Expert Advice with Simon Pressley 23/07/2018

If you thought that Australian property markets were all doom and gloom, think again. Double-digit price growth was produced for one in every eight locations across Australia over the last 12 months.

Our research shows that the median house price increased by 10 per cent or better in 12 per cent of Australia over the year ending April 2018.

The property markets of 550 city councils spread across our 8 states and territories is akin to the stock exchange for Australia’s property markets. 67 out of 550 had double-digit growth.

The property markets of 16 out of Greater-Melbourne’s 31 city councils produced double-digit price growth. These were predominantly in the outer parts of Melbourne where housing is more affordable. Hume (25%), Whittlesea (23%), Cardinia (21%), Nillumbik and Casey (both 19 per cent) were the biggest winners.

Interestingly, 45 of the 67 locations that produced double-digit price growth are located outside of Australia’s 8 capital cities.

24 of the 27 locations in New South Wales where the median house price grew by more than 10 per cent last year are in the regions.

The median house price in Uralla in regional New South Wales increased by 24.1 per cent last year. A typical house in the New England region is still an affordable $367,000.

We’ve been saying for quite some time that the outlook for many parts of regional Australia is increasingly better than most capital city markets.

Employment growth in some of Australia’s regions is strong, especially in tourism, health, agriculture and specialised manufacturing. The mining sector is also showing a strong recovery.

Victoria had the biggest representation of double-digit price growth with 28 locations, of which 12 were regional locations.

Tasmania had 7 locations; 4 of these are within Greater-Hobart, currently Australia’s hottest property market.

South Australia was also well represented with 3 of its 4 locations also in the regions.

The median house price in Roebourne (Karratha) in Western Australia increased by 13.5 per cent while Queensland didn’t have any locations on the list of double-digit growth.

Locations don’t produce double-digit growth very often. Several capital cities still haven’t seen it since before the GFC. The strongest growth cycle unfolding right now is in strategically-chosen regional locations.

The Asian Century is real, it’s having a positive impact in key industries and this is flowing through to certain property markets, including regional Australia. The opportunities are significant, and we are only nineteen years in to it.

Local confidence and job growth increases demand for housing. Our buyer’s agents have already seen the positivity within regional communities flow through to property prices.

The research also shows that 45 of the 67 city councils with double-digit price growth still have a median house price below $600,000.

Regional Australia has housing affordability in spades. The median house price is still under $350,000 in strong growth locations such as Berri, Cooma-Monaro, Coffs Harbour, Forbes, Lithgow, Launceston, and Muswellbrook.

|

Double-Digit Price Growth [YE April 2018] |

|||||

|

Hume VIC * |

$ 566,000 |

25.0% |

Newcastle NSW |

$ 640,000 |

12.6% |

|

Uralla NSW |

$ 367,000 |

24.1% |

Glenelg VIC |

$ 195,000 |

12.5% |

|

Whittlesea VIC * |

$ 625,000 |

23.0% |

Wentworth NSW |

$ 272,500 |

12.5% |

|

Cardinia VIC * |

$ 535,000 |

20.9% |

Berri & Barmera SA |

$ 191,500 |

12.3% |

|

Dorset TAS |

$ 220,000 |

20.0% |

Eurobodalla NSW |

$ 510,000 |

12.2% |

|

Nillumbik VIC * |

$ 780,000 |

19.3% |

Launceston TAS |

$ 307,000 |

12.0% |

|

Casey VIC * |

$ 620,000 |

19.0% |

Kyogle NSW |

$ 300,000 |

11.8% |

|

Snowy River NSW |

$ 495,000 |

18.9% |

Bega Valley NSW |

$ 470,000 |

11.8% |

|

Melton VIC * |

$ 505,000 |

18.4% |

Burnside SA * |

$ 960,000 |

11.7% |

|

Cooma-Monaro NSW |

$ 320,500 |

18.4% |

Lithgow NSW |

$ 342,000 |

11.7% |

|

Grant SA |

$ 275,000 |

18.0% |

Glamorgan TAS |

$ 411,000 |

11.6% |

|

Berrigan NSW |

$ 238,750 |

17.7% |

Port Augusta SA |

$ 195,000 |

11.4% |

|

Glenorchy TAS * |

$ 376,000 |

17.3% |

Bass Coast VIC |

$ 418,000 |

11.3% |

|

Wyndham VIC * |

$ 560,000 |

17.2% |

Macedon Ranges VIC |

$ 550,000 |

11.2% |

|

Mitchell VIC |

$ 430,000 |

15.9% |

Mornington Peninsula VIC * |

$ 781,000 |

11.2% |

|

Kingborough TAS * |

$ 576,600 |

15.7% |

Golden Plains VIC |

$ 445,000 |

11.2% |

|

Palerang NSW |

$ 727,500 |

15.6% |

Queanbeyan NSW |

$ 665,000 |

11.2% |

|

Gloucester NSW |

$ 286,000 |

15.5% |

Knox VIC * |

$ 801,000 |

11.1% |

|

Dungog NSW |

$ 420,000 |

15.5% |

Tweed NSW |

$ 650,000 |

11.1% |

|

Wellington NSW |

$ 193,750 |

15.4% |

Dandenong VIC * |

$ 700,000 |

11.1% |

|

Auburn NSW * |

$ 985,000 |

15.0% |

Murrindindi VIC |

$ 980,000 |

11.0% |

|

Forbes NSW |

$ 260,000 |

14.8% |

Coffs Harbour NSW |

$ 342,500 |

11.1% |

|

Sorrell TAS * |

$ 357,500 |

14.8% |

Inverell NSW |

$ 270,000 |

11.0% |

|

Moreland VIC * |

$ 887,500 |

14.7% |

Colac-Otway VIC |

$ 325,000 |

10.9% |

|

Baw Baw VIC |

$ 405,500 |

14.7% |

Darebin VIC * |

$ 997,500 |

10.9% |

|

Melbourne VIC * |

$1,180,000 |

14.6% |

Muswellbrook NSW |

$ 300,000 |

10.7% |

|

Yarra Ranges VIC * |

$ 685,227 |

14.2% |

Indigo NSW |

$ 307,000 |

10.5% |

|

Brimbank VIC * |

$ 654,000 |

14.1% |

Moorabool VIC |

$ 432,250 |

10.5% |

|

Frankston VIC * |

$ 625,000 |

13.9% |

Taree NSW |

$ 396,000 |

10.5% |

|

Roebourne WA |

$ 353,000 |

13.5% |

Wyong NSW * |

$ 590,000 |

10.2% |

|

Hobart TAS * |

$ 690,000 |

13.3% |

Strathbogie VIC |

$ 307,500 |

10.1% |

|

Shoalhaven NSW |

$ 575,000 |

13.2% |

Corangamite VIC |

$ 191,250 |

10.1% |

|

Kiama NSW |

$ 991,000 |

13.1% |

Gosford NSW * |

$ 800,000 |

10.0% |

|

Geelong VIC |

$ 522,000 |

13.0% |

|

|

|

|

SOURCE: CoreLogic. Analysis of Australia’s 550 city councils as at end of April 2018 (more than 100 dwellings sold over 12 months) |

|||||

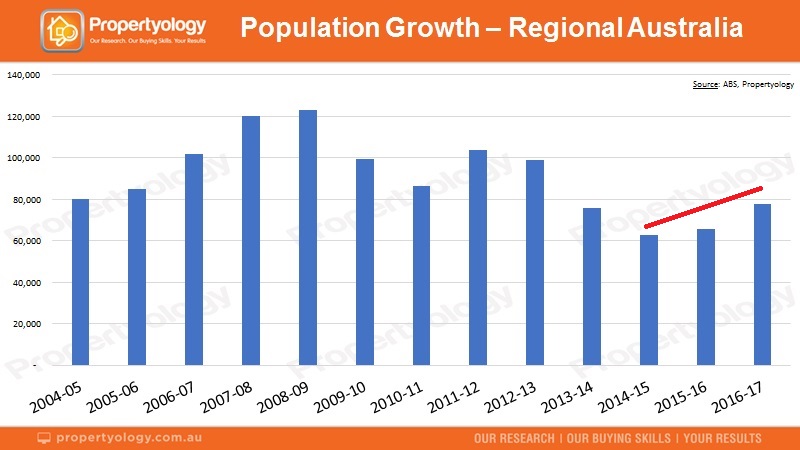

Propertyology research shows that, in addition to significantly improved economic conditions, regional locations are attracting migration from people moving away from capital cities.

The population of regional Australia increased by 7,740 people over the 2017 financial year. That’s comparable to a city the size of Port Macquarie - Australia’s 29th largest city – in just one year.

In addition to the 67 city councils where the median house price increased by at least 10 per cent, another 64 locations increased by 7.2 per cent or more. 7.2 per cent is the average growth rate required for an asset to double in value over 10 years.

......................................................................

Simon Pressley is Head of Property Market Research and Managing Director at Propertyology.

Simon Pressley is Head of Property Market Research and Managing Director at Propertyology.

Propertyology is a national property market researcher and buyer’s agency, helping everyday people to invest in strategically-chosen locations all over Australia. The multi-award-winning firm’s success includes being a finalist in the 2017 Telstra Business Awards and 2018 winner of Buyer’s Agency of the Year in REIQ Awards For Excellence.

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.