A recent study undertaken for the Australian Housing and Urban Research Institute (AHURI) took a wide-ranging and critical look at tech disruption in our housing market, and uncovered some new insights and forward-looking predictions.

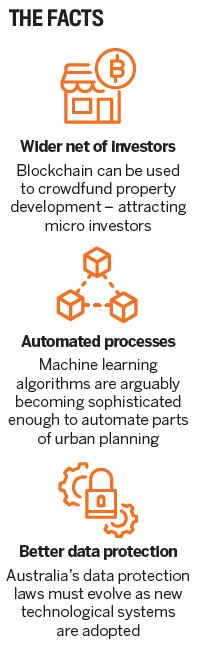

One interesting opportunity our research team identified was the potential for developers to use blockchain technology to attract micro investors – who would not be limited to the same country but could potentially be from across the world. These investors would each own small parcels of shares (or tokens) in the development. In essence, this would create a means of crowdfunding property development.

The main difference between this new model of investing and existing real estate investment trusts is that, through real-time information, blockchain property gives micro investors complete control over what they purchase, without having to pay the high fees a portfolio manager might charge to manage a similar investment.

Blockchain may also lead to better tenant–landlord relationships in the private rental sector. When paired with blockchain’s security, standardised rental application forms could be considerably expanded to become a full ledger of the applicant’s rental records. This could include their correspondence with agents and landlords, their previous track record of being in arrears, and their bond lodgements. If robust enough, it could potentially replace the need for references.

Beyond the buzz of blockchain, housing market disruption is also being driven by the growing capabilities of AI. Machine learning algorithms, which learn by analysing large data sets, allow data to be ‘understood’ (based on legislation or policy documents). This information can then be acted on using a variety of methods, including classification, clustering, decision trees and more.

In urban planning, for example, such systems are arguably at the point where interpreting statutory land use applications could be automated. Capacity now exists for digital planning systems to do initial assessments of planning proposals based on long-term data gathered from historical planning decisions, together with current state and territory laws. This could speed up the assessment of planning applications, particularly for smaller endeavours, and make developers’ applications quicker and possibly cheaper, leading to potentially greater efficiencies in housing supply.

Ensuring adequate data protection is crucial for these systems to be adopted without inappropriate legislated privacy interference, and reform may be required. This requires sensible laws and trusted institutions to ensure adherence to those laws.

At present, Australia’s privacy, information and data protection bureaucracies and institutional structures are underfunded and inadequate. A powerful and independent Information Commissioner and Privacy Commissioner would be a useful fi rst step to ensuring existing legislation is properly enforced.

is the inaugural chair of

urban science at the

University of New South Wales