What an incredible 12 months for our property markets around the country?

Amazingly, you could have purchased a property anywhere a year ago and you would have made money.

On the surface every property looks good in a rising market, but how well have you really done?

This is something we work with our clients to understand on an annual basis with a Property Portfolio review.

These annual reviews encompass many things - finance, interest rates, and rent, but most importantly how the property has performed.

Perhaps the biggest thing that blew us away this year during the reviews, was the level of growth our clients have received when compared to the averages.

I thought I would take this opportunity to show you what we have been buying and the above-average, wealth-producing rates of return our clients have been receiving.

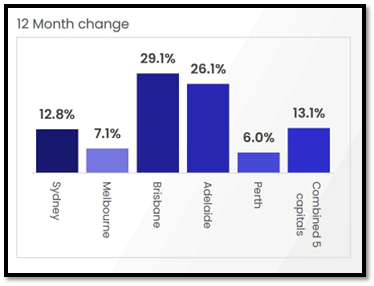

The Averages

When assessing the performance of your assets, it is important to have a benchmark to compare them to.

As recent figures highlight, it has been Brisbane that has led the way over the last year, closely followed by Adelaide and then Sydney Melbourne, and Perth.

As Property Strategists, we never try to predict what will happen to our markets over any period of time.

What we can advise though, are the areas that will perform better in the good times and hold their own in the downturns.

Just like there is not one Australian Property Market, I would also argue that there is not one Brisbane real estate market or one Sydney housing market.

As Property Strategists our job is to find the best suburbs and then the best pockets and streets within those suburbs.

To highlight this point, here are some of the great properties we have purchased for our clients this year.

Melbourne

The Melbourne property market has not performed as strongly as other areas, with a little over 7% growth in the past 12 months.

But by applying our strict investment-grade fundamentals, we were able to far exceed the benchmark.

We secured an amazing Townhouse in the gentrifying suburb of Bentleigh East, that performed significantly better than the averages.

We very rarely buy brand new properties, but in this case, we were able to find a unique off-market opportunity where we were able to avoid unnecessary commissions and kickbacks.

The property has been architecturally designed, with quality finishes, and is in the highly desirable Mackinnon School catchment zone.

The property was purchased 12 months earlier for $1.4mil and 12 months later was revalued at $1.625mil, an increase of 16% which was more than double the Melbourne average.

Sydney

The Sydney market performed strongly with almost 13% growth over the last year.

Home Buyers would also understand that it was incredibly difficult to get anything near perfect for under the $1mil mark.

Our Sydney team managed to find this amazing apartment in Randwick, off-market - really pre-market prior to an upcoming Auction campaign.

These older-style blocks are in smaller complexes and have much larger living spaces making them highly sought after.

The property also has amazing walkability to the new light rail, Coogee Beach, the Uni, and Hospital, with a great school catchment.

We thought it was a great buy last year for $950,000 and with a 21% increase, it is an even better buy now being revalued at $1.15million.

Needless to say, our Home Buyer clients were very happy!

Brisbane

There is no doubt that the Brisbane market has been the hottest market around the country with almost 30% growth.

By only selecting A grade locations and the best streets, once again, we were able to outperform that average substantially.

A great example of this was a house purchase for our client in Tarragindi last year for $743,000.

Another off-market purchase by the team less than 6km from the Brisbane CBD was purchased at the same as a block of land in a nearby street.

Fast forward to our client review and they now have a value of $1.05mil, an astonishing 41% growth in only 12 months.

11% growth may not sound huge, but this additional amount was the difference in allowing our client to refinance and buy again.

This has been a common theme for many house buyers this year, but it doesn’t stop there.

Brisbane Town House purchase

Our Townhouse buyers also saw the market take off recently to achieve some amazing results.

This 3 bedroom Townhouse is Camp Hill, sitting on 300sqm saw 46% growth over the last 18 months.

Brisbane properties with development potential

By far the best result we have seen for our clients in Brisbane is for those that have purchased a property with the potential to develop.

This property in Mount Gravatt, just 10km from Brisbane was purchased for $761,000 last year and today it was revalued at $1.125 after a nearby sale.

At 48% growth, that is fast approaching a 50% gain with a little more market movement over the last 12 months.

In Summary

How has your property performed over the last 12 months?

It is important to review your property's performance on a regular basis.

Benchmarking against the average for your location can be a great starting point.

Ensuring you are achieving above-average results, it will allow you to get into your next property faster and grow your wealth faster.

Some investors make the mistake of thinking their property is not costing them anything despite very low growth - with the rent covering the mortgage they claim “At least is not costing me anything”

In reality, the opportunity costs could be hundreds of thousands of dollars.

Do you have a proven system, framework, and strategy to achieve above-average rates of return, or prefer to take a guesswork approach?

.....................................................

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

Brett Warren is a director of Metropole Properties in Brisbane and uses his 18 plus years property investment experience and economics education to advise clients how to build their portfolios.

He is a regular commentator for Michael Yardney's Property Update.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.