash buffer for children’s expenses (sitting in offset account).

- Super property paid off in approx. 17 years, due to continued employer contributions, $5,000 per annum salary sacrifice, and rental income.

- Provided with tax-free passive funds come retirement, and ensured that he is control of his superannuation.

- Portfolio will be worth over $3.6m at Year 10.

The coach:

The coach:

David Brewster

David Brewster became one of the founding directors of Buy Property Direct in 2006. Having worked in real estate for over a decade, including owning and managing two agencies, David has extensive experience and expertise in property investing.

This feature is from the October issue of Your Investment Property Magazine. Download the issue to read more!