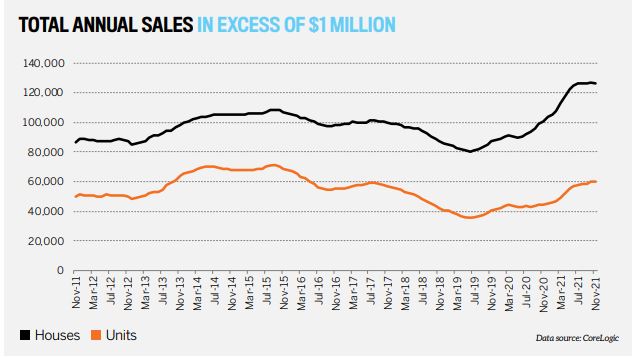

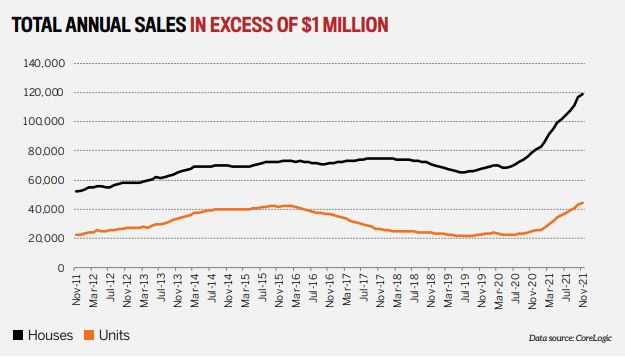

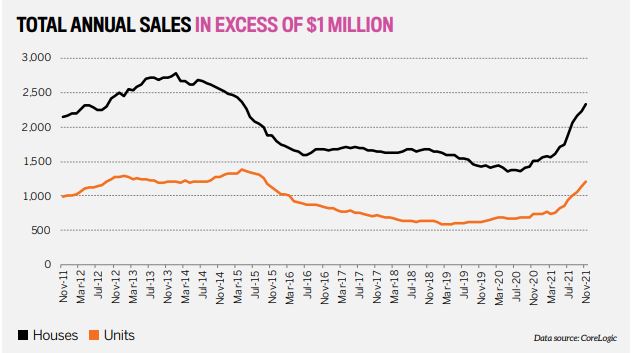

Investors around the country could be sitting on a goldmine after whopping property price rises resulted in almost 500 suburbs joining the million-dollar club in the 12 months to January 2022, according to CoreLogic.

In the December 2021 quarter, Australian property prices experienced a 6.5% rate of growth that saw the national median capital city house price exceed $1 million, according to Domain.

Commenting on the state of property prices nationally, Domain Chief of Research Dr Nicola Powell said several factors contributed to this massive surge in growth.

“House and unit prices continue to beat records nationally due to lockdown activity rebounds in Sydney, Melbourne, and Canberra, high household savings, and the ongoing demand from Australians to buy a property,” Dr Powell said.

“Demand continues to outstrip supply across a majority of the cities, however, rapid price growth and affordability issues are likely to shift demand in 2022. Price growth has slowed from earlier in 2021 but it is higher than last quarter.”

Those who have built up a decent pile of equity probably have a burning desire to put that money into another investment property, while those who missed out on the massive property price growth from the last couple of years want to find out where the next growth market is.

So if you had enough cash to buy $1m worth of real estate in Australia today, how and where should you spend it? And where would deliver the best bang for your buck?

Michael Yardney, director of Metropole Property Strategists believes too many investors start their journey by trying to choose a top location to invest in.

“Obviously, everyone would like to know how to find the best property investment locations or Australia’s best growth suburbs,” he told Your Investment Property Magazine.

“However, when you look at the results that most investors achieve by asking these types of questions, it makes little sense to invest the way they do or ask the questions they are asking.

“Statistics show that around 50% of all property investors sell up in the first five years, and of those that stay in the market, 92% never get past their first or second investment property. So if you want to outperform the average investor then don’t start by selecting a location, or looking for that ideal property.”

Instead, he says investors should start by thinking about what they want to achieve from investing, and work from there.

“In my mind, the correct order is to begin with the end in mind. What do you want to achieve with your property portfolio and then build a property plan to get you there - one which takes into account your surplus cash flow position, your risk profile, whether you currently own a home or want to buy a new one or upgrade in future, if you are going to earn more income in the future (or decrease it), how many other investment properties you own and how they’re performing, and so on.”

When you’re investing in property, there are only three major levers you can pull, according to Yardney: budget (which is often determined by the banks), location (which you can’t afford to compromise on) and the right property in that location.

“Unless you have an unlimited budget, and that applies to very few of us, investors usually need to compromise on at least one of the above,” he said.

So, the first lesson is to formulate a comprehensive investment strategy. But once you’ve done that, where should you invest that money? Read on for our extensive market update.

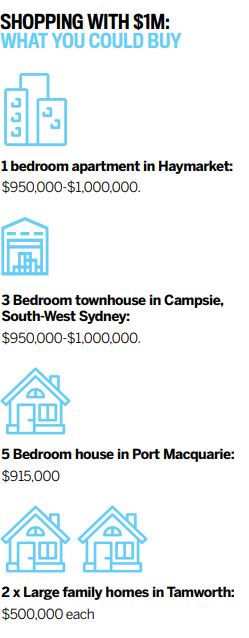

What $1m buys in NSW

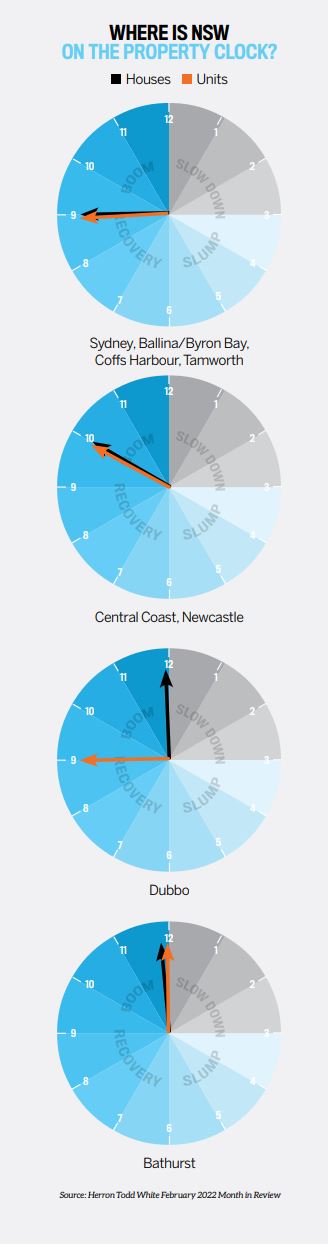

According to CoreLogic data, Sydney property prices rose by more than 25% over the 12 months to January 2022.

Domain’s House Price Report revealed that Sydney house prices rose by roughly $1,100 per day over 2021, a total rise of almost $400,000 to a new record of $1.6 million. At 33.1%, this is Sydney’s steepest annual rate of growth on record.

The curve is somewhat flattening in Sydney, as supply has increased to start 2022. However, Sydney will always attract investors for its proven steady growth market.

“Sydney markets are back, particularly the inner rings,” says Dr Diaswati Mardiasmo, PRD’s chief economist.

“We are seeing good growth here, especially with many making their way back into the CBD for work opportunities. That said, the market has slowed down a little, with growth rates not as high as prior.”

In the inner city, options would be very limited if you were looking to buy at $1m. For example, in the suburb of Haymarket 3.7km from Sydney CBD, a one-bedroom apartment alone would set you back over $950,000. But if you were to venture 407km out to the guitar town of Tamworth, you could buy two large family homes for the same amount.

“With a budget of less than $1.5m you only have access to 8.2% of the inner ring market,” Dr Mardiasmo said.

“However if you choose the outer ring, you can access approximately 36% of the market. Five years of growth in Sydney’s inner ring was 22.3% between 2017-2021, and the Sydney Outer ring was 21.5%. However, Sydney Inner’s median house price in 2021 was over $2.5M and Sydney Outer was $1.75M.

“Therefore by going to Sydney Outer, you have a better chance of entering the market, with a lower entry price, and similar five years capital growth.”

Mr Yardney said smaller, boutique blocks are where investors should look.

“Think small complexes of six to 10 apartments, rather than huge big-box buildings with hundreds of similar style properties.”

What $1m buys in VIC

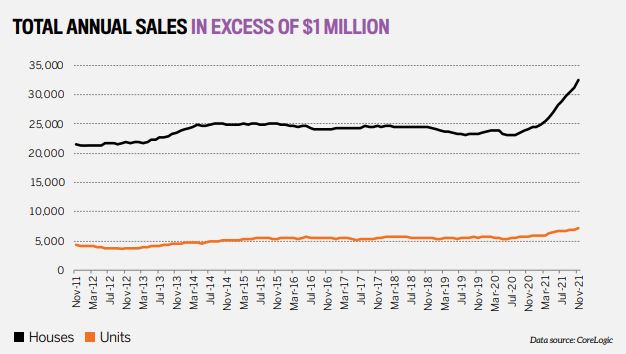

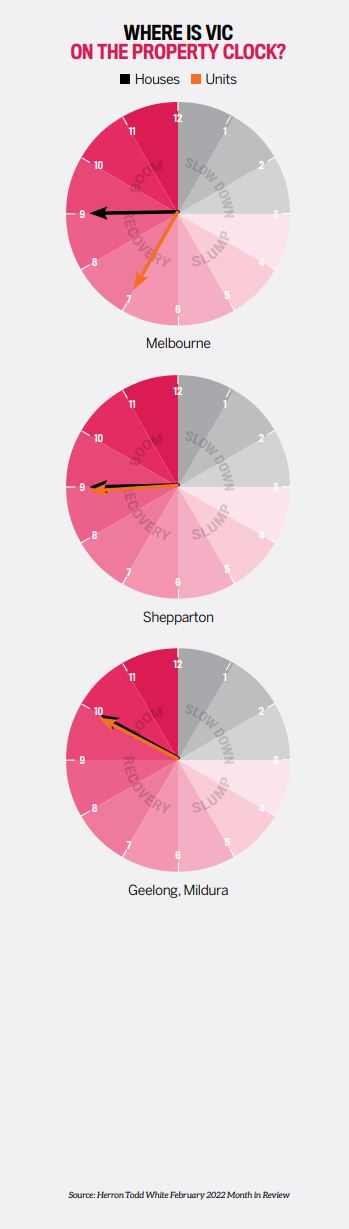

Always competing with Sydney for value is of course Melbourne. According to Domain, house and unit price growth gained momentum over the last quarter as buyer and seller activity rebounded post-lockdown with house prices reaching a new record high at $1.1 million (5.8% quarterly growth), and unit prices reaching a new record high of $593,387 (3.9% quarterly growth, strongest in two years).

Melbourne saw 62 suburbs join the million-dollar club in 2021 according to CoreLogic, with Domain data noting the southern suburb of Blairgowrie topped Melbourne's house price growth, rising 58.4% to reach a median of over $1.5 million.

Data from CoreLogic shows Melbourne dwelling values rose 14.9% in 2021, but could that be set to slow?

CoreLogic’s Research Director Tim Lawless said in January that the housing market may not have peaked, but may have reached its peak rate of growth.

"Although we can’t see any evidence that specific housing markets have peaked, it is clear that most markets have moved through a peak rate of growth," he said.

"What I mean by that is the point at which markets achieved their biggest monthly growth rate. We saw most of the capitals moved through a peak rate of growth around March last year."

Much like in Sydney, the price gap between units and houses is growing further apart.

For investors, houses and land are still at a premium, however, data from the ABS shows businesses and homeowners have left the CBD throughout the pandemic.

With a budget of $1m, you might get a two-bedroom apartment in Fitzroy, 2.8km from the CBD, with change left over. For about the same amount, you could get a three-bedroom townhouse in Box Hill, just 20km from the CBD.

Mr Yardney said townhouses are a good long-term bet for investors.

“Townhouses are in strong demand by both owner-occupiers and tenants ensuring ongoing strong capital growth and increasing rental returns for investors,” he said.

“Melbourne’s middle ring bayside suburbs such as Cheltenham, Parkdale, Mentone or Mordialloc are great investment locations for townhouses.

“Another alternative is to buy a single-story older villa unit with renovation potential in Melbourne’s middle-ring suburbs such as Elsternwick, Caulfield, Glenhuntly or Surrey Hills.“

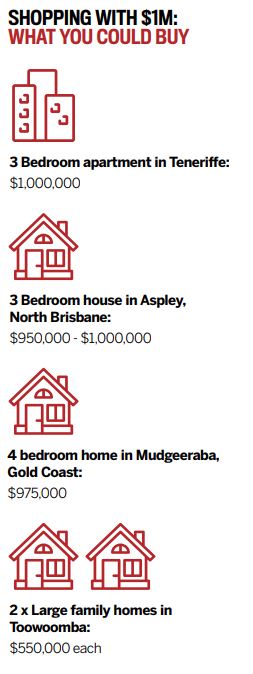

What $1m buys in QLD

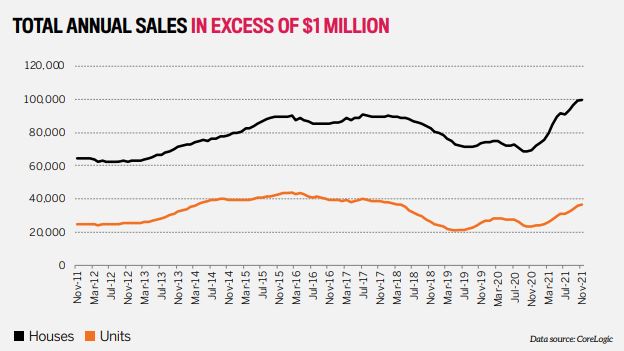

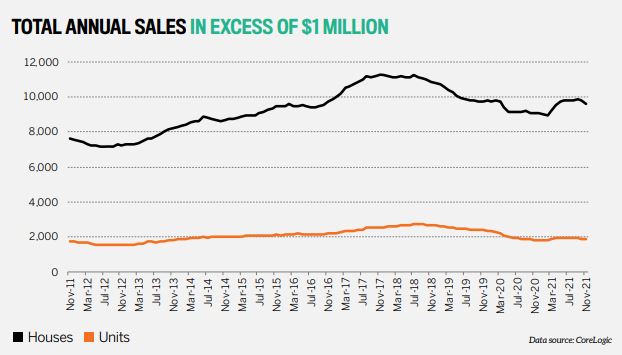

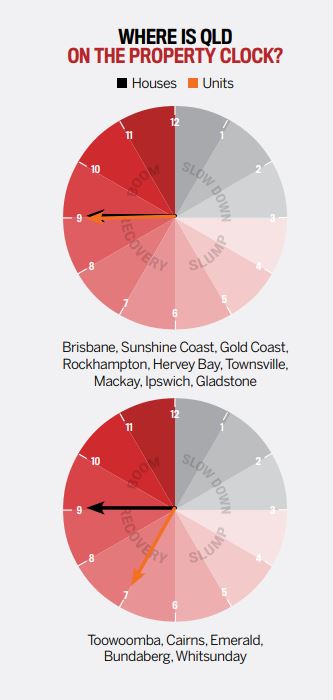

Queensland’s property market doesn’t appear to be slowing down.

CoreLogic’s Research Director Tim Lawless said in January the only regions showing no signs of stunted growth were Brisbane, regional Queensland and Adelaide.

"These markets are benefiting from a healthier level of affordability compared with the largest capitals along with a positive demographic trend and consistently low advertised stock levels,” Mr Lawless said.

"We could see our two biggest capital city markets Sydney and Melbourne hit their peak later this year although the timing is highly uncertain and depends on a broad range of influences."

According to Domain, buyers can expect to pay a record high of $792,065 as Greater Brisbane house prices grow 10.7% over the quarter and 25.7% annually, the steepest increase in almost 18 years. Unit prices grew 2% over the quarter and 3.5% annually, for the first time since mid-2016, hitting a new record high of $416,033.

Dr Mardiasmo said Queensland is one of the biggest property hotspots for investors.

“The Brisbane and Queensland market continues to grow, especially as compared to Sydney and Melbourne it has a more affordable entry price and a strong track record for economic recovery from COVID-19,” she said.

“There is also the lure of the Olympics in 2032, and with Brisbane prices being considered affordable internationally (compared to Singapore, Beijing, London, New York, Dubai, and many others), there is a strong attraction for international investors to come knocking.”

In Brisbane, a three-bedroom apartment in the upmarket suburb of Teneriffe would set you back $1m, while a four-bedroom home in Mudgeeraba on the Gold Coast could be just under $1m.

Mr Yardney said investors who pick their property well could be primed for strong capital growth.

“The Sunshine State is shining and strong demand for detached houses and outstanding demand for lifestyle areas means as an investor, if you buy the right investment property in the right location, you could be primed to supercharge your growth. One million would be a good home in an inner Brisbane suburb,” he said.

“Some of the areas I would consider include: New Farm, Teneriffe, Ascot, Holland Park, Stafford and Wavell Heights.”

An hour's drive south from Brisbane, the Gold Coast property market was one of the hottest in the country in 2021.

A report from Domain listed the top 20 suburbs across Australia for property transactions to September 2021, with the Gold Coast's Surfers Paradise taking the top spot, with nearby Southport and Broadbeach also landing in the top 20.

What $1m buys in SA

According to Domain, Aussies can expect to pay more than $700,000 for a house in Adelaide for the first time on record.

House prices grew by more than 27% annually for 2021.

Unit prices also reached a new record high of $380,349, a result of a quarterly increase of 4.5% and an annual increase of 11.5%, the strongest annual gain since 2008.

Dr Powell said demand continues to outstrip supply.

“With the overall supply of homes for sale dropping to a multi-year low and forcing house price growth, current demographic trends will continue to support housing demand with more people arriving into Greater Adelaide than leaving,” she said.

“South Australia has been one of the states to benefit from the flow of Australians that have sought to either escape lockdown, embrace remote work culture, or return to their home state.”

CoreLogic’s Head of Research Eliza Owen said the quarterly growth in dwelling values across Adelaide reached 6.5%, the second-highest of the capital city dwelling markets across the country and its highest quarterly growth rate for the past 20 years.

“The Adelaide housing market has seen sustained, high levels of quarterly growth in part attributable to persistently low levels of housing supply and relative affordability,” Ms Owen said.

A three-bedroom townhouse just 2km from the CBD can be found for around the $975,000 mark. With $1m to spend, you could also get a three-bedroom house in West Beach for $1m and still be within 8km of the CBD. Or, you could hop on the regional bandwagon and buy three large family homes in Port Pirie for under $350,000 each.

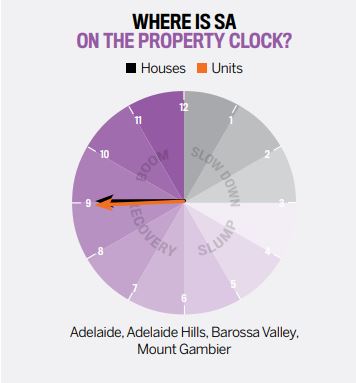

In other words, investors with a long-term outlook may be able to secure good value, affordably priced properties while the market is still at a 9 on the property clock.

What $1m buys in TAS

Tasmania’s capital city, Hobart, has seen house prices surge by more than 44% since the start of 2020 and has had the second-highest growth rate of all Australian cities over that time according to Domain.

Dr Powell said the median house price has now passed $700,000 for the first time.

“With the lowest average wages of all the states we can expect that entry-level buyers who are on a local average wage will find it increasingly difficult to enter the housing market,” Dr Powell said.

“Values have risen sharply across all house price points suggesting a broad spectrum of buyers are active.”

Home hunters will find buying conditions to be fierce as the number of homes for sale is well below the five-year average, and while stock is starting to build, it remains tight.

“Buyer demand is likely to be fuelled by the reopening of the Tasmanian state border to the mainland states, likely providing more buyers in Hobart as those interstate are able to relocate more freely.”

If you were expecting $1m to stretch further in Tasmania, you’d be correct. A three-bedroom apartment just 2km from the Hobart CBD could fetch around $940,000. Or, you could snap up two three-bedroom houses in Launceston for under $500,000 each.

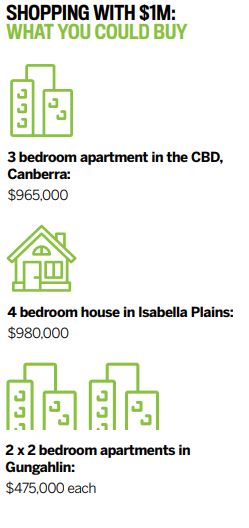

What $1m buys in the ACT

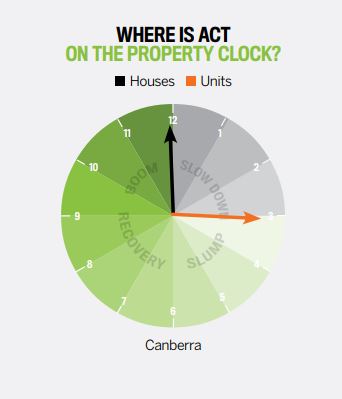

Like much of the east coast, there was a strong divergence between house and unit prices in the nation's capital, as house prices surged in Canberra, while units declined for the most recent quarter.

Canberra is now the second most expensive city to purchase a house with house prices hitting a new record high of $1.178 million according to Domain. This is the steepest quarterly growth on record and makes the past year the strongest upswing in Canberra’s house price history, up 36.6%.

Dr Nicola Powell said since the start of the pandemic, Canberra has seen property prices rise by over 50%.

“The rapid escalation in house prices will be a financial barrier for entry buyers and upgraders against a backdrop of low wages growth,” Dr Powell said.

“The disparity between property performance and associated affordability constraints is expected to drive demand to units.

“While it is still a competitive market for home hunters, rising supply and easing demand trends should support more realistic seller prices and greater buyer choice.”

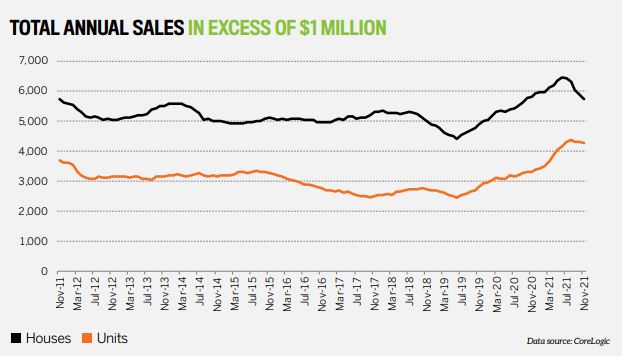

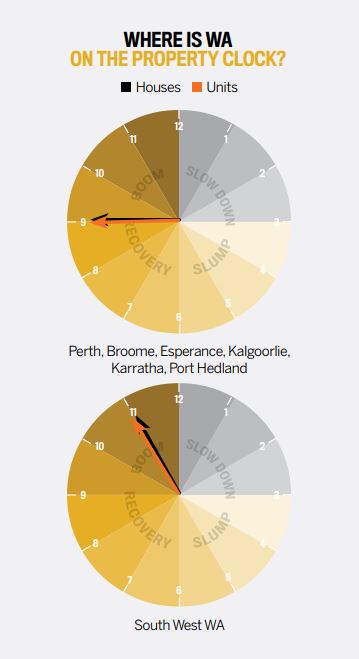

What $1m buys in WA

Perth remained less impacted by surging house prices during the pandemic compared to the east coast.

According to Domain, Perth continues to hold the title of the most affordable capital city to buy a house as prices swiftly rise across the other cities.

“Perth remains a sellers’ market, this is helping to entice more homeowners, reacting to rising prices and putting their homes up for sale,” said Dr Powell.

“While it is still a competitive market for home hunters, rising supply and easing demand trends should support more realistic seller prices and greater buyer choice.”

According to Dr Mardiasmo, new housing supply in Perth has been quite low, with not many houses coming on to the market.

“The number of Aussies that have relocated to Perth reached its highest points in the past eight years, meaning that demand has been increasing, but supply has not been able to keep up,” she said.

“Buyer sentiment has been strong in Perth, due to the low number of COVID cases and business continue to operate, thus unemployment levels have not skyrocketed.”

Looking towards the new year, Dr Diaswati said supply is proving “sluggish.”

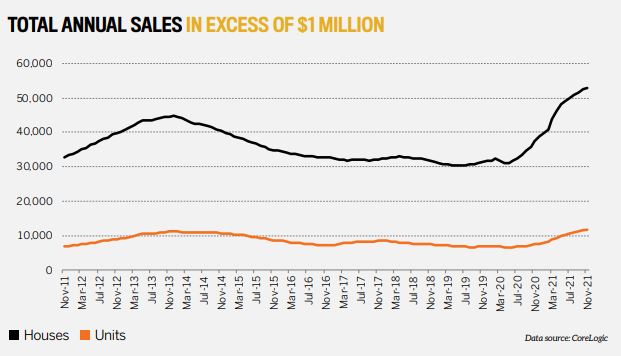

What $1m buys in NT

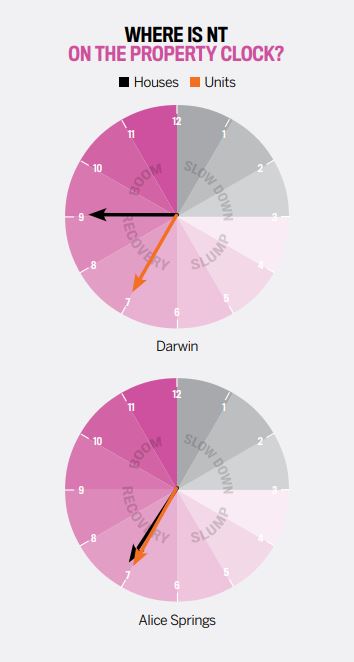

According to CoreLogic data, Darwin is the only capital city to have likely passed its peak.

CoreLogic’s Research Director Tim Lawless outlined how to identify a market that has peaked, and the trends property watchers should be keeping an eye on in the latest Property Pulse.

"To categorise a market peak across a region, we would generally be looking for a consistent trend in negative monthly movements," Mr Lawless said.

"To date, the quarterly trend remains positive across the major regions, with the only exception being Darwin houses, which is the only capital city housing sector to record a negative quarterly change."

Dr Nicola Powell also reinforced Darwin's housing market has peaked.

“Darwin house prices have seen a sharp upswing since the pandemic began, producing the strongest rate of annual growth in roughly 17 years and the highest median price in six years,” she said.

“Demand for Darwin property still remains strong as the number of homes sold reached a thirteen-year high over the December quarter. However, it appears the pace of price growth has peaked.”

For $1m, investors are spoilt for choice in this market. For instance, you could purchase two three-bedroom apartments for under $500,000 each in the Darwin CBD. A five-bedroom house just 2km out from the CBD will give you change from $1m.