Fear of the unknown is confining many investors to the residential market. However, the reality is that commercial real estate is nothing to be afraid of. In fact there are some truths that may well blow you out of the water. Alastair Lynn sets out to shed a little light on the murky world of commercial property

The world of commercial property is unfamiliar territory for many investors. The vast majority of the population enters home ownership at some point in their life, and it makes sense to stick to what you know. The average person on the street is likely to have at least a basic understanding of the residential property market, and this is what makes it such a popular option. However, in the current property climate, residential may not be the only or the best way to go

With prices becoming so high in the residential market, investors are very likely to have negatively geared property. Colliers head of investment sales Matthew Meynell says jumping onto the commercial bandwagon will help diversify your investments.

“Residential historically may get a net return of circa 2–2.5% on investment once you take out all costs. With commercial historically the return on investment sits between 6% and 9%,” he says.

“For people who like to have a diverse portfolio it makes a lot of commercial sense to include commercial property. You look at your sovereign pension funds, superannuation funds, large institutions; the majority of investments are weighted towards commercial because of the bulk and scale.”

As it stands, Australian commercial property is delivering favourable returns against the global property market. The latest Property Council/IPD Australia All Property Index pointed to a 10.6% return in 2014, and a rise of 10% was reported for the September quarter. This is the highest return since June 2012. The strengthening in return performance reflects the ongoing compression in capitalisation rates, which is reflected in stronger capital returns.

However, despite this, the thriving commercial market is relatively untapped. Savills valuation and consultancy director Brett Schultz says a lack of education in commercial investing is steering inexperienced investors away from this path.

“People are scared of it and they tend not to invest in it because they don’t understand the intricacies of certainasset classes and markets,” he says.

“Land is basically indestructible. Fixed in supply, they don’t make any more of it, and that’s why it goes up in value. There are some really good suburbs for commercial properties, and over the long term they’re going to do very, very well.”

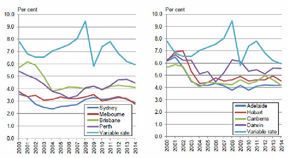

National office yield vs 10-year government bond rate

Variable interest rate and indicative rental yields by capital city: houses

The ins and outs of the commercial world

The reality is that there are many opportunities to create positive cash flow through commercial investing. A wide variety of options await potential investors, and diversifying your portfolio can be a very beneficial move to mitigate risk. The numbers are higher, both in terms of entry costs and net returns.

While the idea of commercial property may instantly provoke thoughts of high-rise offices or mass distribution plants, Meynell says there are ample opportunities for the average residential investor. “We see a lot of mum and dad investors, whether that’s in the CBD or in more city-fringe marketplaces,” he says.

“People always need commercial space to work from. When they start off they might be paying $500,000 per strata investment, the tenant might be there on a three-year lease, and the yield might be up to 8%.”

The commercial market is not only reserved for billionaire property tycoons. Lower-scale investments can be found, and investors can reap the rewards. One positive of investing in commercial over residential property is the lease. Commercial properties typically have leases lasting upwards of two years.

“You have three-, four-, five-, seven-, 15-year terms in commercial property, whereas in residential you normally have 12-month terms,” says Schultz.

“As long as the tenant stays in place and continues to pay the rent month in, month out, it’s a very attractive attribute to have in an asset.”

Meynell says the value of commercial property is built around the strength of the covenant with the tenant.

“The longer the lease, the tighter the yield,” he says.

“If you bought a property with a two-year tenant, it might yield 8%; if you bought a property with a 15-year lease, it might be 5%. You are de-risking your investment because you have a rental guarantee.”

Unfortunately, risk is one thing that is also higher in commercial property. Where finding a new tenant for a residential property can take a matter of days, a commercial property could be sitting empty for months.

“The thing with commercial property is the value is only there when it’s producing income,” says Schultz.

“If you’ve got a building and it becomes obsolete, or there’s competition in that area that makes it secondary, then all of a sudden your income will lessen. If it becomes vacant and you find it hard to re-lease it, then the fundamentals of that property have been eroded and the value will go backwards.”

How to avoid the pitfalls

The commercial market, just like residential, has its ups and downs. While they are both wildly different, they can also be very similar.

“Anybody looking to branch out of residential should adopt very similar metrics to buy,” says Meynell.

“Investing in commercial property is similar to residential; you look for things such as proximity to amenities. You’d look to be near public transport, education, schools and the central business district.”

Sticking to major cities or industrial areas is also must for any would-be commercial investor.

“You would be necessarily wary of buying in a regional town, because if you don’t live and know that market it can become more risky. In a Melbourne or Sydney CBD, for example, there is less risk because there is more population density.”

Meynell says research is key to finding a good commercial investment property, and this begins with sourcing good advice.

“People can do their research quite thoroughly. Find a trusted advisor, whether it’s someone in property, their lawyer or accountant. They need to get some advice and make sure they know what they’re doing.”

It pays to be wise with your investments. Mitigating risk plays a significant part in developing a successful portfolio. As a way of achieving this, current trends are pointing towards a multipronged approach.

“We’ve seen a lot of people buy free-standing property that has one or two or three tenants,” says Meynell. “In a perfect investment scenario, someone may look to buy a three-level investment with a restaurant on the bottom, a commercial in the middle, and a residential on the top level; therefore they have multiple income streams. That gives you a chance to de-risk the investment, where for one residential unit you’ve only got one tenant.”

Types of commercial property

Retail

Retail doesn’t have to be limited to huge shopping complexes or malls. The local strip can often provide a wide variety of smaller but by no means less profitable investment options. Finding an appealing area with good exposure, good parking and easy access is key. Competition for quality retail assets is strong. Beachfront or village-style centres often provide highly sought-after properties.

Office

The office investment market saw another record year in 2014, with over $17bn worth of product traded. Whether running a small start-up business or managing a series of interoperational departments, companies will always need office space. Over the past five years there has been a considerable surge in demand for strata offices. Costing anything from $136,000 upwards, these properties can provide multiple income streams, thus de-risking your investments.

Industrial

From the bloke who fits a new alternator in your car to the company developing machines that make fridges, these businesses all need warehouses, workshops and depots. Due to the unique nature of industrial businesses, these properties can range from small to large, with a variety of purpose-built features. Construction of industrial property tends to be faster and simpler than it is for other commercial developments, typically reducing the fluctuations between supply and demand. Yields tend to be higher than for other commercial properties, and growth is tied directly to the economy.

Car parks

Car parks in the city are always in high demand. Whether it’s a 500-space Wilsons parking building, a small lot downtown, or even a single space in an apartment block, space is being snapped up. This can be an easy way to hold a lower-cost property while waiting for capital gain.

Storage

Storage provides a wide range of investment opportunities, essentially based on the size of the storage facility. On a small scale, storage units are a popular option. Low maintenance costs coupled with growing demand makes this an appealing option for the savvy investor. On a larger scale, the demand for logistics and distribution centres is on the rise in Australia. Due to the need to adapt to the ever-changing world of e-commerce, companies are looking to claim their stake in rail, road and port hubs.

Returns by sector

Spotlight on car parks

Parking their cars is not something people generally put a lot of thought into. That is, until they can’t find a car park. With over 13 million registered private cars in Australia and almost two out of three people driving to work daily, competition for that tiny slab of concrete can be fierce.

In comparison to finding a car park, owning one can be quite carefree. Car parks tend to have low vacancy rates, and due to their scarcity can be excellent cash flow investments. However, if your thoughts immediately drift towards large multistorey parking buildings, try thinking smaller. The demand for single car parks is on the rise, and although they may measure in at less than 3sqm, they are for sale.

Findacarpark.com.au founder Francis Armstrong says car parks are a low-cost, effective way to develop an income.

“Name me a property as an asset class that you can buy for around $50,000,” he says.

“Supply has been shrinking, and demand has been increasing in the last 10 years. If you bought a car park as an investment, it’s not difficult to get a tenant. Conditional that your car park is in a good location, you always get demand.”

Parking in the inner city in areas like Sydney or Melbourne can be expensive. Even with commercial parking, rates are around $50–$60 a day. Although many of Australia’s commercial hubs have a variety of public transport, for many this is not a viable option.

“It’s not like our public transport compares with cities like Tokyo, New York, London, where if you work in the city you can get away with using public transport. A lot of people that require car parks drive not because they want to but because they have to.”

As long as a car park is in a good location, it is likely it will be highly sought after.

Buy and walk away

One of the major benefits of owning a car park is that, unlike residential property, once it is bought, there is very little to do in terms of maintenance.

“If you own an apartment as an investment, you’re most likely to give it to a real estate agent to manage because of issues with damage and maintenance. With a car park there is no maintenance, absolutely zero,” says Francis Armstrong, founder of Findacarpark.com.au.

“The worst you can get is an oil leak on the concrete, which you can fix with a $5 degreaser. You also don’t need a real estate agent, so you save on management fees.” Another positive is that the market for car parks is very stable, while offering high rental yields.

“In terms of yields, there wouldn’t be any property asset class right now that would match it. In NSW in the last 10 years we’re looking a 7% yield, around about 9% in Victoria, and double digits in Queensland, and it’s been like that for 10 years.”

However, don’t be fooled into thinking that there are no extra costs involved. State governments have different rules and regulations around parking spaces. Depending on the location, levies can cost anywhere between $800 and $1,340. Regardless, as long as you do your research, car parks can be a very profitable investment option.