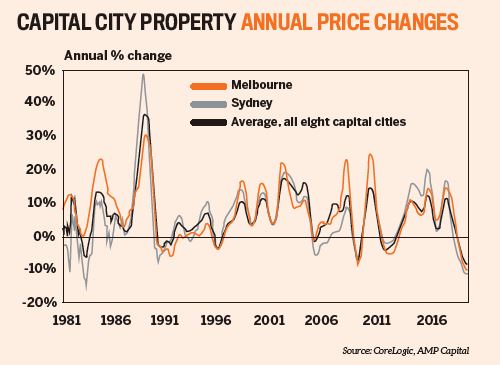

According to CoreLogic, capital city dwelling prices are down 10.1% from their September 2017 high – their worst decline in the last 40 years. This represents a huge range: prices are down 15% in Sydney, 11% in Melbourne, 30% in Darwin, 19% in Perth, 2% in Brisbane and less than 1% in Adelaide, and are at a near-record highs in Canberra and Hobart.

Credit conditions are still tight, and the pipeline of units to hit the Sydney and Melbourne markets is huge. Though auction clearance rates in these cities have risen from their December lows, clearances are still weak, at pre-boom levels of just above 50%, as are sales volumes.

However, while the drags remain significant, several positives have become apparent. First, financial support for first home buyers is now on the way with the government’s First Home Loan Deposit Scheme.

On its own, the underwriting scheme isn’t a game changer, particularly as it’s capped in terms of numbers. In addition, borrowers will be taking on big mortgages, which will come with a higher risk of negative equity; they will still have to meet the tougher credit standards of recent times; and it won’t kick in until next year. That said, with the federal budget looking even and probably already in surplus thanks to the surging iron ore price, I suspect the deposit scheme will morph into a far more attractive home buyer grant at some point.

Second, APRA is relaxing the 7% mortgage rate serviceability buffer. This was inevitable, given APRA’s move to focus on more fundamental credit standards, and 7% is way out of whack with current interest rates. Again, on its own, it’s not a game changer – it wasn’t the main driver of the property downturn, and borrowers still have to meet tougher credit standards.

Third, and as widely expected, at its June meeting the Reserve Bank cut the official cash rate by 0.25%, taking it to 1.25%.

We expect another 0.25% rate cut in July or August and two more by mid next year, taking the cash rate to 0.5%. We also expect most banks will pass on all or the bulk of the RBA’s cut to customers. House prices bottomed out around three months after the first cuts in 2008 and 2011. It may take longer this time as debt is now much higher, rates are already very low and lending standards are tougher, but they will still help.

Meanwhile, annual population growth of around 1.6% is still driving strong underlying demand for housing at a time when supply is likely to start slowing again next year.

Taking all these factors together – some of which are minor but still positive – it’s likely that we’ll see house prices bottom out a bit earlier and little higher than we had expected.

Shane Oliver

is head of investment strategy and chief economist at AMP Capital